19

Apr

April 19th 2016 Technical Analysis Pairs: EURUSD, USDJPY, & XAUUSD. The differentiation stuck between victory & disappointment in Forex trading is incredibly probable to depend on the lead which currency pairs you decide to trade every day & not on the precise trading method you strength use to settle on trade entry & exits. Every day I am going to examine fundamentals, technical, & sentiment positions in sort to resolve which currency pairs is nearly everyone likely to make the easiest & a good number of commercial trading opportunities over today.

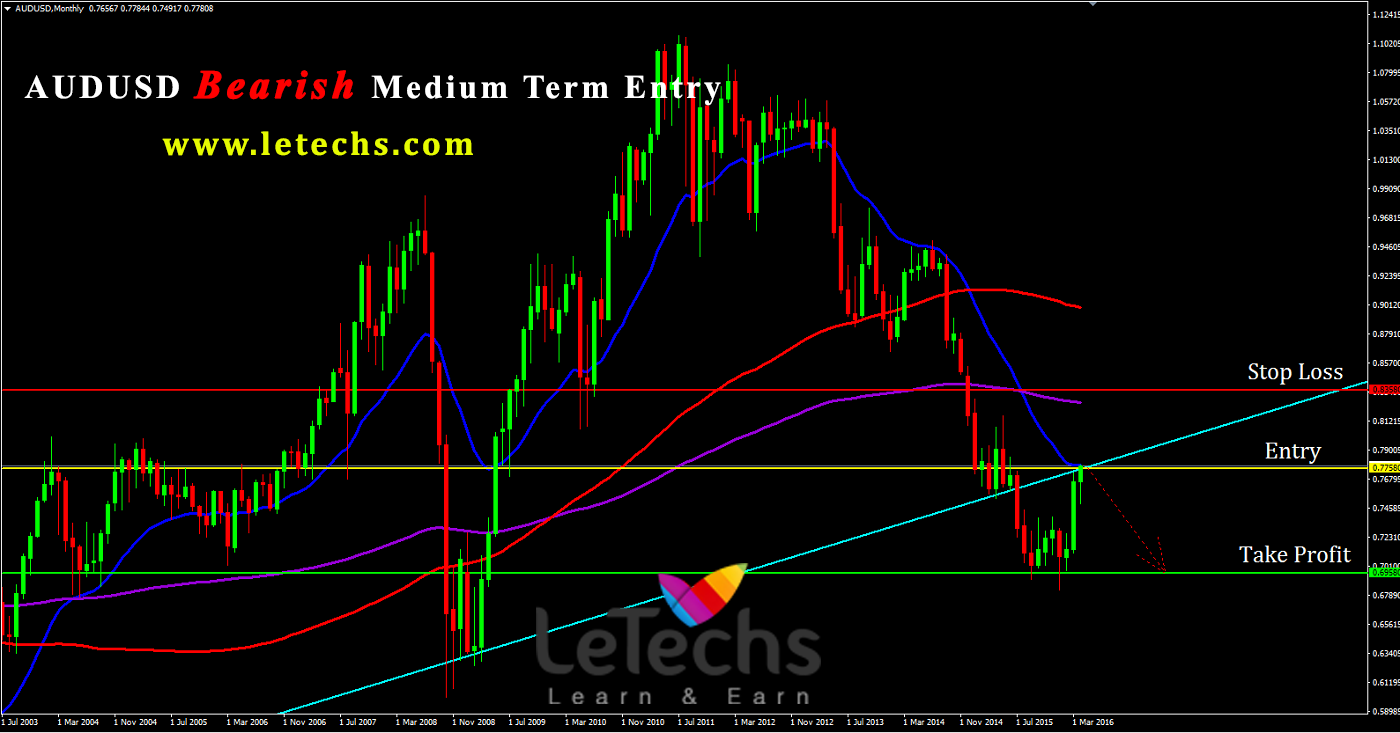

AUDUSD

EURUSD

Intraday bias in EURUSD remains neutral & near term position is unmoved.

Additional rise is anticipated with 1.1143 unbroken. On top of 1.1464 levels will target 100 percent protrusion of 1.0517 levels - 1.1376 levels from 1.0821 levels at 1.168 levels, which are nearby 1.1713 level resistances.

On the downwards, although, a break of 1.1143 levels support will be the 1st signal with the intention of such increase is accomplished & will rotate outlook bearish.

Value actions since 1.0461 levels are analysis as improvement to fall on or after 1.3993 levels. A break of 1.0461 levels will extend the reject from 1.3993 levels.

On the advantage, break of 1.2042 supports twisted resistance is desired to be the 1st sign of trend reversal. or else, we'll remain bearish & wait for a new low underneath 1.0461 levels at a later stage.

GBPUSD

Although contain pursue from first to last higher on Monday, additional bullishness is probable.

On the downwards, support lies at the 1.425 level somewhere a break will go round concentration to the 1.42 levels. Supplementary down, support lies at the 1.415 levels. Underneath here will situate the stage for further weakness towards the 1.41 levels.

On the other hand, resistance set at the 1.435 levels with a twist over here tolerates more force to put up towards the 1.44 levels.

Added out, resistance exists in the level of 1.445 pursued by the 1.45 levels. Overall, GBPUSD remains prejudiced to the upside on remedial healing.

USDJPY

Intraday bias in USDJPY stays neutral at present. Upcoming viewpoint remains bearish with 110.66 levels support turned resistance unbroken.

As generally marketplace risk from the Doha disaster emerge to lighten on Monday, yen power easiness somewhat, and prompt USDJPY to rebound once again from its key support level at 108.

From the 1st complete week of the month, while the currency pair thrust down to the critical 108 level, it has challenge to go down but has been constantly disenchanted by the force of that support.

In spite of the failure to attain an output freeze deal in the midst of most important oil-producing countries on Sunday, & a resulting plunge in oil prices, crude oil paired nearly all of those losses by the conclusion of trading on Monday & worldwide equity markets correspondingly meeting.

USDJPY was bright to lift off 108.00 supports yet again after having approach precariously shut to a breakdown.

XAUUSD

XAUUSD (GOLD) marketplace goes back & forth throughout the path on Monday, as there is unmoving fairly a bit of instability in the generally trading community.

We initially achieved over the 1240 level, only to twist back around & figure a rather caring candle. Eventually, this is a marketplace that appears to errand the benefit over the longer term, but in the interim it seems as if there is a bunch of query. Enclosed, we are watchfully hopeful but be familiar with that unpredictability is here to remain calm. We comprise no interest whatever in selling.