WEEKLY TECHNICAL FORECAST on 18th APRIL to 22nd April, 2016 - Trending pairs are EURUSD, GBPUSD, AUDUSD, USDJPY, & XAUUSD. The differentiation stuck between victory & disappointment in Forex trading is incredibly probable to depend in the lead which currency pairs you decide to trade every week & not on the precise trading method you strength use to settle on trade entry & exits. Every week I am going to examine fundamentals, technical, & sentiment positions in sort to resolve which currency pairs is nearly everyone likely to make the easiest & a good number of commercial trading opportunities over this week.

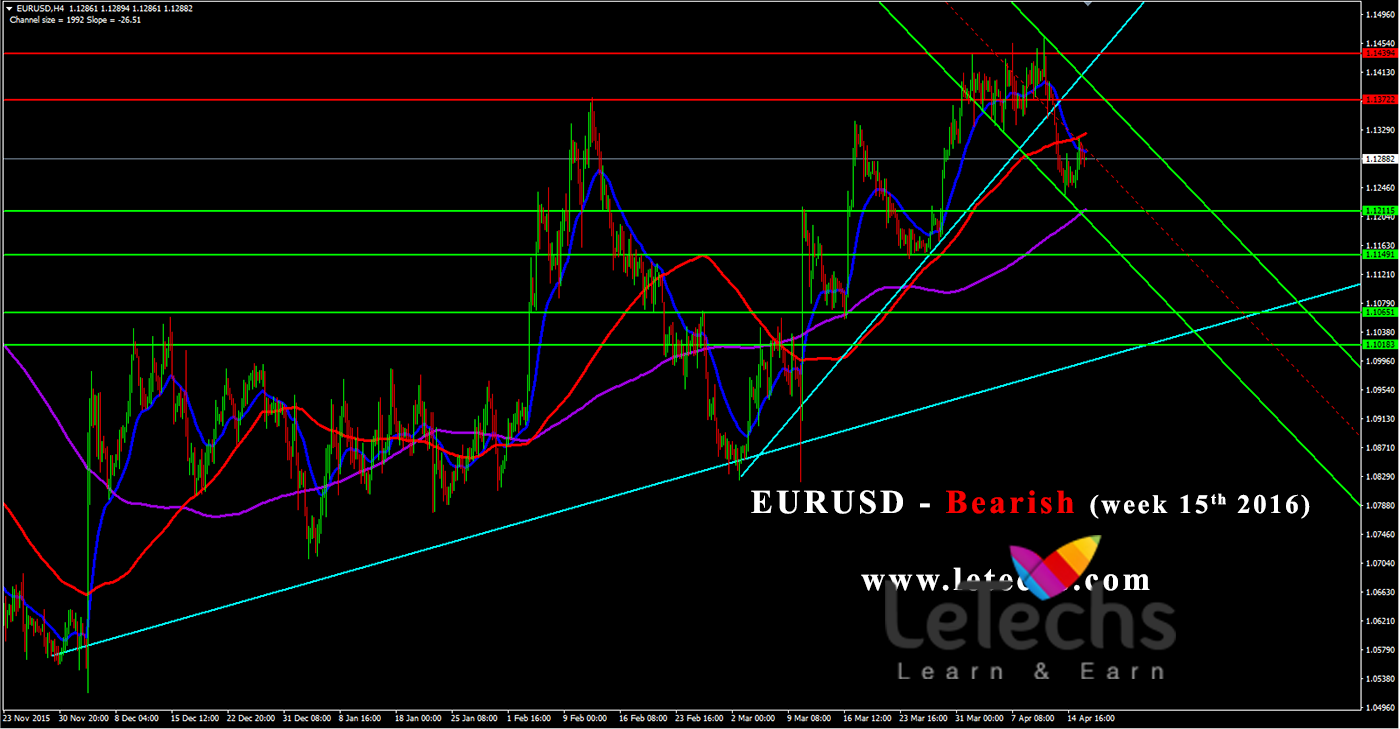

EURUSD

EURUSD botched in its effort to break superior & ultimately dropped. Last week EURUSD breaks past 45days uptrend support near 1.1370 ranges.

The ECB decision is the major event in a hard week. What’s then for the world’s mainly popular currency pair?

Let’s discuss Greece stay behind hopeful & also stays at the back-burner.

Euro-zone statistics wasn’t so persuasive, with declining business output, but at least price increases are not unenthusiastic according to the adjust data.

As well as in the US, mutually retail sales & inflation missed prospect and left the indefinable second rate hike in the coldness.

All the same, following a few weeks of anguish, the US dollar managed to go forward against the majors and subsequent to EUR/USD failed to attain the superior position, but it went south. If bounce back near 1.1370 range we can put medium term short, immediate support’s are 1.1211, 1.1149, 1.1065, 1.1018

In other hand breaks upside resistance 1.1370 we expect to continue last week high 1.1439.

EURUSD this week stays Bearish

After weakening to break higher, the pairs turned downward and the ECB might include stimulating to the fire with stark caution about the price rises situation. A plunge in oil prices subsequent an unsuccessful OPEC-Non-OPEC meeting might also put into the negative mood on price increases and still to opening the door for additional events in June.

GBPUSD

GBPUSD confirm strong upward action but stopped the week with self-effacing gains.

The pair clogged the week slightly underneath the 1.4200 levels.

This week’s things to see are Average Earnings Index, Retail Sales, & Claimant Count Change

In the UK, CPI placed a stronger gain than predictable, raising conjecture regarding a rate hike. Over in the US, both retail sales & price increases report missed potential, which has possible ruled away an April rate hike by the Fed.

GBPUSD pairs unlocked the week at 1.4129 levels. This pair quickly mounts to a high of 1.4348 levels, testing the resistance at 1.4297 levels. Then the pair reversed directions & fall down to a low of 1.4089 levels.

GBPUSD this week stays Neutral

By means of the marketplace unsure of the economic plans of the BoE & the Fed, the dollar has lost its deviation benefit, as a minimum for now.

The Doha oil meeting might be a huge disappointment, which can lead to inferior oil prices. This might push extra investors towards the refuge US dollar.

USDJPY

USDJPY had an uneventful week, redistribution slight gains.

The pairs closed at the levels of 108.67. The forthcoming week is extremely light, with just only 3 events on the schedule. Here is a viewpoint on the main events affecting the yen.

USDJPY pairs unlocked the week at 108.29 & quickly mount to a low of 107.60 levels. The pair after that overturned directions & climbed to a high of 109.73 levels, as resistance detained hard at 109.81 levels.

I remain expect to fall up to 105.00, 105.00 area has strong support (Monthly 200SMA).

USDJPY this week stays Bearish

The yen is measured an asylum asset, & weak worldwide demand has fueled require for the Japanese currency, which has esteemed sharply in 2016 next to the dollar. Through oil producers meeting in Doha improbable to accomplish a cap on yield, oil prices could fall, which might lead to more investors break up the yen.

AUDUSD

AUDUSD upturned directions last week, as the pair jumps 150 points ahead.

AUDUSD clogged the week just over the 0.7700 levels since June 2015 this is the highest level.

This week AUDUSD has six events on the calendar. Australian release was strong, by means of business confidence & employment numbers reorganization tough gains. Strong Chinese exports also strengthen the Aussie.

In the US, both retail sales & price increases reports fail to spot outlook, which has likely in use an April rate hike sour the table.

AUDUSD pairs unlocked the week at 0.7563 & quickly mount to a high of 0.7527 levels. It was every uphill from there, as the pair off a scramble to high levels of 0.7737, floating above resistance at 0.7692 levels.

AUDUSD this week stays Bearish.

In the midst of an unsure global economic environment, the refuge US dollar remains a smart asset for many investors. For AUD, the oil producers meeting in Doha are not anticipated to end with any noteworthy conformity & this might drive oil prices lower & boost the greenback.

After the last week bounce back finally reached long-term uptrend resistance. Now, the right time to take AUDUSD short first targets 0.6911 previous short-term market low and next target 0.6295.

In other hand, if breaks this resistance immediate resistance 0.8379.

XAUUSD

XAUUSD marketplace goes up slightly throughout the course of the last week on Friday; as we go on to see support underneath.

The marketplace looks as if it is departing to spring back a bit, maybe try to achieve towards the 1260 dollars knob. We have no interest whatever in shorting this market up till now.

We see an enormous amount of support all the technique downward to the 1200 knob, so we are presently coming up to observe whether or not we know how to break upper, or if we require to sit on the tangential & remains for a supportive candle.