20

Apr

Daily Technical Analysis Pairs: EURUSD, GBPUSD, & USDJPY on 20th April 2016. An appearance a moderately neutral candle. The differentiation stuck between victory & disappointment in Forex trading is incredibly probable to depend on the lead which currency pairs you decide to trade every day & not on the precise trading method you strength use to settle on trade entry & exits. Every day I am going to examine fundamentals, technical, & sentiment positions in sort to resolve which currency pairs is nearly everyone likely to make the easiest & a good number of commercial trading opportunities over today.

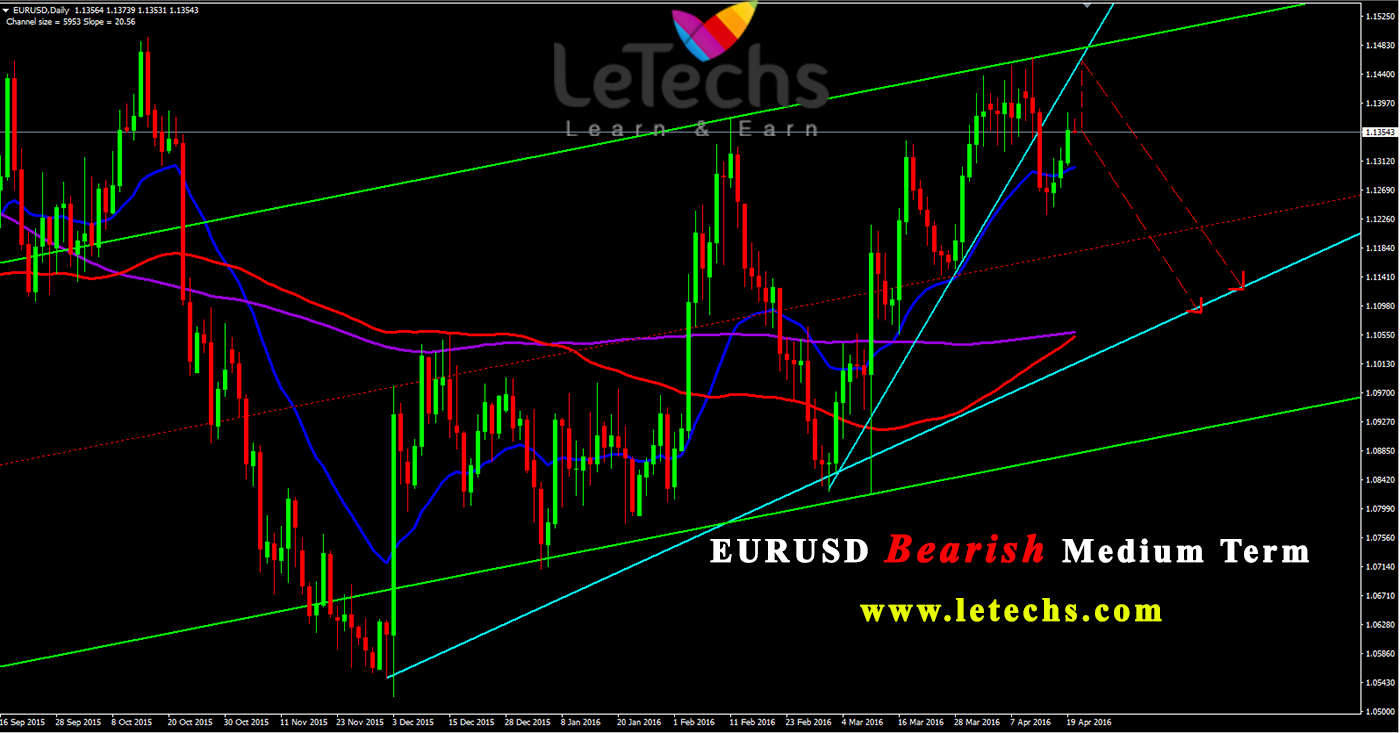

EURUSD

The euros develop among the risk hatred. Currently, the euro dynamics depends somewhat on the marketplace sentiment than on European economic statistics & superior European official’s remarks.

The 1st support lies at the level of 1.135 & after those 1.126 levels. The 1st resistance locates at the level of 1.145; then subsequently is at 1.155 levels. For EURUSD it’s confirmed & a puny sell signal. MACD indicator is in an optimistic region. So the price is rising. The possible reduce targets are 2 levels of support: 1.135 & 1.126.

GBPUSD

The pound may stay put unstable as the prospect of a rate hike was condensed by the BOE (Bank of England). Whereas captivating a result on the interest rates previous week, the English regulator also converse the risks for the country financial system in case of Brexit. According to M. Carney meets on yesterday, the collision of Brexit would not be supportive & it would make an investment of the expense balance added costly.

The value is verdict the 1st support at 1.432 levels, the other one is at 1.424 levels. The value is verdict the 1st resistance at 1.44 levels, & after those 1.448 levels. For GBPUSD it’s confirmed & a well-built buy signal. MACD indicator is in an optimistic region. So the price is rising. If presume these pairs will go to 1.44 levels first. Boast overcome the 1st target, the value might go upwards to 1.448 levels.

USDJPY

Following a strong improvement since 17-month low, USDJPY returned into a fine range. The US available Building Permits (the key came in at 1.086M, but they predict was 1,200M) & Housing data starts (the key came in at 1.089M, but they predict was 1.170M).

The 1st support lies at the level of 109, & the other one is at 108.2 levels. The 1st resistance locates at the level of 109.8, & the other one is at 110.6 levels. The MACD indicator is in a neutral region. USDJPY value is decreasing. Subsequent to the support level of 108.2 burst through downward the technique to the support 107.4 levels will be unlocked.