03

May

Daily Technical Analysis on 3rd May 2016. Technical Pairs: EURUSD, GBPUSD, USDJPY, WTI Crude Oil, & XAUUSD

EURUSD

Manufacturing PMI in Germany reduced opposing to our prospect. According to Market Research Group, the sign showed 51.8 balances with 51.9 in the earlier month. Experts anticipated the key at the previous level of 51.9.

The 1st support lies at the levels of 1.145 & then at 1.135 levels. The 1st resistance remains at 1.155 levels, the other one is at 1.165 levels. It’s a confirmed & a burly buy signal. MACD sign is in a positive region. The value is rising.

We suppose the pair will go to 1.155 levels primarily. Having defeated the 1st target the price might go upwards to 1.1650.

GBPUSD

According to the global rating organization S&P, if the UK leaves the EU grouping it may lose its AAA rating. GBPUSD rise amid the universal dollar fault & conjecture that the UK will stay put inside the EU. UK marketplace was blocked yesterday in the middle of premature May celebration.

The value is finding the 1st support at 1.467 levels, the other one is at 1.456 levels. The value is finding the 1st resistance at 1.476 levels, after those 1.488 levels.

It’s a definite & a well-built buy signal. MACD sign is in a positive region. The value is mounting. A potential growth target is the resistance levels: 1.476 & 1.488.

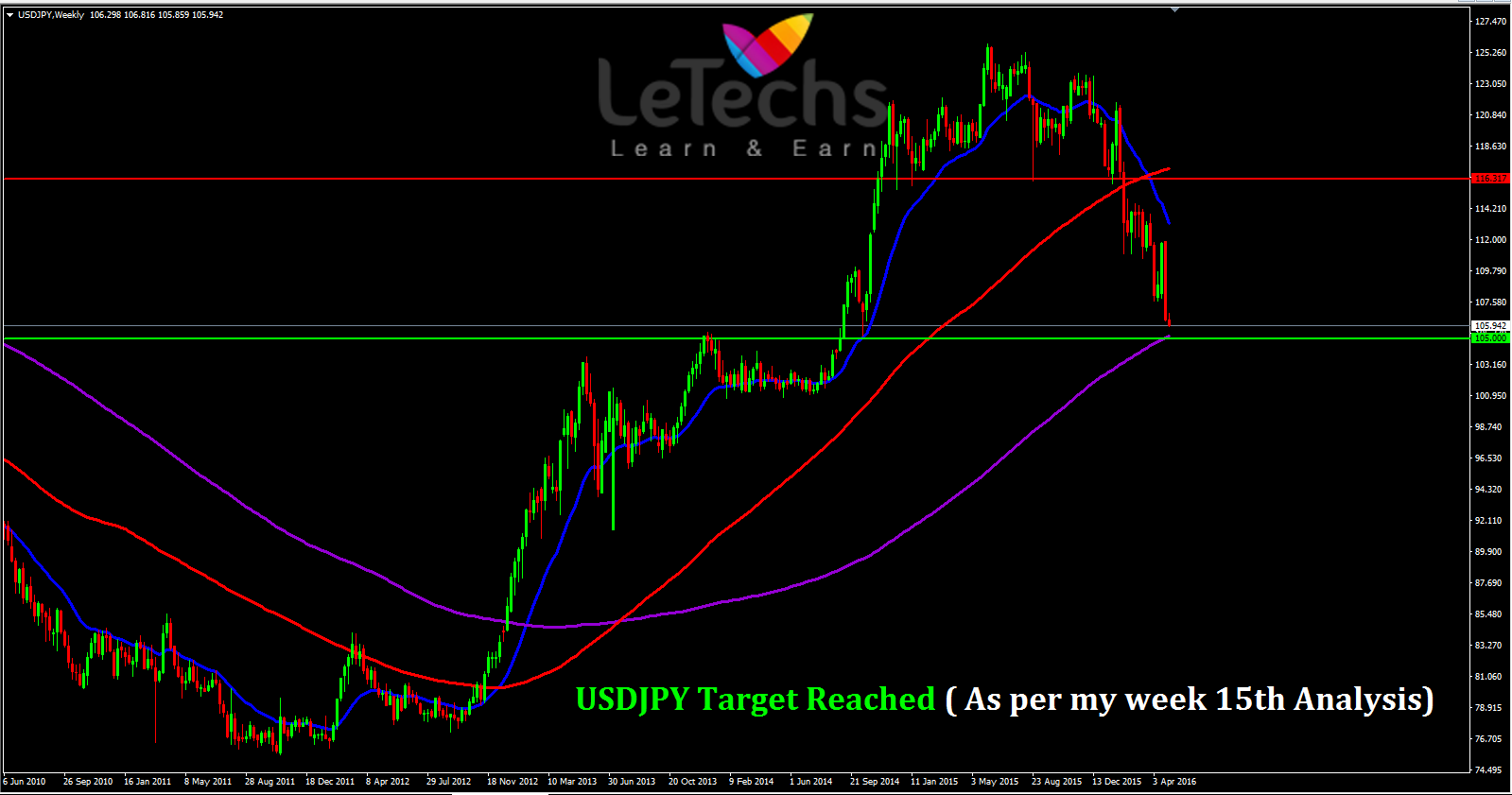

USDJPY

For USDJPY USA Manufacturing PMI for April will rise up to 51.8. Traders anticipated the index to reduce to 51 versus 51.5 in last March. Manufacturing PMI in JPY surpassed our potential & increased to 48.2 versus the estimate of 48.0.

The value is verdict the 1st support at 105.8 levels, the other one is at 105 levels. The value is finding the 1st resistance at 106.6 levels, the other one remains at 107.4 levels. It’s a confirmed & a muscular sell signal. MACD sign is in a negative region. The value is strengthening.

We presume the pair will go to 105.8 levels initially. Having conquered the 1st target the price may go downwards to 105 levels. We do not reject the uphill rebound to 107.7 levels.

WTI Crude Oil

US - WTI Crude Oil marketplace chop down throughout the session on yesterday, breaching the establishment of the shooting star that appearance for Friday. In that case, the marketplace might very well go down a bit from at this point, because it has been a morsel overextended. There is possible support at the 44 level, & the 42 level below that.

Eventually, this is a market with the intention of having quite a fragment of bullish force bottom it even if, so it’s hard to visualize that the trend has distorted fairly yet. A supportive candle underneath would be cause sufficient to go lengthy, & it is not pending we break beneath the 42 level that we can still divert the thought of selling as the bullish thrust has been so not in control. A crack over the pinnacle of the shooting star is as well bullish but appears less probable as this is a region of controversy.

XAUUSD

XAUUSD - Gold markets originally rallied all through the path of the session on last day, but create the area over the 1300 level far away too resistive. We broke up turning rear around and figuring a shooting star & that obviously are an awfully negative indication. Nevertheless, when I do stumble on exciting is that we handle to pierce the 1300 level still following being overextended. For the reason that of this, I sense that this marketplace will carry on to go upper given sufficient time but recoil is probably wanted in order to put up sufficient momentum to crack out.