07

Jul

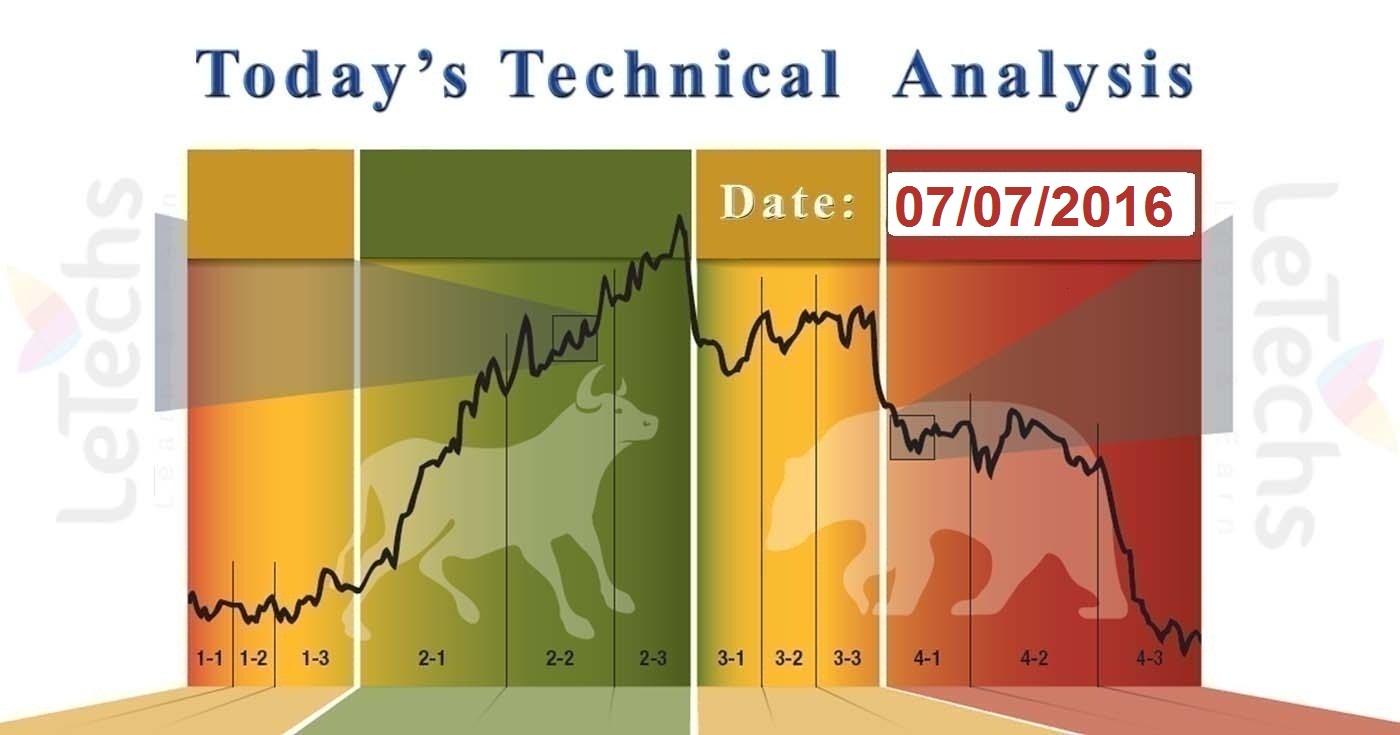

Daily Technical Analysis on 7th July 2016

Technical Pairs: EURUSD, GBPUSD, AUDUSD, USDJPY, & Brent-Crude Oil.

EURUSD

EURUSD weakened last day. There are no positive movers for the euro. The retail sector in the Euro zone reduced and the euro start experiencing the consequence of Brexit. The euro once again came below pressure. This time this pair cut down due to the risk aversion. EURUSD tried to regain last day, but blocked at the mark level of 1.1100. The sudden support is examined at 1.1000, the resistance lies in 1.1130 levels.

The indicators advised short positions. The moving averages of 50, 100 & 200 are moving downsides. The value touched the 50-EMA in the 4HR chart. The pair is under the 100-EMA & 200-EMA on the equal chart. MACD decreased giving a sell signal. RSI drives away from an oversold region. If the signal line will be turn back undervalued area it will be a sell signal.

GBPUSD

The pound sustained to fell down across the US currency, despite Mark Carney- BoE Governor crystal plan on how to recover the British economy. The political void in the UK is blocking any additional actions to support the economy. In the mean time, the outflow of the assets in the country is also gaining some power.

GBPUSD stayed below the pressure line, its key trend is down. GBPUSD pair smashed a solid psychological level 1.3300 & lost regarding 200 pips. The pair reached a new 31-year low at the mark 1.2793 levels. The resistance seems at 1.3100 levels, the support lies in 1.2900 levels. The indicators stand in a red zone. Decreased MACD signs a sell signal. RSI stayed in the oversold region, which is also a sell signal.

GBPUSD is under the Moving Averages of 50, 100 & 200 on the 4HR chart. The Moving Averages are moving downsides. All indicators show only the bearish trend. We consider that any recurred will be short-lived & will be finite in 1.3500 region.

USDJPY

The dollar chops down across the yen, as British pound sales had an upside force on the Japanese currency. The yen also gained some support when traders start closing their long trades in the emerging markets. The pair has been prospecting for 4 days in a row. The instrument reduced as a risk aversion thought dominated in the economical world. The value put a fresh low from June 24th itself. USDJPY pair reached a solid psychological level 100.00. The resistance seems in 101.40 levels, the support lies in 100.00 levels.

The indicators rebound from the oversold zone in the 4HR chart. MACD stayed in the negative region. At the equal time RSI grew aside from the oversold zone. The moving averages of 50, 100 & 200 directions are downside directions. The technical outlook is bearish. In the event that the sellers guide to pressure under 100.00 levels reduce will be constant up to 99.00 levels. The USDJPY might recover to the levels at 102.50.

Brent – Crude Oil

The oil prices preserved following the sharp losses of the day before. Nonetheless, Brent stayed in the red zone. The oil reduced when investors twisted their attention to the safe capitals due to renewed concerns regarding the global financial prospects. The Brent gained some force after a 3day reduced. The value was adept to grow by 1.50 percent. The level 49.50 bent its additional growth. The resistance lies in 49.50 levels, the support seems at 48.50 levels.

MACD & RSI remained negative area & finished the day in a red position. RSI bounce back from the oversold region. If it grows more it will be a buy signal. The price is under the moving averages of 50, 100 and 200 in the 4HR chart. The instrument reached the 50-EMA. The moving averages are moving flat in position. If the prices smash under the level of 47.50 the Brent will reduce to the level of 46.50. Alternatively, the quotes will sustain their recovery to the level of 50.5o.

XAUUSD

The pair has been boosting for 6 successive sessions. The yellow metal is in demand due to the risk aversion in the market place following the Brexit. In further, investors are expect for leading Central Banks to begin their fresh easing measures, which will support the precious metals in futures. The gold futures sustained its growth & put a fresh high at 1374 levels. Since 2014 this is the highest position of this metal. After touching 1374 levels the pair began a consolidation & reduced to 1360 levels. The resistance seems in 1390 levels, the support lies in 1360 levels.

All the indicators stand in a green zone. MACD & RSI signs a buy signal. RSI is in the overbought region. The moving averages of 50, 100 and 200 are moving upside directions in the 4HR chart. The price resides over them. The fundamental aspect support buyers. We guess that any alteration will be short-lived. In the potential outlook, the next block for the XAUUSD might well be around 1390 levels. A crack under 1350 levels will be followed by drive down to the support level 1330.