06

Jul

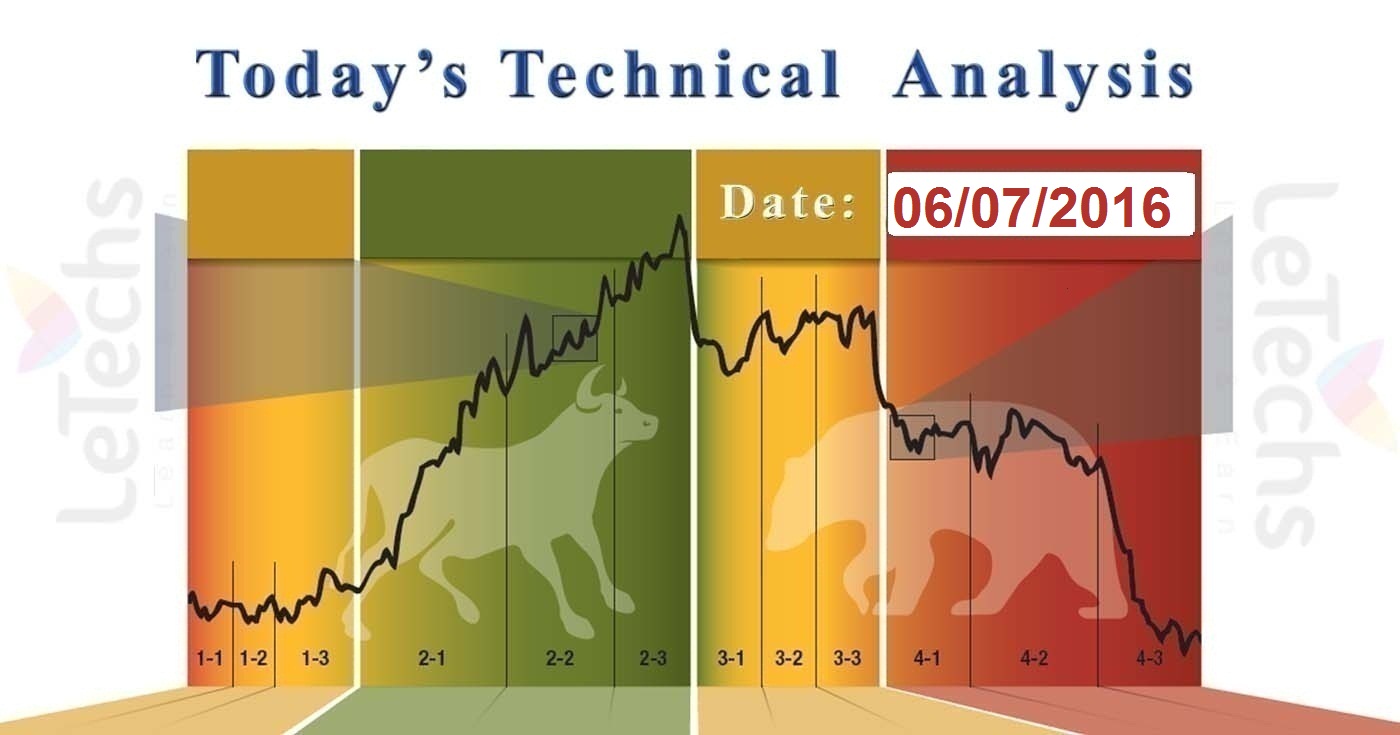

Daily Technical Analysis on 6th July 2016

Technical Pairs: EURUSD, GBPUSD, AUDUSD, USDJPY, & Brent-Crude Oil.

EURUSD

The Euro weakened due to the volatility about the future of the UK & Italian banks. The Italian Government is considering banks resubsidization to beaten the present situation. The pair stayed under the upward channel. There was a struggle to grow that failed. The pair rebound upwards from the 50-days moving average & surrounded the 200-day moving average on the 4HR chart. After all, the recurred sellers sent the value under the level of 1.1130. The resistances levels are 1.1130, the support levels are 1.1000.

Technically all the indicators stand in a green zone. MACD indicator decreased. If its histogram turns into a negative zone it will be a sell signal. RSI moved aside from an oversold region, which is also a sell signal. The moving averages of 50, 100 & 200 are flat in position. Currently the 50-day moving average is a resistance. We are noticing for the support level of 1.1050 breaks & after those continuations of a cut down with an additional target at the level of 1.1000. Or else, the pair might grow 1.1200-1.1220 levels.

GBPUSD

The pound fell down to 31-year low across the US dollar following the weak data of UK service sector. The BOE- Bank of England determined to launch fresh liquidity measures to support the economical sector. GBPUSD pair remained below pressure. The pair was not adept to crack 1.3500 levels and reduced to 31-year lows. The resistances are 1.3100 levels; the support levels are 1.2900.

Indicators stand in a red zone. MACD decreased signs a sell signal. RSI enrolled the oversold region, which is also a sell signal. GBPUSD is under the Moving Averages of 50, 100 & 200 on the 4HR chart. The Moving Averages are indicating downside directions. All indicators only support the down trend. Sellers are aiming to test the intellectual level of 1.3000. If they achieve, the pair will reduce to 1.2900 levels.

AUDUSD

The Australian Central Bank left the interest rates unmodified amidst a political volatility in the country & abroad. The value was not adept to move far from the level of 0.7500. After touching the 0.7550 levels, AUD cut down & put a fresh local low at the mark level of 0.7450. The resistance stands in 0.7500, the support levels are 0.7400.

MACD & RSI decreased signs a sell signal. Any additional reduce will indicate sellers growing very much solid. The instrument surrounded the 50-day moving average on the 4HR chart. This line might become a support for the value & it bounces upside. At present the Moving Averages 50, 100 and 200 are moving flat in position.

The price might rebound from the level 0.7440. In the outlook where the buyers recurred to the market place value will grow to 0.7550 levels. Conversely, if the AUDUSD pair does make a getaway at the level 0.7450 the price will reduce to 0.7400 levels.

USDJPY

The yen grew amidst a widen demand for the safe capitals. This was due to the fresh signs of volatility about the future of the UK & Italian banks. USDJPY got below pressure when traders started profit-taking. The pair reduced & put a fresh local low at 101.40 levels. The resistance is 102.50 levels, the support levels are 101.40.

MACD decreased, RSI reached the oversold region. MACD & RSI constant giving sell signals. The Moving Averages of 50, 100 & 200 are moving downsides, it is another sell signal. We consider the 101.40 line smash that will unlock the path for the sellers to 100.30 levels.

Brent – Crude Oil

The oil prices were below pressure as concerns above the global economy forced the future demand of oil. The Brent futures were adept to test a solid physiological level at 50.50. Subsequently testing the level the oil quotes reduced. The Brent smashed levels 49.50, 48.50 & reached 47.50. In common, the crude oil futures lost regarding 4 percent throughout the trades. The resistance remains in 48.50, the support levels are 47.50.

The indicators of MACD & RSI became negative & remain in a red zone. RSI reached the oversold region, which signs a sell signal. The 100-day moving average cracked the 50-EMA & 200-EMA on the 4HR chart. If the resistance over 47.50 levels hold the next stop might well be at the 46.50 area. Alternatively, the Brent will increase to 49.50 levels.