05

Jul

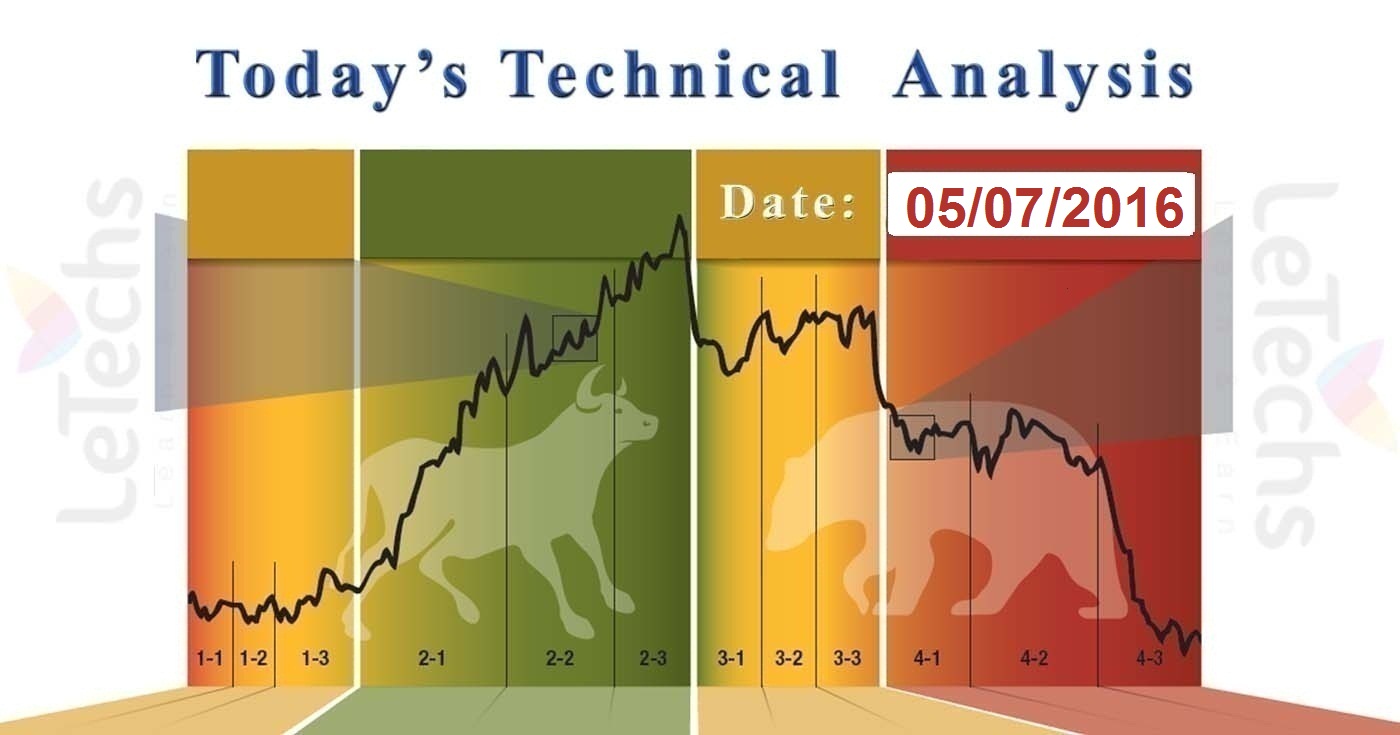

Daily Technical Analysis on 5th July 2016

Technical Pairs: EURUSD, GBPUSD, USDJPY, Brent-Crude Oil, & XAUUSD.

EURUSD

The euro reclaims lost ground across the US dollar, the price rebound to the opening level. Originally, the euro refused due to the weak data of the investor belief indicator from Sentix. According to the indicator investors' mind worsened in the Euro zone in July. The index touched 18-month low due to the heightened concerns regarding the economic impact of the Brexit.

The EURUSD spent the whole day at the opening level. MACD stayed in the zero levels. RSI is near to the overbought zone. Technically the indicators are in a horizontal within a neutral region. The indicators MACD & RSI are not showing a crystal direction. The resistance remains in 1.1200 levels, the support remains in 1.1130 levels.

The moving averages of 50, 100 and 200 are in horizontal position. The pair earns a good support from the 200-day moving average close to the level of 1.1100. At the same time the 100-day moving average is a resistance. If the EURUSD pair moves over the mark 1.1130 levels the euro might grow towards 1.1200. If the pair goes down the pair might reach 1.1000 levels. EURUSD remains Neutral.

GBPUSD

Construction sector activity in the UK unpredictably fell in June to a 7-year low. That news added further concerns that the British economy cut down following the Brexit referendum. The pair traded at the last week close levels. The value spent the full day in a narrow flat in reach 1.3330 – 1.323 levels. The resistance lies in 1.3300 levels, support remains in 1.3100 levels.

Indicators cautioned in a red zone. MACD decreased negative region, the histogram is at the equal level it closed previous week. RSI is near to the oversold region. The indicator 50-day moving average limits the growth on the 1HR chart. The GBPUSD pair is under the Moving Averages of 50, 100 and 200 on the 4HR chart. The Moving Averages are moving downsides. All indicators support only the bearish trend.

Buyers seem not to have sufficient powder to launch the pair upside. We anticipate markets to remain eventually neutral until Mark Carney gives his statement. We will be keeping a close eye on the resistance level of 1.3500. If the pair fixates above it the instrument might grow to 1.3700 levels to block the gap. Should the level 1.3200 cracks down and the pair might fall further to 1.2900 levels.

USDJPY

The dollar kind of modified against other currencies in a quiet Monday although the markets are again discreet & this time it is all regarding the Fed decision to raise the rate or not. USDJPY pair sustained to excludes the growth of "risk appetite" that indicated sellers’ live in the market. The instrument stayed at the level of 102.50 on Yesterday. The market place showed less volatile trades due to the Independence Day celebration in the US. The resistance remains in 103.50, the support stands in 102.50 levels.

The indicators of MACD and RSI are in a red zone. Both indicators not show clear signals. The USDJPY is under the Moving Averages of 50, 100 & 200 which are moving downsides. The upside bounce potential target is 103.50, 104.50 levels. If the value falls it will bring into 101.40 levels.

Brent – Crude Oil

The Brent sustained its recovery last day. The ceremony in Nigeria & the Norwegian oil and gas industry workers’ victory in a battle for higher wages supported the oil values. The fundamental backdrop supported the oil imminent. The value was able to touch a current resistance levels at 50.50 where it twisted down & slightly reduced. The mark level of 50.50 seems to be a solid level to crack. The price has freshly bounced downside 4times from this level. The resistance remains in 50.50, the support stands in 49.50 levels.

MACD & RSI stayed in positive zone. Standing in a green zone is a specific factor for buyers. The moving average creates a cross-over. The 100-days moving average smashes the 200-day moving average on the 4HR chart. If the price fixates under the support level of 49.50, it might sustain the downside trend in the short term. The potential targets are 48.50 levels.

XAUUSD

The gold futures continued to mount, remaining close to a 2-year high. The fading anticipations that the Fed will raise the rate this year supported the yellow metal. The gold slightly improves due to the absence of US traders on yesterday. The pair gained 1.53 percent & surrounded the lately put high at 1360 levels. The resistance stands in 1360 levels now, the support remains in 1330 levels.

Technically, all the indicators support the overbought area. The MACD is developing with strong momentum, the RSI oscillator moved over the level of 70 that is a sign of bullish signal. The moving averages of 50, 100 and 200 are moving upside directions which signal regards a growth tendency. The precious metal might constant its growth before Non-Farms. The value might crack the resistance level of 1360 & reach 1390 levels. If we get positive Non-Farms the instrument might reduced under the level of 1316.