04

Jul

Weekly Forex Technical Analysis on 4 – 8 July 2016

Technical Pairs: EURUSD, GBPUSD, AUDUSD & USDCAD

EURUSD

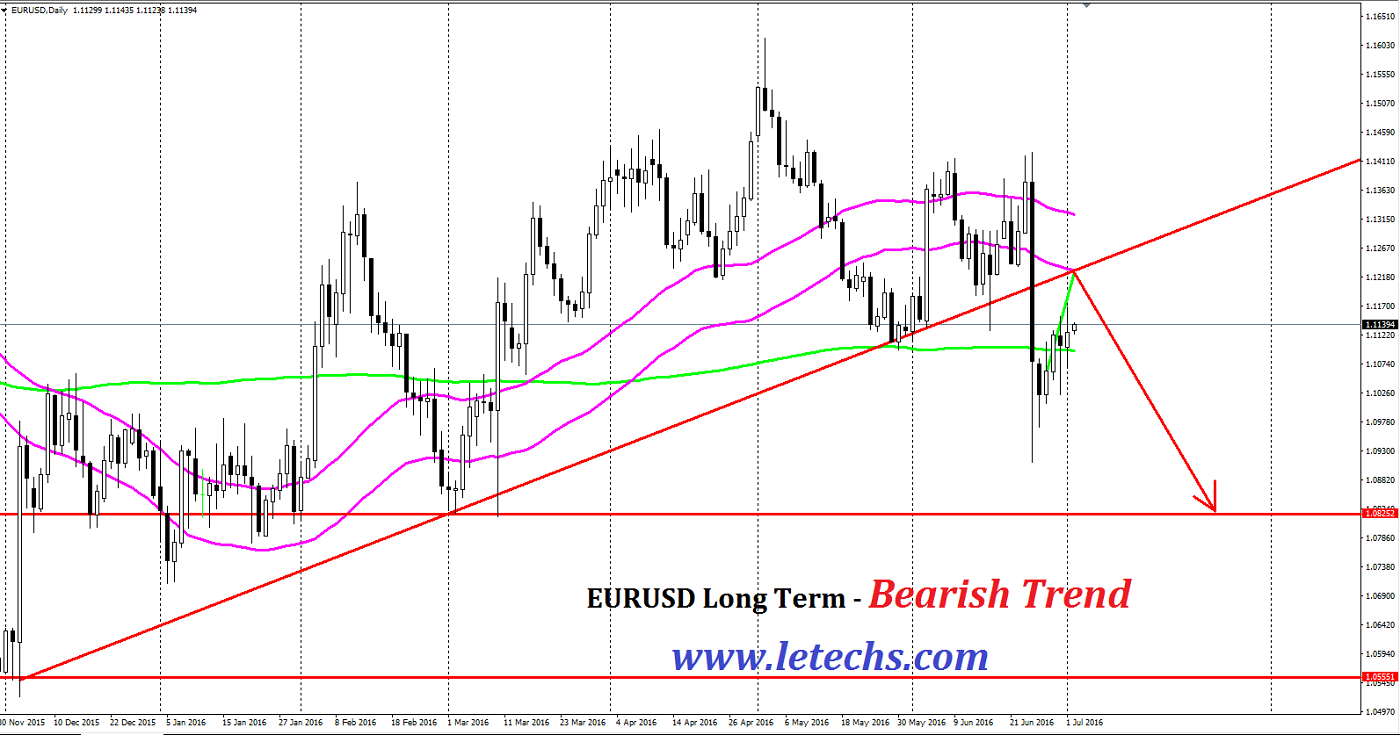

EURUSD flounder in the post-Brexit week, but naturally did not go too long. More PMIs as well as the suspended ECB meeting minutes are minded. In the week following Britain’s decision to depart the EU, there was some confusion that this would actually arise & this provided few support also to the euro. In natural, things seem quieter, and the ECB in any rush to act is definitely not, variation from the BOE. This gives the main support for the normal currency. Spanish politics stay messy following the elections, but there is some belief for a stable government. Hike in the euro-area edged up to 0.1 percent. The two events also backing the euro. In the US, last GDP slightly taken out anticipations but the Fed is in no rush to hike rates.

Euro vs. dollar began the week with a tiny weekend space, but recovered & fairly settled over the 1.1070 level. Contrary to confusions & beliefs, Brexit is here to remain and it takes its cost on Europe simultaneously. And although the ECB is not keen to take rapidly, it seems likely that they will require pursuing the BOE in looser monetary policy. Further in the US, monetary policy is not predicted to be hawkish, but the nation is good positioned to sustain growing. EURSUSD remains Bearish.

GBPUSD

GBPUSD posted stinging gains last week, dropping above 200 points. The pair blocked at the level of 1.3246. This week’s key events are PMI reports & Manufacturing Production. Following a historic plunge specified the Brexit vote; the pound took one more hit previous week, after Mark Carney’s blunt statement that the BoE was outlining a rate cut in the summer. In the US, GDP assigned came in at 1.1 percent, beating the evaluation of 1.0 percent. The week cloaked up on a positive week, as ISM Manufacturing PMI beat anticipations. GBPUSD unlocked the week at 1.3432 & fell down to a low of 1.3112 levels. The pair then twisted directions & mounted to 1.3533 levels, testing the resistance levels at 1.3514. GBPUSD then retracted & protected at 1.3246 levels. By means of the pound registering sharp losses.

GDPUSD is trading at levels not ever seen in last 30 years. We start at fresh lower levels: 1.3600 levels switched to resistance following the pound’s enormous losses after the Brexit results. Now, this line had contributed support since 2009. In the US, monetary policy is not expected to be hawkish and a rate hike appears doubtful. With the British political scene in disarray and the financial markets struggling to come to grips with Brexit, blustery waters might sustain to engulf the pound. GBPUSD remains Bearish.

AUDUSD

AUDUSD had an unfair week & get modest gains. This week’s major events are Retail Sales & the Cash Rate. There were no significant Australian releases last week. The Aussie stabilizes previous week, as global markets dissolve the stunning Brexit vote. In the US, GDP posted arrive in at 1.1 percent, beating the prediction of 1.0 percent. The week unlocked up on a positive week, as ISM Manufacturing PMI taken out anticipations.

AUDUSD cloaked the week at 0.7426 levels & reached a low of 0.7318, testing support levels at 0.7334. The pair then moved directions & mounted to a high of 0.7503 levels & clogged the week at 0.7470 levels. In the US, monetary policy is not anticipated to be hawkish & a rate raise seems doubtful. The markets will have to arrange with the new Brexit reality, & sustaining instability in the market place might weigh on the Aussie much more. AUDUSD remains Bearish.

USDCAD

The Canadian dollars appreciate a strong week, as USDCAD cut down 160 points. The pair closed at the level of 1.2868. This week’s highlight is Employment Change. Canadian GDP posted a tiny gain of 0.1 percent, coordinating the forecast. This broke a tough string of two reduces, and the markets place get the Canadian currency a thumbs up. In the US, GDP posted arrive in at 1.1 percent, beating the prediction of 1.0 percent. The week unlocked up on a positive week, as ISM Manufacturing PMI taken out anticipations.

USDCAD unlocked the week at 1.3025 levels & rapidly reached a high of 1.3120 levels. The pair then fell down sharply to a low of 1.2662 levels, testing support levels at 1.2663. USDCAD dropped slow in the week & blocked at the level of 1.2868. Brexit uncertainty might hurt risk money like the Canadian dollar. At the mean time, the Fed is likely to sustain twiddling its thumbs. Canada is releasing many significant indicators this week, highlighted by employment data. If Canadian figures impress, the Canadian dollar might constant to improve. USDCAD remains Neutral.