27

Jun

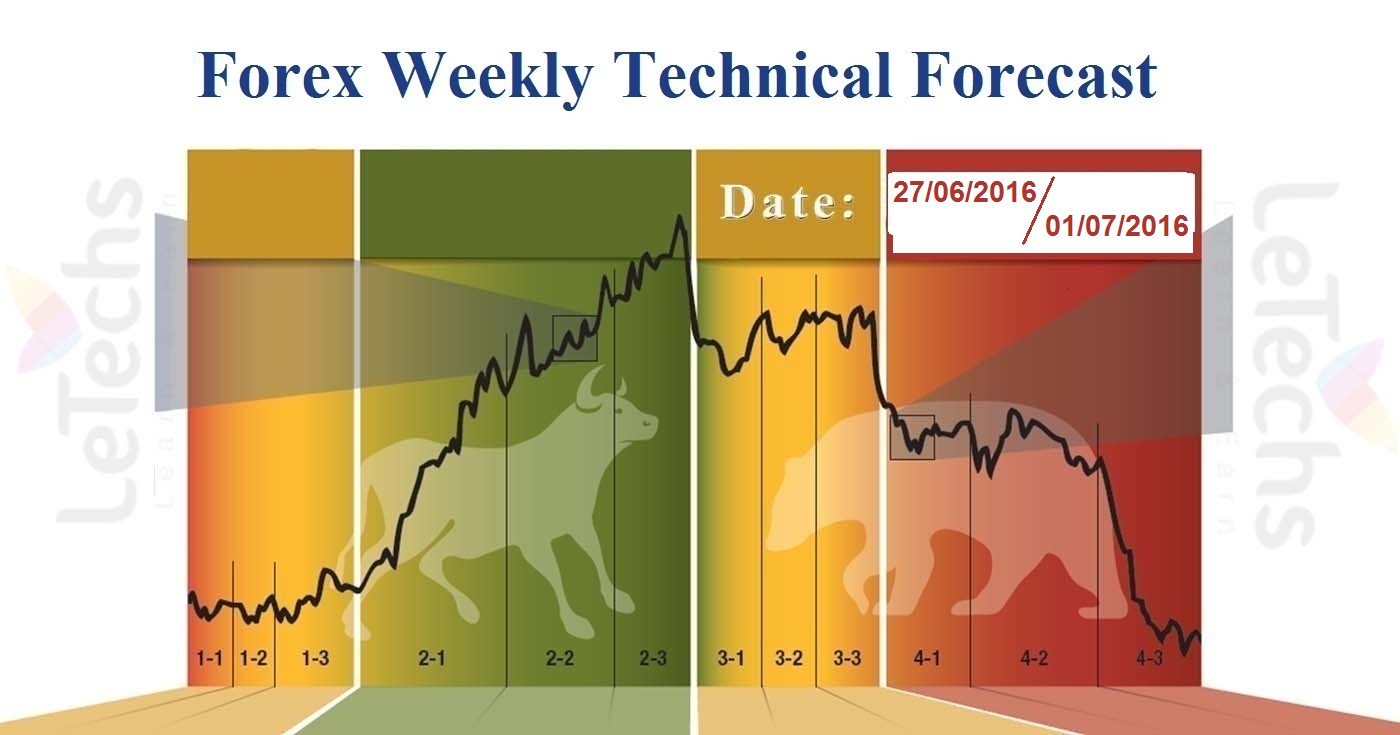

Weekly Forex Technical Analysis on June 27 – 1 July 2016

Technical Pairs: EURUSD, GBPUSD, AUDUSD & USDJPY

EURUSD

EURUSD pair was hit tough on the British decision to depart the EU. This was certainly not valued in & many questions are still open. Will we see more falls? Aside from the Brexit fallout, we have ballot in Spain, inflation figures & more PMIs.

Conflicting to the latest polls, Brits decided to depart the EU in a conclusive 52 percent to 48 percent vote. The Brexit has significance not only on the UK economy & collapsing the pound, but also the euro-zone economies & the destiny of the European Union. There are many anxieties & scrambling continues. An economic decline or even a collapse cannot be ruled out. Will the ECB provide more impetus? President Draghi left the door unlocks to this before the referendum & we might hear more as events improve. Somewhere, the German economy looks great with beats in the ZEW and IFO business sentiment figures. In the US, Yellen hinted totally dovish & numbers were mixed, but the greenback relish safe haven flows, next only to the yen.

Euro vs. dollar begins the week in range & gets support at 1.1230 levels. From there, it did handled to tackle resistance at 1.1410 levels but entirely collapsed on the Brexit results, swing as low as 1.0905 levels before getting on higher ground on the abnormal aftermath. Brexit is now reality & it is not favor news. Even if we don’t hear regarding new impetus from the ECB, the economic position is likely to crumble. More volatile from Spain might join the mix. Also in the US, the Fed is not likely to hike rates at any moment instantly. Nonetheless, monetary policy divergence is handled with the ECB continuing its QE program at full form. EURUSD remains Bearish.

GBPUSD

GBPUSD pair dropped to 30-years down last week, as markets smashed after the Brexit referendum in the UK. The pair decline almost 1200 points on the week, closing at the level of 1.3660. Likely a few events wait for traders this week in further to the Brexit fallout.

Last week’s Brexit vote in the UK sent bump waves in Britain & against Europe. Brexit referendum vote to depart the EU floored the markets, which had anticipated the vote to support remaining in the bloc. In the US, Yellen sounded totally dovish & a rate raise is unlikely sooner September at the earliest. GBPUSD pair opened the week at 1.4577 levels & mounted to a high of 1.5015 held up in the week. The pair then twisted directions in dazzling fashion & fell down to a low of 1.3219 levels. The pair closed the week at 1.3660 levels. Britain is in disarray following the stunning referendum vote, & the political anxiety & instability might push the pound lower. Traders can predict volatility later week from the pound, as the UK & Europe face the volatility of the British decision to depart the EU. GBPUSD remains Bearish.

AUDUSD

AUDUSD showed solid volatility late last week, but finished the week relatively unmoved, at 0.7448 levels. There are six major events this week for AUDUSD.

In a vote that has posted bump waves in the UK & across Europe, Brits posted to depart the EU in a decisive percent of 52 to 48 votes. Following the vote, the pound collapsed. The Brexit has conclusion not only on the economies of Europe, but against the globe. In the US, Yellen sounded totally dovish & a rate firm is unlikely sooner September this year. AUDUSD pair opened the week at the levels of 0.7427 & reached a high of 0.7643 held up in the week, as resistance held firm at the levels of 0.7692. The pair suddenly changed directions & fell to a low of 0.7296 levels, before improving & ending the week at 0.7448 levels. AUDUSD remains Bearish.

USDJY

USDJPY pair dropped relatively 300 points last week, & briefly fell down under the symbolic 100 level. The pair blocked the week at 101.76 levels. This week has 9 key events.

In a vote that has sent awe waves in the UK & across the globe. Following the vote, the safe-haven yen set strong gains as investors dodge away from risk. USDJPY pair unlocked the week at 104.62 levels & reached a high of 106.81 levels held up in the week, as resistance at 107.39 levels. The pair suddenly twisted directions & fell to a low of 98.95 levels, before improving & closing at the levels of 101.76. By means of the BoJ showing no appetite for additional easing, the yen might constant to move near to the symbolic 100 level. As well, hangover from the stunning EU referendum vote might boost the safe-haven yen. USDJPY remains Bearish.