28

Jun

Technical Pairs: EURUSD, GBPUSD, USDJPY, Brent-Crude Oil, & XAUUSD.

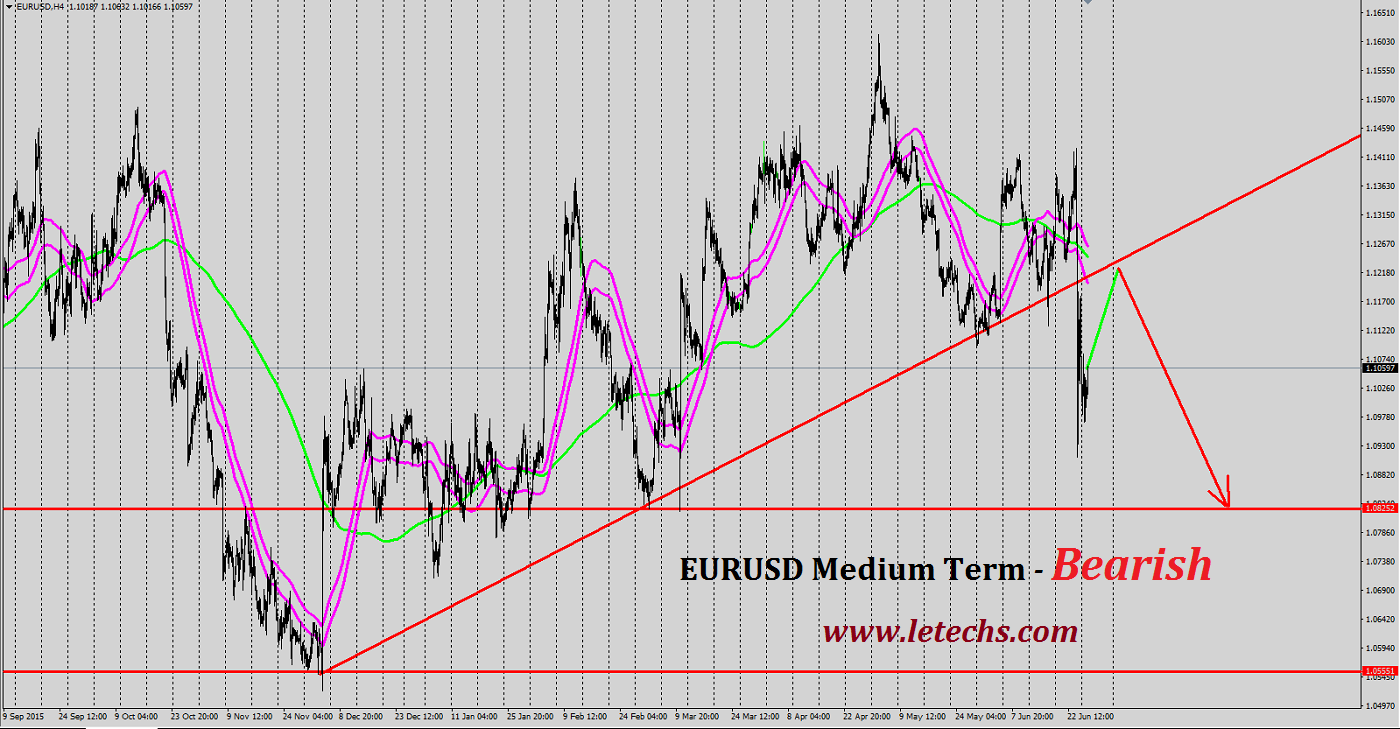

EURUSD

The euro is below pressure across the dollar due to panic that the Brexit will worsen the anticipation for the EU & the euro zone economy. The pair showed a diverse dynamics on Monday. The euro made many attempts to regain; yet the sellers did not let it to improve. The instrument stayed at the same level, close to the mark level of 1.1000. The resistance remains in 1.1130 levels, the support stands in 1.1000 levels.

MACD stand in the negative zone. If the indicator stays in there that will be a Bearish. RSI is near to the undervalued region. If RSI comes in the region, that will be a sell signal. In the outline where the oscillator increases we will get a buy signal. The value is under the Moving Averages. The Moving Averages of 50, 100 and 200 are moving downside, which is a sell signal. EURUSD pair is still below the pressure line. We consider it will fall more & will touch the local low at 1.0900. The pair might increase only to fall from the higher levels.

GBPUSD

The pound got below pressure one more time when the Finance Minister George Osborne said that the end of the referendum will delay the additional volatility in the commercial markets. According to George Osborne the finance of the country is ready to depart the EU & it will successfully survive with its residual. The pair reduced & was adept to put new historical low at 1.3118 levels. The resistance stands in 1.3300 levels, the support remains in 1.3100 levels.

MACD decreased in the negative region shows a sell signal. If MACD stays at the equal levels the pair will move downsides. RSI drop to the oversold level of 30. The oscillator will display a sell signal until it remains near to the undervalued zone. The value is under the Moving Averages of 50, 100 & 200 on the 4Hr chart. The Moving Averages are express downwards, it indicates a sell signal.

We pretend that the pair has no way to recover soon. The Brexit will force the pair additional. We do not ignore few pull backs that we predict to be weak & short-lived. The sellers’ beside targets are 1.3100 levels & 1.3000 levels. GBPUSD might grow later 1.3700 levels.

USDJPY

Following the UK referendum the Japanese Prime Minister Shinzo Abe requested from the Finance Minister Taro Aso to supervise the currency market & to take force if required. USDJPY pair is stayed below pressure. The market place seems rather balanced; the instrument almost did not act & remained at the equal place. There are no key events on the schedule that might significantly volatile the pair. The resistance stands in 102.50 levels, the support remains in 101.40 levels.

MACD indicator remains in the undervalued zone the pair will reduce. RSI is near to the oversold area. If the oscillator reduces or stays at the same levels that will be a sell signal. If RSI increase further, that will be a buy signal for traders. USDJPY pair is under the Moving Averages of 50, 100 & 200 which are moving downside directions. We anticipate markets to remain fairly neutral & the USDJPY apparently will stay in the same area between 101.40 & 102.50 levels.

USDCAD

USDCAD pair rise throughout the day on Yesterday, breaking over the 1.30 level as oil markets chop down, & surely the US dollar was bought in sort to get away from other currencies. At this moment, it seems that the oil markets are going to be testing fairly some serious support, so if they sustain to go lower, it consider to push this market higher. Inclined suitable time, it’s likely that the market place will test the 1.32 level one more at this point. There is obviously a lot of bullish force for the US dollar at present but MACD decreased in the negative zone signs a sell signal. The Moving Averages of 50, 100 & 200 are below the value which are moving downward directions, show a sell signal

Brent – Crude Oil

The crude oil prospective marked the first day of the fresh week with reduce. Nonetheless, few analysts expect that Brexit impact on the global fuel demand is very finite. The oil quotations tested to regain last day yet buyers met the sellers’ resistance levels at 48.90. That mark turn out a pivot point & the price drops. The resistance remains in 47.50 levels, the support remains in 46.50 levels.

MACD decreased shows a sell signal. RSI is close to the oversold area. If RSI reduced that will be a sell signal. Shall RSI bounce upside & the Brent eventually will regain. The Moving Averages of 50, 100 and 200 are over the value. In this potential outlook, the next break for the Brent might well be around 46.50 levels. If value smash over the level of 48.50 & consolidates on top of this level, then this might lead to renewed buying force, apparently towards 50.00 – 50.50 levels.

XAUUSD

The gold again reached the two-year highs. The quotes will grow following the UK unpredicted decision to depart the EU. The yellow metal is in claim as the news made investors seek for safe capitals.

The gold stayed in the growing channel. Generally Monday was poor with news & there were no traders that might move the pair. The gold eventually showed a diverse dynamics yet all trades were less volatile & the pair stayed under 1330 levels dollar per ounce. The resistance stands in 1330 levels, the support stands in 1300 levels.

MACD increased positive region indicates a buy signal. If the histogram stays in the positive zone the growth will be sustained. RSI touched the overbought level. If the signal line brings into the zone the growth will be constant. In the outlooks where the oscillator cut down we will get a sell signal. The value is over the Moving Averages & it directs upwards. The value can move to the resistance 1330 levels & more up to the level of 1360 dollar per ounce. We do not ignore a alteration to 1270 levels.