25

May

Daily Technical Analysis on 25th May 2016

Technical Pairs: EURUSD, GBPUSD, USDJPY, XAUUSD, & WTI- Crude Oil

EURUSD

Bonds market place shows a developing optimism, the Ten-year German government bonds revenue grew which elevated the allure of the European capitals. Economic Sentiment in May was the focal point of our consideration. The index clearly drop which weakened the euro of 6.4 vs. anticipations 12.0.

The 1st support finds at the level of 1.113 & subsequently 1.107 levels. The 1st resistance finds at the level of 1.1200, the other one is at 1.125 levels.

It’s a definite & a burly sell signal. The value is declining. The muscular support level of 1.1200 cracks was followed by the pair reduce. If it breaks the level of 1.113 downwards it will unlock the method to the level of 1.1070.

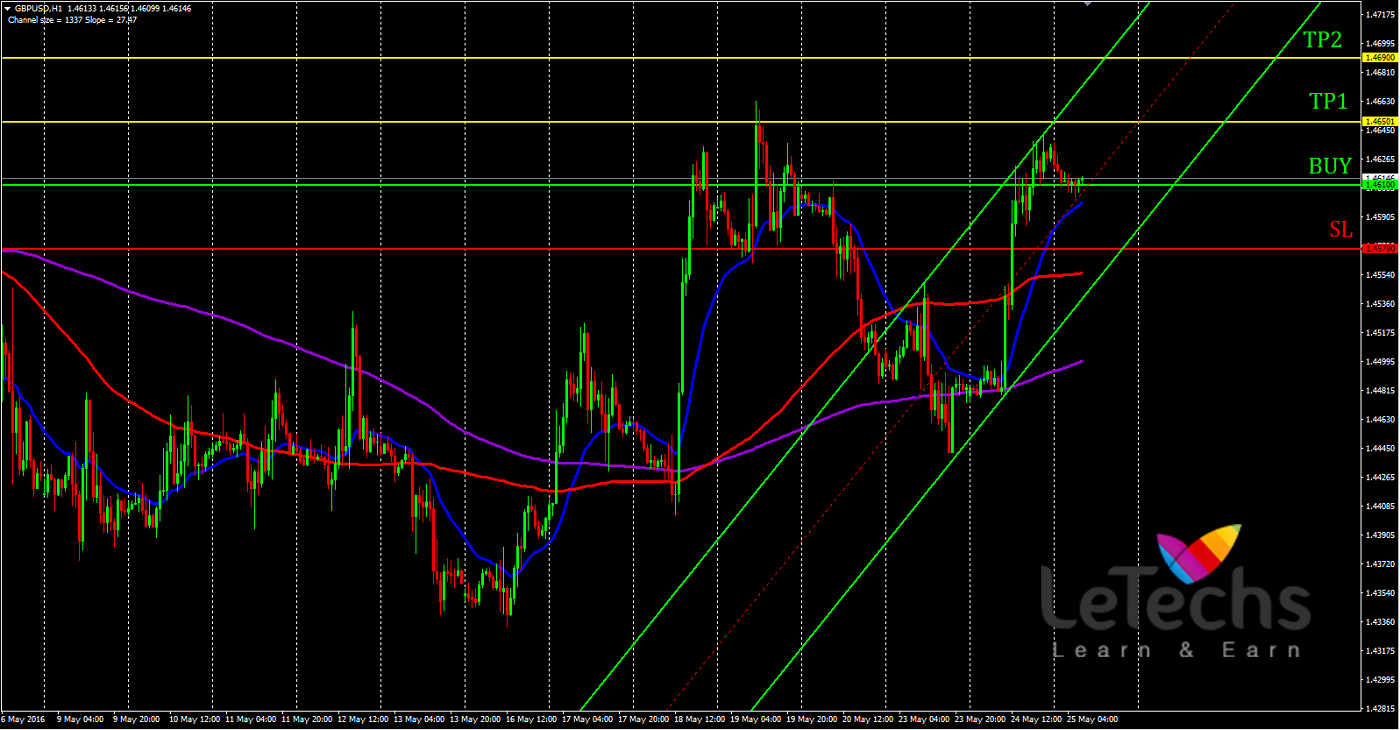

GBPUSD

In UK, the parliamentary hearing on inflation was the key event in the country. The Ten-year government bonds return in the UK will rise by 5 basis points from the previous meeting of the Bank. Nonetheless, the referendum on membership in EU bears a bit of risk for the country recession.

The value finds the 1st support at 1.4560, after those 1.448 levels. The value finds the 1st resistance at 1.467 levels; the other one is at 1.476 levels.

It’s a confirmed & a muscular buy signal. The value is growing. If the value fixates over the resistance levels of 1.467, it might sustain the upward trend in the short time period. The potential targets are 1.476 levels.

USDJPY

In US, New Home Sales Modify for April was 16.6 percent vs. Earlier -1.3 percent. The 1st support remains at 109.8 levels; the other one was 109 levels. The 1st resistance remains at 110.6 levels, after those 111.4 levels.

There is a confirmed and a strong buy signal. The value is improving. The pairs climbing upwards, the bulls target was 110.60 & 111.4 levels.

XAUUSD- Gold

Gold markets place have a rough session on last day as we cracked under the 1250 level. There is an important amount of support under still, so alike though it looks like we are going to chore a bit diminish, we admit that sooner or later the buyers will rebound. At this time, short-term traders will more than likely constant to sell as the US dollar hint to be improving at the same time. It’s not until we crack underneath the 1200 level that I would deal with selling this market as it have been so bullish around the longer term period.

WTI- Crude Oil

WTI Crude Oil market drop slightly throughout the path of the session here on Yesterday, but found suitable support under the 48 level in order to twist things over & shape a little bit positive candle. It looks as if we are closed trying to build up suitable momentum to smash on top of the 50 level. Once we did, I consider this point in time it will be much of a “buy-&-hold” position, but not as far as we close over there at the final of the day on a daily candle chart. Short-term period will more than likely sustain to be the best technique to be involved.