18

May

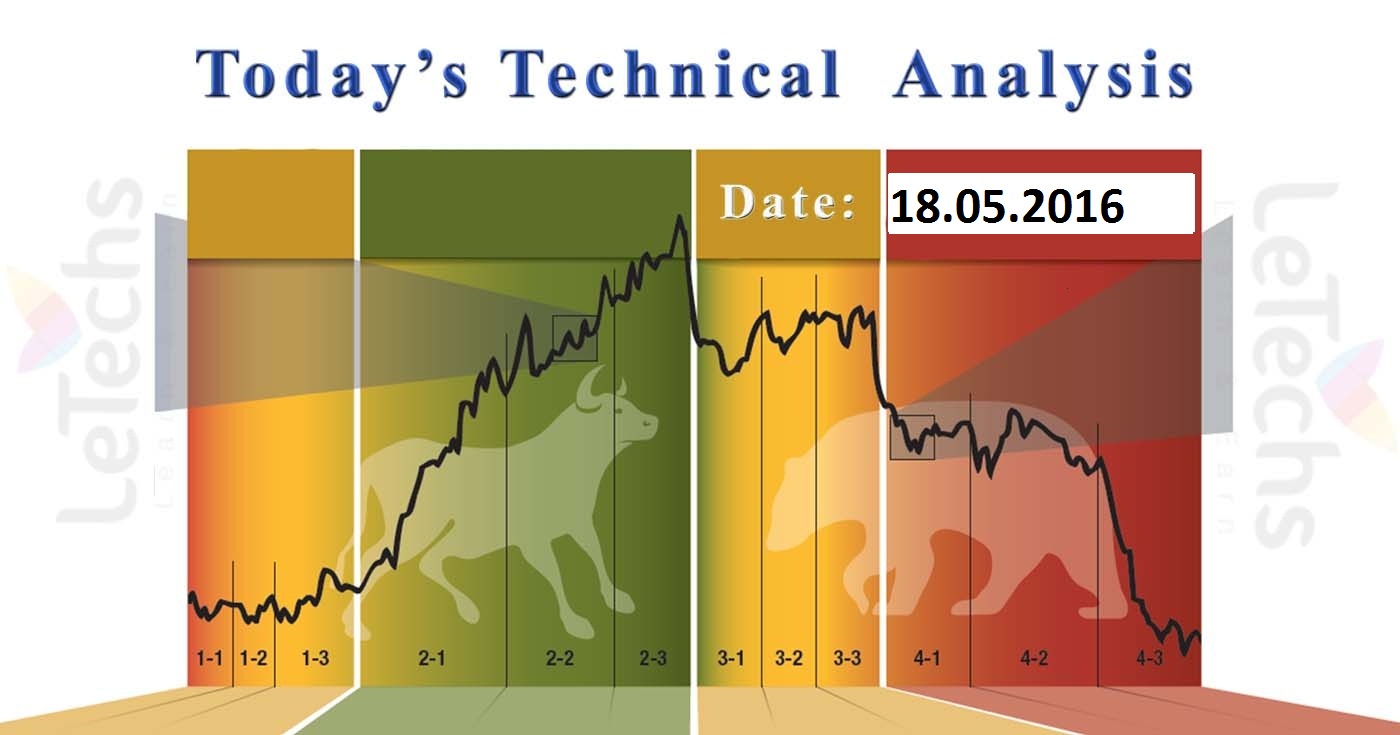

Forex & Commodity Intraday Technical Analysis on 18th May 2016

Today's Technical Pairs: EURUSD, GBPUSD, USDJPY, XAUUSD, & WTI Crude Oil

EURUSD

All traders thinking were focal point on the US statement amid an unfilled macroeconomic calendar in Europe. In US industrial production was also the central point of our consideration of 0.7 percent m/m vs. predictions -0.3 percent m/m. The basis is considered as a dominant sign of the FOMC monetary policy changes.

The 1st support stands at the level of 1.126; after those 1.115 levels. 1st resistance stands at the level of 1.135, the other one is at 1.145 levels.

It’s a definite & a burly sell signal. Following the support level of 1.126 finding down the method to the support of 1.115 will be unlocked.

GBPUSD

For GBPUSD, Bonds Market the Ten-year UK government bonds return decline which reduced the investments of the British capitals. UK released Consumer data Price index for April was 0.3 percent y/y vs. expectations 0.5 percent y/y.

The value is verdict the 1st support at 1.44 levels, the other one is at 1.432 levels. The value is finding the 1st resistance at the level of 1.448; the other one is at 1.456 levels. MACD indicates a neutral region. The value is strengthening. The buyers demand to smash on top of 1.448 levels for a constant growth. We don’t refuse the fell to 1.44 levels.

USDJPY

US & Japanese government bond yields various extended which elevated the attractiveness of the US capitals. For the US released Inflation report of Consumer Price index for April was 0.4 percent vs. earlier value of 0.1 percent.

The 1st support remains at the level of 109, after those 108.2 levels. The 1st resistance lies at the level of 109.8; after those 110.6 levels. It’s an established & a muscular buy signal. MACD shows in a positive region. The value is correcting. We anticipate the 109.8 level line cracks that will unlock the path for the buyers to 110.6 levels.

XAUUSD- Gold

Gold markets primarily rallied throughout the course of on Tuesday, but found sufficient support at the 1270 level to twist over & form a rather positive candle. It shows that there are enough of buyers underneath, & that we will apparently continue to try to touch the 1300 level on top. If we can get over there, it becomes a “buy-&-hold” position, and definitely we turn into very bullish at that time. Short-term evacuate should be buying chances, & we wait for that selling is all nevertheless inaccessible at this occasion as there is a enormous amount of support just underneath.

WTI-Crude Oil

WTI Crude Oil market rose kind of throughout the path of the session here on Yesterday, cracking over the 48 level. There is the probability of touching the 50 level at this time, & as a conclusion right now bullish. We consider that pullbacks become buying chance as well However, as they twisted back everywhere & forming a tiny of a supportive candle on shorter-term period. We don’t interest in selling this market place, slightly not before we get a longer-term sell signal.