13

May

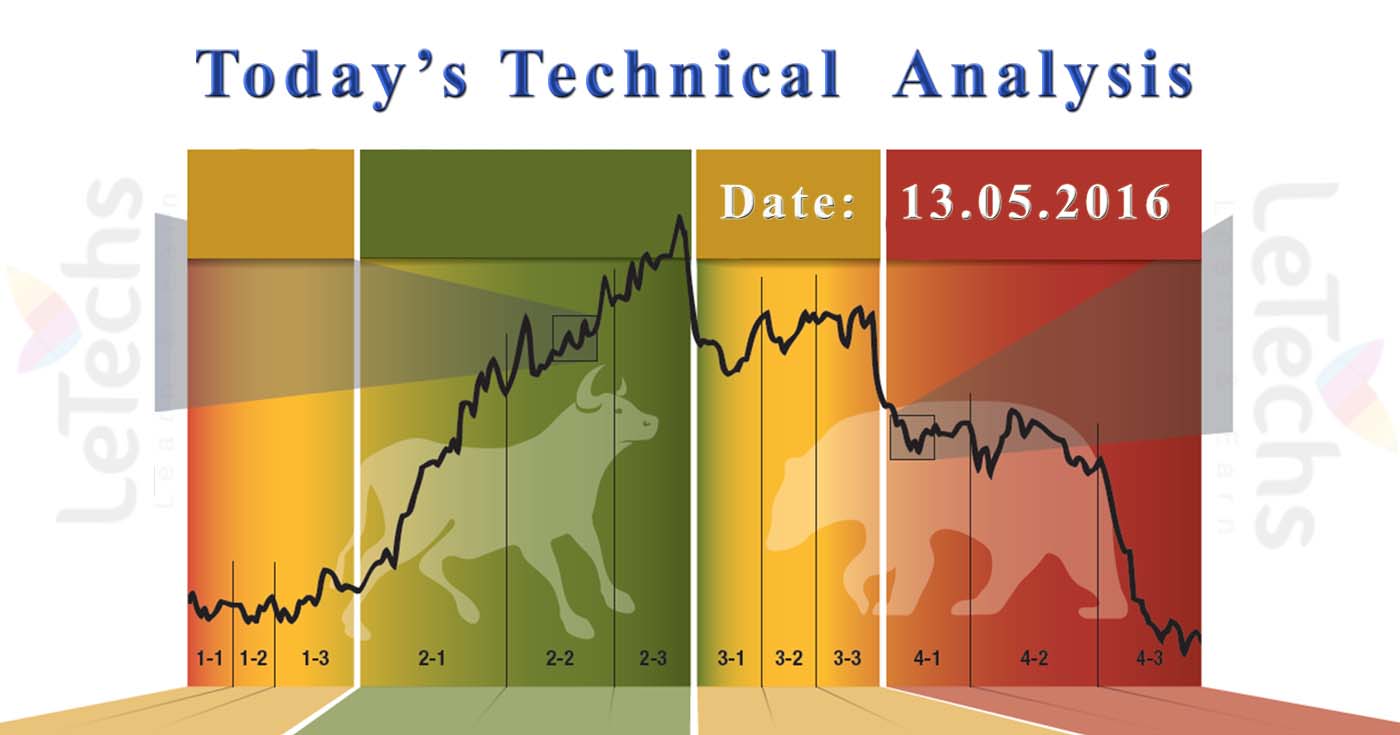

Daily Technical Analysis on 13th May 2016

Technical Pairs: EURUSD, GBPUSD, USDJPY, USDCH, XAUUSD, & WTI- Crude Oil

EURUSD

Eurozone released IP- Industrial Production for March of -0.8 percent vs. expectations 0.1 percent. Ten-year governments bond provides in Germany develop which played into the pass of the euro bulls.

EURUSD 1st support lies at 1.135 levels, after those 1.126 levels. The 1st resistance lies at the level of 1.145, the other one is at the level of 1.155. It’s a established & a well-built sell signal. MACD sign is in a negative region. The value is declining. These pairs can develop to the resistance level of 1.145. Once flouting 1.145 the buyers might go to 1.155 levels.

GBPUSD

GBPUSD - BOE Bank of England price rises statement was the key event of Yesterday. As anticipated the Central Bank commentary concerning the economy & the inflation development were reasonable negative. The UK controller left the price unchanged at the level of 0.5 percent.

The value is finding the 1st support at 1.44 levels, the other one is at the level of 1.432. The value is verdict the 1st resistance at the level of 1.448, subsequent is at 1.456 levels.

It’s a definite & a muscular sell signal. MACD display is in a negative region. The value is falling. Following the support level of 1.44 come through downhill the method to the support 1.432 will be unlocked.

USDJPY

According to Haruhiko Kuroda-JPY Head of the Central Bank of Japan it determines to be solid for the Ministry of Finance to grow weaker the yen to boost exports. The dynamics of the liability marketplace also point out an increase in order for Japanese resources.

The 1st support remains at 108.2 levels, the other one is at 107.4 levels. The 1st resistance stands at the levels of 109, after those 109.8 levels.

It’s a confirmed & a burly buy signal. The rising spring back potential aim is 109.8 levels. If the value go down it will dig up to 108.2 levels.

USDCHF

Hesitation regarding the prospect of global growth sustained to pressure the US exchange. US released preliminary Jobless Claims 294K vs. predict 277K & the preceding value 274K.

The value is verdict the 1st support at 0.966 levels, the other one is at 0.958 levels. The value is verdict the 1st resistance at 0.975 levels, the other one is at 0.985 levels.

It’s a confirmed & a well-built buy signal. We advised going along with the 1st target of 0.975 levels. When the values consolidate over the 1st target it might go to the next level of 0.985.

XAUUSD

XAUUSD markets chop down primarily during the last day, but twisted right back just about to form a spot of a knock. That being the case, the marketplace looks as but the buyers are ingoing the market & enchanting benefits of prices in a market that looks extremely bullish generally. The buyers carry on finding price every time we go down, & we’ll see some cause that this will modify anytime shortly. Actually, it’s only an affair point in time before we lastly crack through the 1300 level & expand more into a “buy-&-hold” situation in this marketplace.

WTI- Crude Oil

WTI- Crude Oil marketplaces rise throughout the path of the session here on yesterday, but resist over the 47 level. By means of that we broken up turning reverse approximately in appearing a shooting star which obviously is a reasonably bearish sign. However, I do consider that there is fairly a bit of consolidation is coming up to happen in this region, as we might go down all the way losing to the 43 level. So in the region underneath is extremely supportive.