02

Nov

Daily Technical Analysis on 2nd November 2016

Today’s Technical Pairs: EURUSD, GBPUSD, USDJPY & XAUUSD.

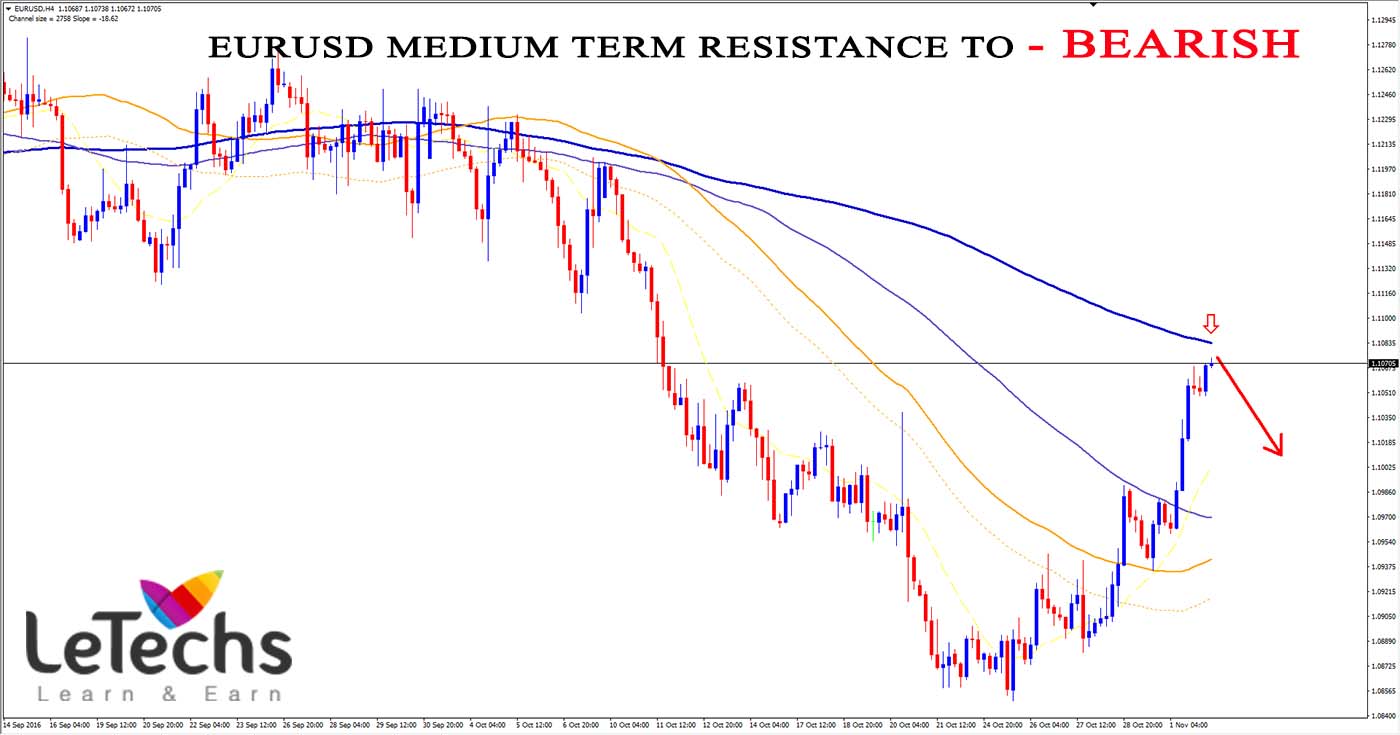

EURUSD

The U.S. dollar weakened across the board before Fed, U.S. jobs data & election. The euro regained its lost ground on Monday & handled its bid tone on yesterday. Following a brief phase of consolidation seen throughout the Asian session, the pair accelerated its growth and moved towards 1.1000 levels. The EURUSD crash the level post-European session opened. The 50-EMA is turning upside but the 100 and 200 EMAs handled their decline in the 4HR chart. The value reached the 200-EMA which clogged its upside momentum in the 4HR chart.

The resistance finds at 1.1050, the support lies at 1.1000 levels. The MACD histogram grew which hints the buyer’s strength. The RSI oscillator remained close to the overbought levels, favoring a fresh move higher. We advise short-term bullish outlook for the pair now. The euro might widen its growth towards 1.1050 levels.

GBPUSD

UK's Manufacturing PMI which came under our estimates lost to promote the pound. Still, the British pound handled its bid tone following the Mark Carney's announcement to stay the BoE's governor until June 2019. The sterling strengthened on starting off the week and conserved its new gains on yesterday, staying around trading range’s upper limit. Buyers lost to regain the 1.2300 level, the price rolled back after reaching the resistance levels. The pair spent the whole day at 1.2200 levels.

The moving averages keep moving lower the 4HR chart. The value broke the 50-EMA and met a barrier around the 100-EMAs which blocked its bid momentum. The resistance currently seen in 1.2300 levels, the support appears in 1.2200 levels. MACD indicator is at the centerline, remains Neutral. RSI indicator is within the overbought region.

USDJPY

As expected the BoJ left its monetary policy on hold. Also, the controller cut its inflation forecasts. The news released slightly impacted the pair. The upside movement seems to have run out of steam. The pair gave up its recent highs, trading around the major levels of 105.00 throughout the European session. Sellers seem to be guarding 105.00 levels as the price bounces from the level on each attempt to the upward.

The moving averages are twisting lower in the 1HR chart. The value broke all moving averages and jumped lower the 1HR chart. The resistance remains at 104.50 levels, the support stays at 104.00 levels. MACD is in the positive zone decreased which hints the buyers’ spot weakening. Indicator RSI is within the oversold region. A crack under the level of 104.50 suggests additional weakness of the pair. Sellers might advance the price to 104.50 handles where the pair might bounce off.

XAUUSD

The yellow metal price moved higher on last day before the Fed meeting and among volatility over the US presidential elections. Yesterday, Gold prices had some positive day. The pair began the day at 1275 levels. Buyers forced the value to 1280 levels first which was not adept to resist pressures of bulls and was quickly broken. The metal extended its gains following the level break, leads towards 1290 levels before the US session opening.

The 50 and 100 EMAs are turning upside direction in the 4HR chart but the 200-EMA is heading much lower. The resistance currently seen in 1290 levels, the support comes in 1280 levels. The MACD histogram grew which hints the buyers’ growth. RSI oscillator is in the overbought region. We handle a bullish outlook in the short-term period. The pair currently seems to be moving towards its quick resistance close to the 1290 levels.