24

May

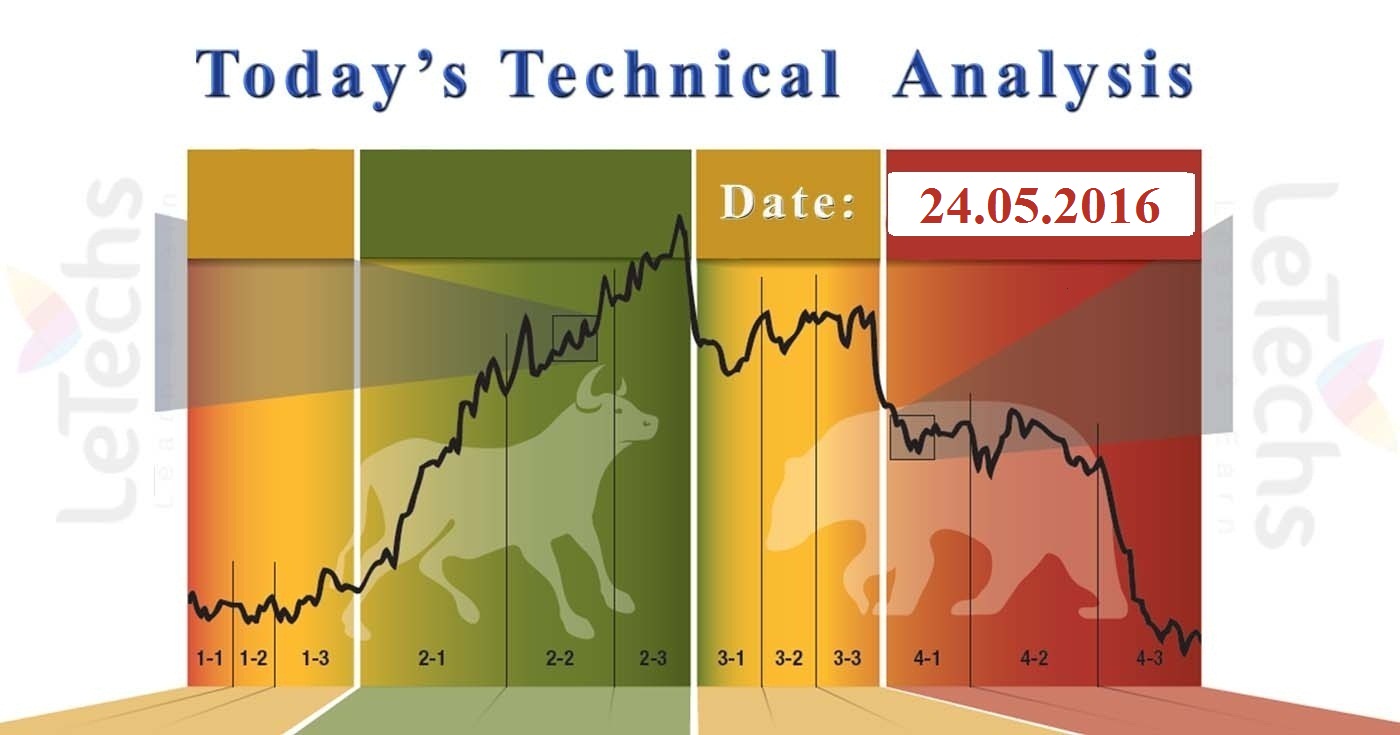

Daily Technical Analysis on 24th May 2016

Technical Pairs: EURUSD, GBPUSD, USDJPY, & XAUUSD

EURUSD

Manufacturing PMI in Germany will rise to a five-month peak in May of 52.4 vs. earlier 51.8 but the anticipations 52.0. Services PMI in Germany will rise to a three-month peak of 55.2 vs. predictions 54.6.

The 1st support stands at 1.1200 levels & following that 1.113 levels. The 1st resistance stays at the level of 1.125; the other one is at 1.1300 levels.

It’s a definite & a well built sell signal. We pretend the pair will go to 1.1200 levels. Having beaten the 1st targets, the value may go downhill to 1.113 levels.

GBPUSD

On Yesterday, Britain did not release significant fundamental reports. According to Bonds market place the pound grew heavily, government bonds turnout differential widen to the peak level in the last & a half month

The value finds the 1st support at 1.448 levels; the other one is at 1.4400 levels. The value finds the 1st resistance at 1.456 levels; after those 1.467 levels.

It’s a non- settled & buy signal. Following the support level of 1.4400 finding down the technique to the support level of 1.432 will be unlocked.

USDJPY

Japan released Trade Balance for April was 823.5 B vs. anticipations 492.8B. Japan has been display a positive trade balance for the 3rd month in a succession. The Ten-year government bonds widened clog to the mark of 200 BP, which added on the fascination of the US assets.

The 1st support level is at 109, then after 108.2 levels. The 1st resistance level is at 109.8, subsequently 110.6 levels.

It’s a confirmed & a burly buy signal. Buyers need to smash on top of 109.8 levels for a reliable growth. The method to the mark of 110.6 levels will be unlocked after this development.

XAUUSD- Gold

Gold markets place primarily tried to convention on last day, but suddenly twist bounce back all around to begin falling down yet again. Nevertheless it’s a fairly bearish movement, we see some of in the way to support under that is going to be very clumsy to begin selling, & quite openly would prefer to start buying on indication of support or at least a rebound somewhere underneath. It is not as far as we smash down fewer than 1200 levels that we are suitable for selling. It doesn’t things what happens in the meantime still, for the reason we notice is apparently the only thing that you can bet on.