19

May

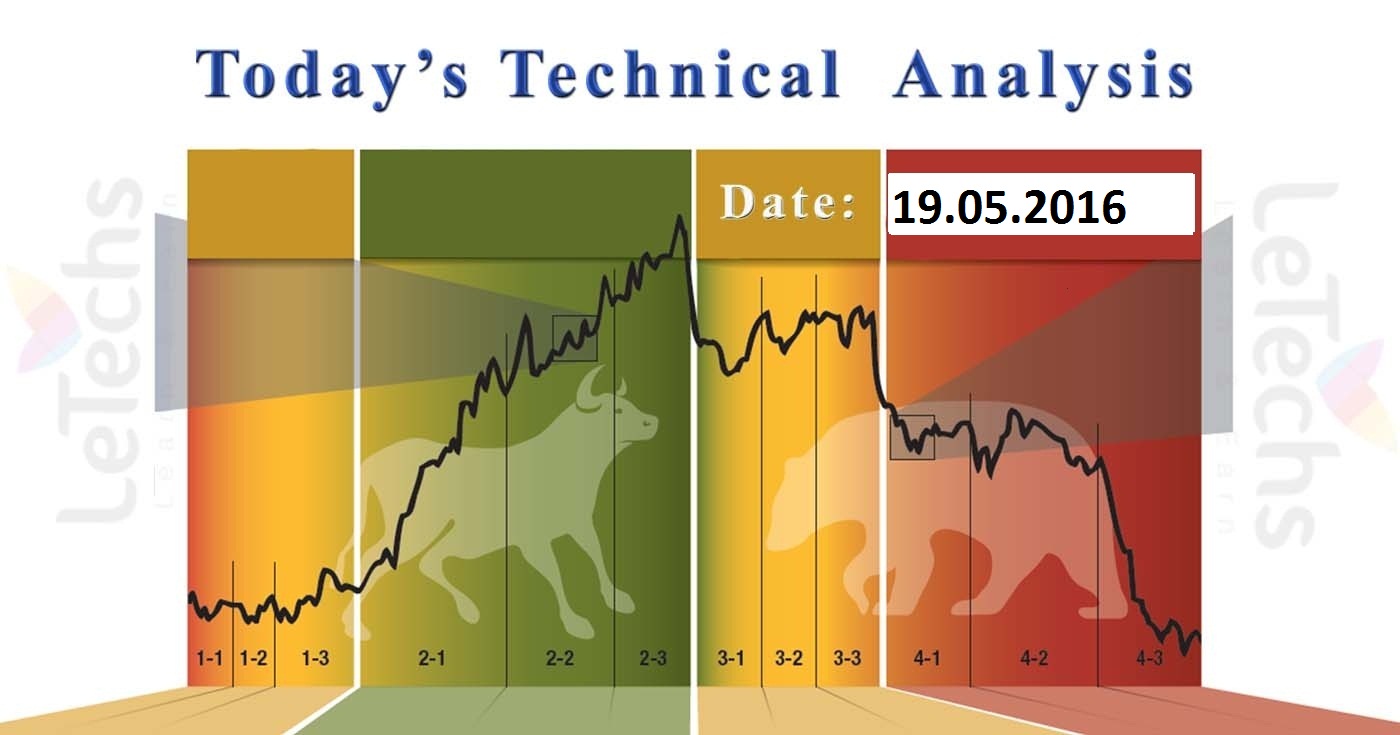

Daily Technical Analysis on 19th May 2016

Today's Technical Pairs: EURUSD, GBPUSD, USDJPY, & XAUUSD

EURUSD

The US dollar will rise against the euro on Yesterday, due to anticipation of that the Fed would hike the rates. Euro area released CPI for April of 0.2 percent vs. predictions -0.2 percent.

The 1st support stands at 1.126 levels and then at the level of 1.115. The 1st resistance remains at 1.135, after those 1.145 levels.

It’s a definite & a well-built sell signal. The value is declining. If the price fixates under the support 1.1150, it might sustain the downhill trend in the short term period. The essential target is 1.104 levels.

GBPUSD

UK released unemployment data was Claimant Count Change of -2.4K vs. expects 4.0K, Unemployment rate stays unchanged of 5.1 percent, and Average Income including Bonus was 2.0 percent vs. predictions 1.7 percent.

The value is finding the 1st support at the levels of 1.456; afterwards 1.448 levels. The value is verdict the 1st resistance at the levels of 1.467, the other one is at 1.476 levels.

It’s a non-established & a muscular buy signal. The value is increasing. We consider the 1.467 line smash that will unlock the path for the buyers to 1.476 levels.

USDJPY

Japanese fundamental Gross Domestic Product for Q1 strengthened was +0.4 percent vs. forecast 0.1 percent. The GDP grew by 1.7 percent throughout the 1st quarter of annual basis. Hope that the Bank of Japan-BOJ will diminish the monetary policy in addition more importantly reduced amid the improved statistics in Japan & US.

The 1st support stays at the level of 109.8; the other one is at 109 levels. The 1st resistance remains at the levels of 110.6, the other one is at 111.4 levels.

It’s an established & a burly buy signal. The value is increasing. We consider the growth will be sustained now. The 1st target is the level of 110.6, after those 111.4 levels.

XAUUSD- Gold

Gold markets primarily drops but twisted right back over throughout the path of the session on last day, after that begin enough potential to form object akin to a hammer. We admit that the gold market place & currency markets in natural should sustain to go superior. By reason of this, we have no favor in selling & take a look at the short-term bounces as positive value. Conclusively, we might have to build up suitable momentum to finally crack on top of the 1500 level, but we stays bullish at this occasion in time as central banks sustain to follow very baggy monetary policy.