17

May

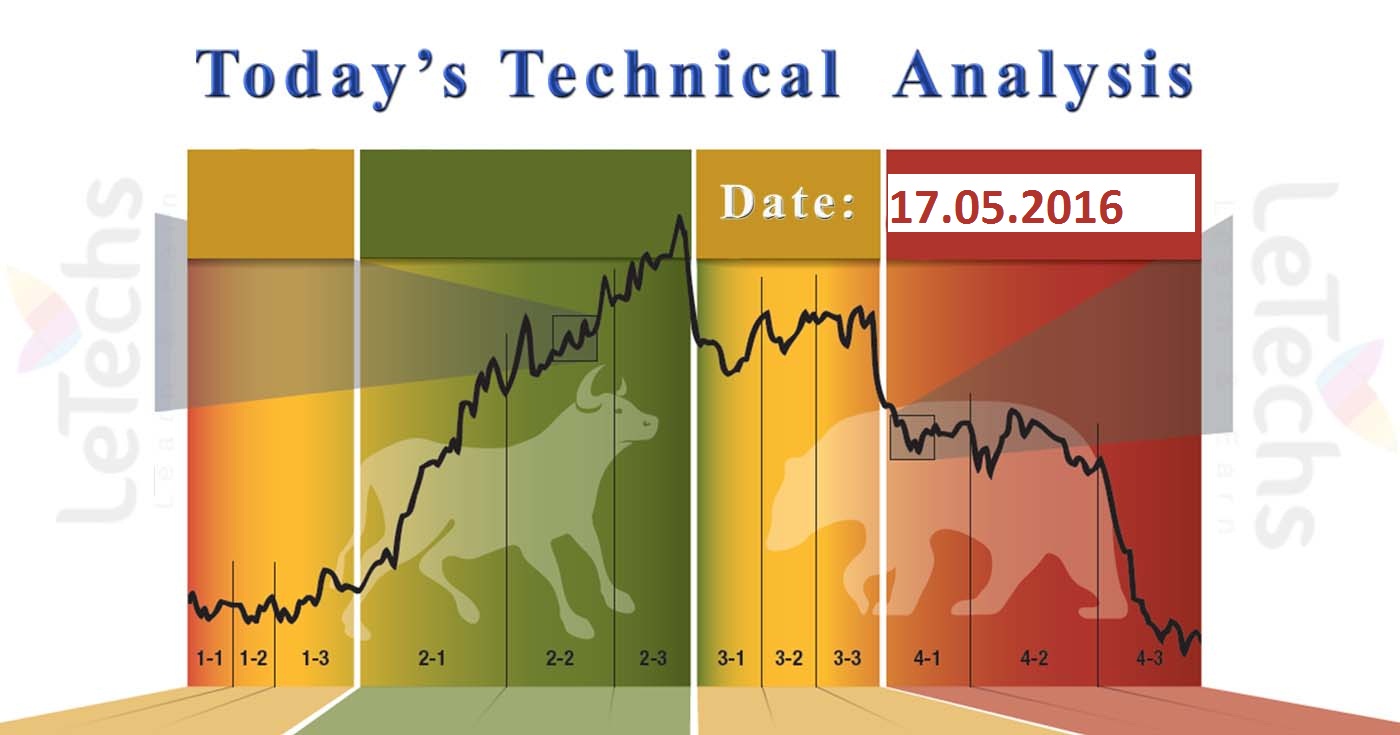

Daily Technical Analysis on 17th May 2016

Technical Pairs: EURUSD, GBPUSD, USDJPY, XAUUSD, & WTI Crude Oil

EURUSD

No major news was released on Monday. Greater European markets were locked to celebrate the Day of the Holy Spirit. In the Bond Marketplace the Ten-year government bonds outcome in Germany denied which decreased the enhancement of the European capitals.

The 1st support stands at the level of 1.126, after those 1.115 levels. The 1st resistance lies at the level of 1.135, after those 1.145 levels. It’s a confirmed & a well-built sell signal.

GBPUSD

UK released Housing Price index for May of 0.4 percent m/m vs. earlier 1.3 percent m/m. Empire State producing Index was the only US statement that was rate mentioning of 58 vs. predictions 59.

The value remains the 1st support at 1.44 levels; the other one is at 1.432 levels. The value stands the 1st resistance at 1.448 levels; after those 1.446 levels.

It’s a definite & a muscular sell signal. The value is correcting.

We pretend the pairs will go to 1.432 levels first. Acquiring overcome the initial target the price could go downside to 1.424 levels.

USDJPY

USDJPY price basis for corporate goods (CGPI) in Japan declined in the contrary to our anticipations. According to the BOJ- Bank of Japan the sign came in at -4.2 percent related to -3.8 percent in the earlier month. Analytics had predicts a growth to -3.7 percent.

The 1st support stands at the level of 108.2, the other one is at 107.4 levels. The 1st resistance remains at 109 levels, the other one is at 109.8 levels.

It’s an Established & a burly buy signal. MACD indicator is in a positive region. The price is increasing. We do not reject the declined to 108.2 levels.

XAUUSD- Gold

Gold markets primarily rallied throughout the course of on yesterday, but twisted right back over at the 1290 level. We swing right back over all to create a tiny shooting star, which obviously is a most negative indication. Negligent, we do consider that there is plenty of support underneath, so we are expecting to see a supportive candle/ a smash over the top of the shooting star in sort to start going long-term. We don’t have affection in selling.

WTI-Crude Oil

WTI- Crude Oil market rallied throughout the path of the session on last day, breaking superior & touching towards the 48 level. A pullback at this mark in occasion should be a buying chance, as there is a 46 level “Ground” in this marketplace at the time, and definitely there is quite a tiny support just under & continuing all the way to the 43 handle. At this occasion, it seems that we are trying to influence towards the 50 level that had been formerly resistance.