12

May

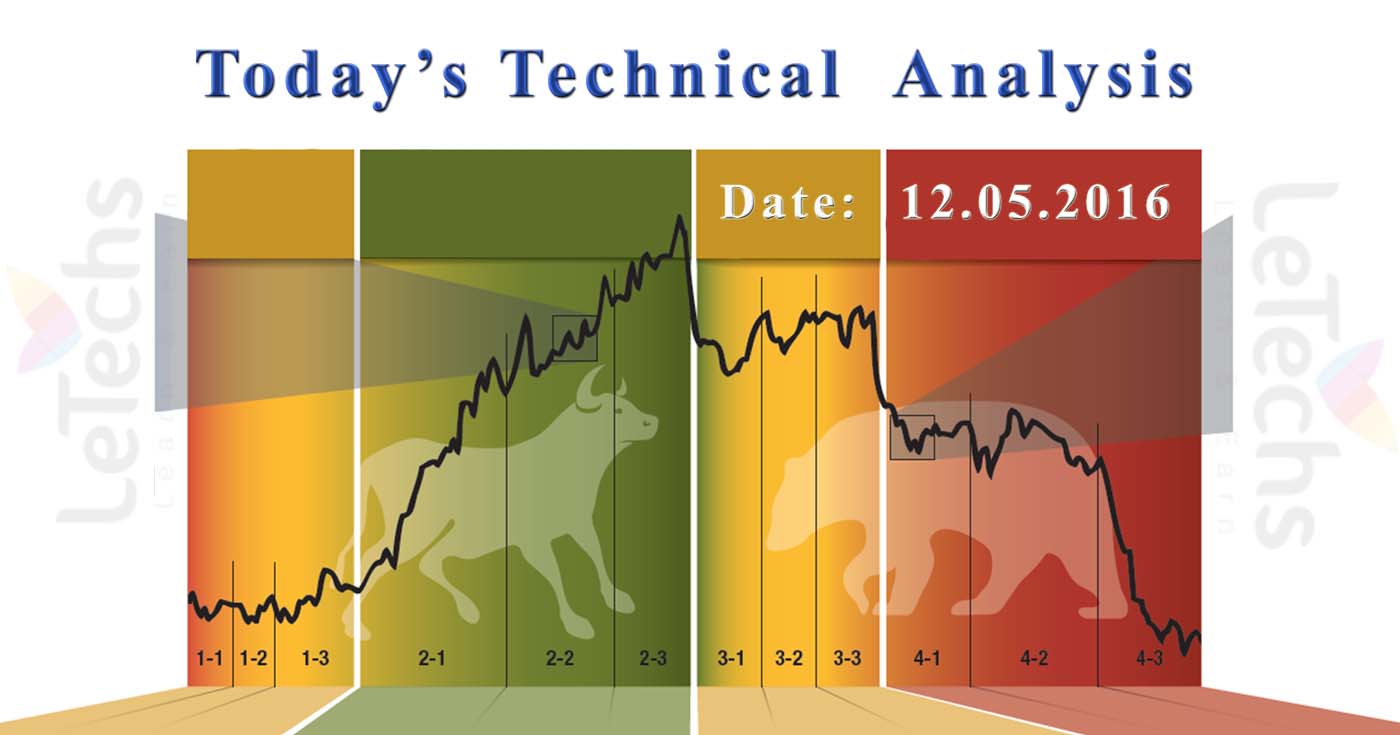

Daily Technical Analysis on 12th May 2016

Technical Pairs: EURUSD, GBPUSD, USDJPY, XAUUSD, & Crude Oil

EURUSD

In the Bonds markets, the German Ten-year government bonds capitulate condensed which diminish the magnetism of the European possessions. The political part of the day was the ECB Member speech of Nowotny. According to Nowotny it is pleasing to keep the problem of national bonds in beside with Eurobonds.

EURUSD 1st support lies at 1.135 levels & then at 1.126 levels. The 1st resistance remains at 1.145 levels, the other one is at 1.155 levels. MACD sign is in a negative region. The value is prospecting. EURUSD remains Neutral. The potential bounce back downward target is the support levels of 1.135, & 1.126.

GBPUSD

Industrial Production in the UK for March came underneath the agreement forecast of 0.1 percent vs. prospect 0.3 percent. In the daylight, the trading was definite by Crude Oil Stocks modify in the US of -3.410M vs. anticipate 0.714M, earlier value 2.784M.

The value stands at the 1st support levels 1.44, the other one is at 1.432 levels. The value is verdict the 1st resistance at 1.448 levels, after those 1.456 levels.

GBPUSD is a complete & a well-built sell signal. We suggest going short with the 1st target at the level of 1.44. When the values consolidate under the 1st target it might go to the level of 1.432.

USDJPY

The expansion of "risk appetite" had a positive blow on investor's reaction. The foremost stock exchanges showed confidence which stress the yen as a funding currency. In the meantime, the government bonds yield discrepancies have been moribund for quite a few successive trading days. On the other hand the USDJPY pairs chop down on the yesterday trades.

The 1st support remains at 108.2 levels, the other one is at 107.4 levels. The price 1st resistance stands at the level of 109, after those 109.8 levels. These pair can reduce to the support level of 108.2. We do not keep out the increase to 109 levels.

XAUUSD

XAUUSD commodities have stopped the progress of its flaw & activate a bull force. On the negative aspect, support comes close to the 1.27 level where a crack will turn notice to the 1.26 level. Additional down, a cut from side to side here will unlock the door for a shift lesser towards the 1.25 level. Underneath here if seen might set off extra downside pressure aim at the 1.24 level. In opposition, resistances reside at the 1.285 level where a smash will intend at the 1.3 level. Twists over there will depiction the 1.31 level. More out, resistance remains at the 1.32 level. In general, GOLD looks to decline further rectification.

Crude Oil

Crude Oil prices rallied further than 3 percent subsequent a larger than anticipated draw in stocks according to the Energy Information Administration. US crude oil imports averaged regarding 7.7 million barrels per day earlier week, down by 5000 barrels/day which was one of the catalysts that lead to the mount in value oil prices. Prices hack during short time resistance near the Ten-day moving average which is now perceived as short term support down with the squat above the last week near 44. The RSI-Relative Strength Index is climbing in tandem with value action bear out positive momentum.

The inventory turn down was absolutely a surprise known the put up in inventories description by the API on Tuesday sundown. According to the EIA, US marketable crude oil inventories reduce by 3.4 million barrels from the last week. Gasoline inventories reduced by 1.2 million barrels previous week & concentrate fuel inventories reduced by 1.6 million barrels final week.