11

May

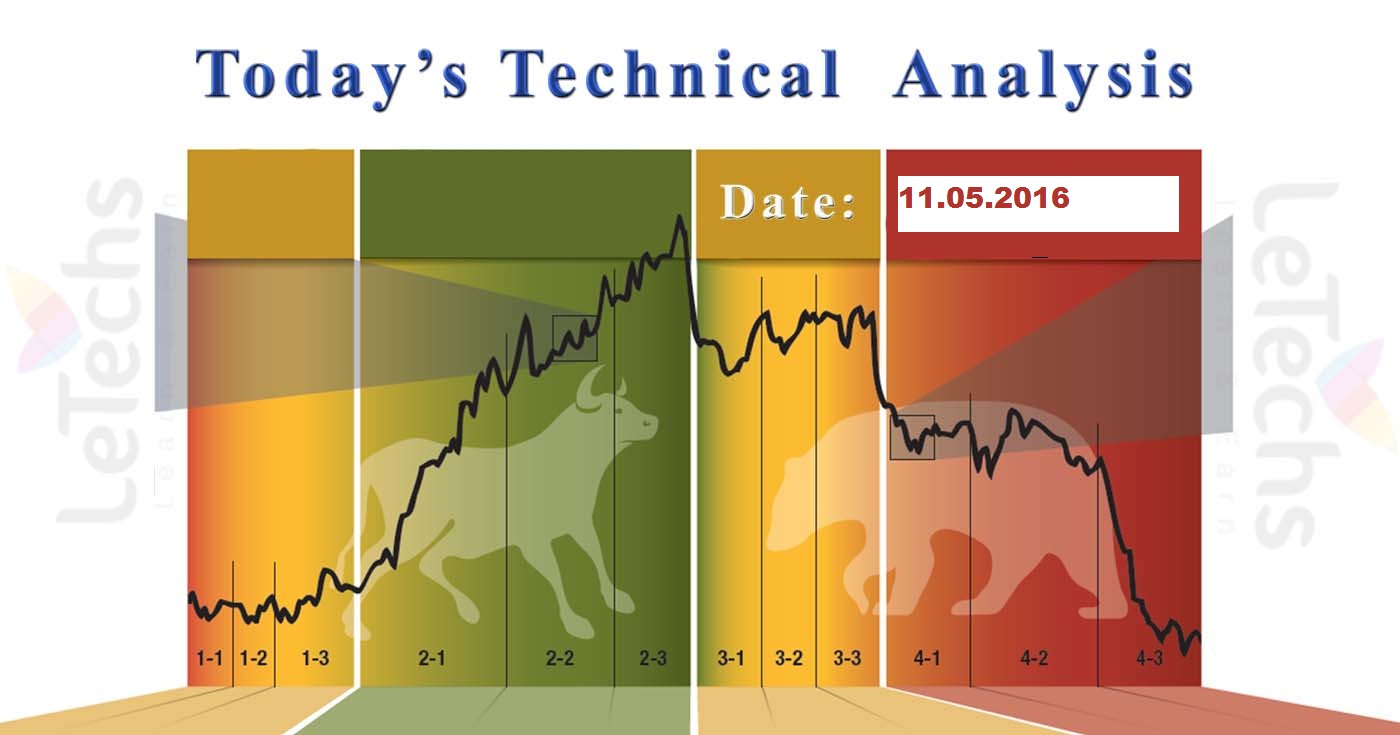

Daily Technical Analysis on 11th May 2016

Technical Pairs: EURUSD, GBPUSD, USDJPY, XAUUSD, & WTI CRUDE OIL

EURUSD

Germany released weak Industrial Production statistics for April which pressures the euro of -1.3 percent vs. outlook 2 percent. In the Bonds marketplace, the ten-year government bonds give way in Germany reduced that as well played into the pass of "bears".

The 1st support stands at 1.135 levels & then at 1.126 levels. The 1st resistance lies at 1.145 levels, the next target is at 1.155 levels.

It’s a confirmed and a well-built sell signal. MACD sign is in a negative region. The value is strengthening. The potential reduce target is 2 levels of support: 1.135 & 1.126.

GBPUSD

Goods Trade Balance in the UK rise more than anticipated for the previous month, sustaining the pound. This indicator shows -11.20B vs. predict -11.30B. The March data was modified from -11.96Ð’ to -11.43Ð’. Nevertheless, the oil fall kept setting pressure on the GBPUSD pairs. A fresh oil expansion let the pair to grow up still it reduced by the ending of the trades.

The price is verdict the 1st support at 1.44 levels, the other one is at 1.432 levels. The value is verdict the 1st resistance at 1.448 levels, the other one is at 1.456 levels.

It’s a confirmed and a muscular sell signal. MACD indicator is in a negative region. The value is reducing. The downhill movement will be sustained. The pair might go to 1.44 levels rapidly; then the target will be 1.432 levels.

USDJPY

No important news was available in Japan. In the Bonds marketplace government bond give way differential declined, which condensed the charm of US his assets. For the meantime, most important stock display in the USA & Europe stopped in the "green zone" which usually set pressure on the Japanese yen as a endowment currency.

The support remains at 109 levels, after those 108.2 levels. The 1st resistance stands at 109.8 levels, the other one is at 110.6 levels.

It’s a confirmed & a burly buy signal. We consider the growth will be constant now. The 1st target is the level of 109.8, after those 110.6 levels.

XAUUSD

XAUUSD- Gold marketplace initially struggled to rally all through the session on yesterday, but subsequently ended up declining yet again. Yet, the range is greatly shorter than it was throughout the last day session, so some type of supportive candle in this spot would more than possible be a buying occasion. So would a smash over the top of the sort for the session on Wednesday as far away as we can observe. By means of that being the case, the market be supposed to, then attain towards the 1300 level known sufficient time. Moreover way, we have no awareness whatever in shorting this marketplace, for the reason that all of the noise underneath.

WTI- Crude Oil

WTI Crude Oil marketplace increased throughout the day on yesterday; as we carry on to see fairly a bit of instability. There is rather a bit of support underneath at the 42 level, so currently in time we don’t consider that any shift lower will be capable to go on for any real length of time, now as it is going to be tricky to keep on higher. on balance, the 46 level has accessible moderately a bit of resistance, stay in mind that we enclose the Crude Oil Inventories figure coming out throughout the day today, and that certainly might have a massive consequence on this market as well. Eventually while, I suppose to think that we are cleanly going to walk off from side to side.