06

May

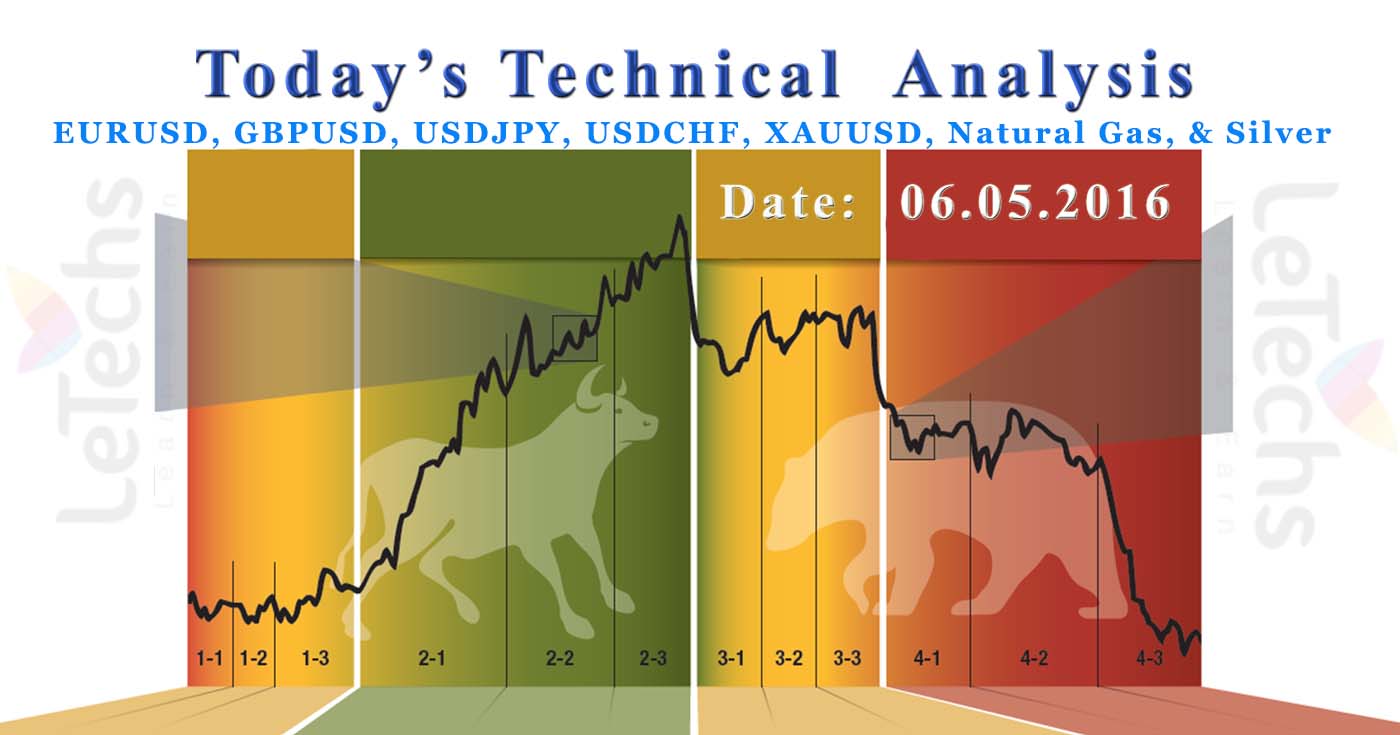

Daily Technical Analysis on 6th May 2016

Technical Pairs: EURUSD, GBPUSD, USDJPY, USDCHF, XAUUSD, Natural Gas, & Silver

EURUSD

According to the ECB-European Central Bank the Euro Zone constant its recovery, still descending risks stay behind. No key news was published among the Ascension Day festival in Europe.

The 1st support lies at the level of 1.135 along with then at 1.126 levels. The 1st resistance remains at 1.145 levels, the other one is at 1.155 levels. It’s a confirmed & a muscular buy signal. MACD indicator is in a positive region. Following the support level of 1.135 breakthroughs downhill the technique to the support 1.126 levels will be unlocked.

GBPUSD

The pound is anticipated to stay behind under pressure. According to the US employment, Department the early jobless claims figure grew to 274K previous week.

The value is finding the 1st support at the levels of 1.44; after those 1.432 levels. The value is finding the 1st resistance at the levels of 1.448, the other one is at 1.456 levels. MACD indicator is in a negative region. The value is falling. The potential reduces target is two levels of support: 1.44 & 1.432.

USDJPY

Japan famous Children's Day & its marketplace were closed. Services PMI in China by Caixin was the focal point of investor’s attention 51.8 vs. outlook 52.6.

The value is lies on the 1st support at 106.6 levels, the other one is at 105.8 levels. The value is verdict the 1st resistance at 107.4 levels, the other one is at 108.2 levels. It’s a confirmed & a burly sell signal. MACD indicator is in a negative region. We wait for the 108.2 line crack that will unlock the method for the buyers to 109 levels.

USDCHF

Switzerland celebrated banquet of the Ascension; its marketplace was stopped. Early Jobless Claims were under the center of attention last day 274K vs. outlook 260K.

The value remains on the 1st support at 0.966 levels, after those 0.958 levels. The value stays 1st resistance at 0.975 levels; the other one is at 0.985 levels. MACD indicator is in a positive region. The value is growing. We counsel to extend with the 1st target - 0.975 levels. When the pair merges on top of the 1st target, we can untie deals to the level of 0.985.

XAUUSD

XAUUSD – Gold markets at first rallied throughout the last day, but move violently over the 1280 levels & broken up forming a morsel of a shooting star. The shooting star of the path is a negative indication, & as a consequence sellers might enter this marketplace but nearby is rather a bit of support underneath. Any rebound from here must attract buyers & move forward this market rear towards the 1300 levels. A crack over that level is supposed to drive this marketplace upper for the longer term too.

Natural Gas

Natural gas marketplace primarily tried to the convention but then twist right back just about to go down significantly. This is a marketplace that must carry on seeing rather a bit of instability. Eventually, if we shatter down under the 2 level, we are sellers as the market would above probable persist to go much lesser. Rallies at this spot in time should be selling chance given that we can keep on underneath the 2.2 levels.

XAGUSD - Silver

XAGUSD - Silver market originally rallied for the period of the day on yesterday, but thrash about at the level of 17.60 handles. By burden so, we broken up shape a bit of a shooting star other than quite honestly a set of this could’ve been easy position squaring in front of that Nonfarm Payroll statistics upcoming today. By means of that being the case, we immobile consider in the uphill velocity of this marketplace, but we require seeing several type of spring back or helpful candle in sort to begin buying. We have no attention in selling, & trust that the 17 level area is especially supportive.