03

May

Part – II: Best Times to Trade Forex

At this moment you recognize which currency pairs to focal point on & why, it is significant that you understand while the diverse forex trading sessions are how they vary from each other, & the best period & best days to trade.

It is right that the forex market is unlocked 24 hours a day, apart from that doesn’t signify the marketplace is dynamic & importance of trading for the whole day. The thought is to trade at what time the market is the most unpredictable, because unpredictability means that a market is stirring, & currency is prepared when the markets are affecting, not when the market is settle down & peaceful.

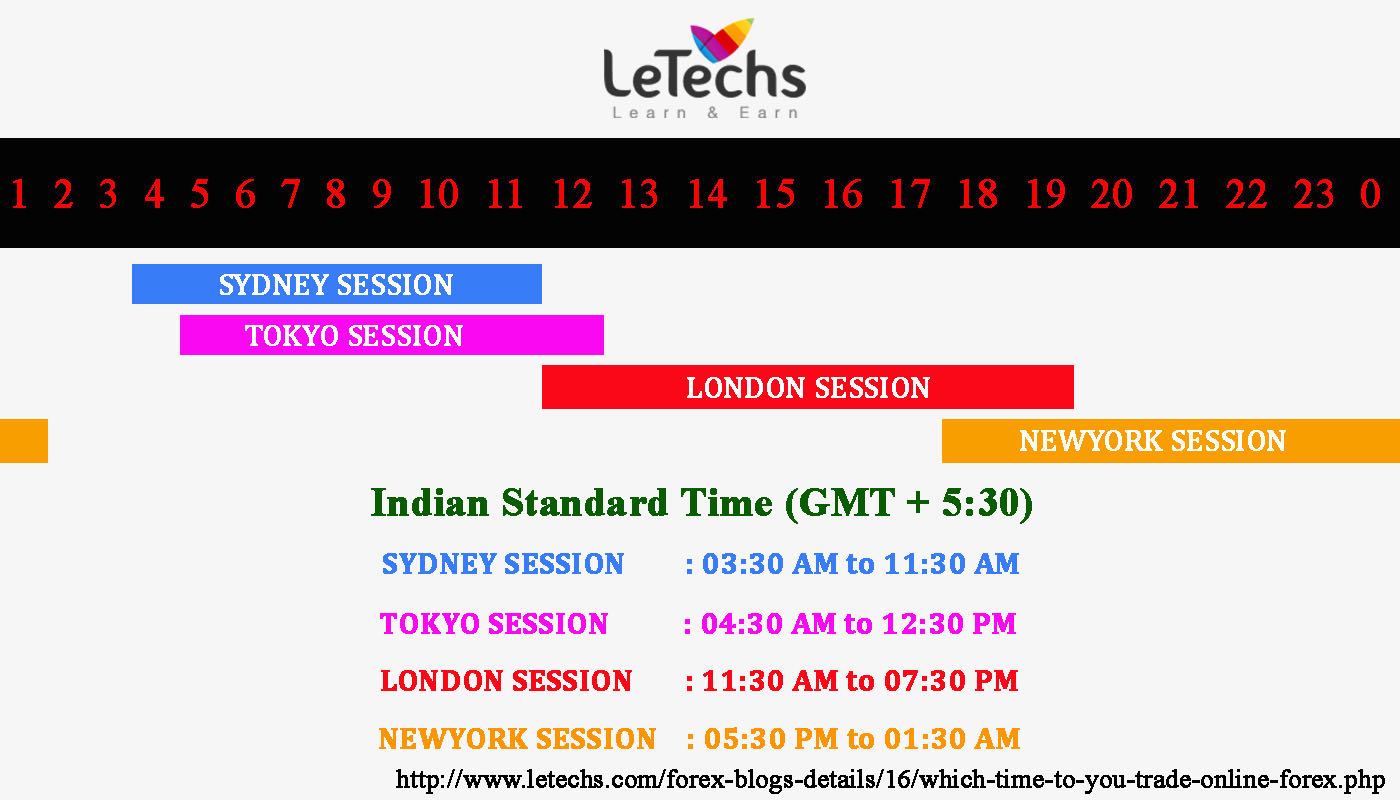

The 24-hours forex market trading day is capable of broken down into 3 main trading sessions:

=>> Asian trading session (including Australia & New Zealand).

=>> London trading session.

=>> New York trading session.

=>> The Asian trading session opens at 6:00pm EST and closes at 4:00am EST

=>> The London trading session opens at 3:00am EST and closes at 12:00pm EST.

=>> The New York trading session opens at 8:00am EST and closes at 5:00pm EST.

You will perceive that in amid each trading session nearby is a porthole of time where 2 sessions are working at the same time. From 3:00 - 4:00am EST, the Asian & London sessions partly covered, and on or after 8:00 - 12:00pm EST, the London & New York sessions extend beyond.

As you might have presumption these over-lapping stages surrounded by the 3 trading sessions are the periods when volume & instability climb to peak levels. The overlie of the London & New York trading sessions between 8am - 12pm EST is normally the finest time to trade, for the reason that, when the world’s 2 most dynamic trading axis cross; as the London session is finishing, the New York session is starting. Many traders stringently trade this 4-Hr time window because it is naturally a very unpredictable & fluid time to operate the forex market.

The Asian trading session:

Asian trading session starts on 6:00pm EST as trading gets ongoing in New Zealand & Australia, an hour afterward at 7pm EST Tokyo opens awake. Tokyo is the economic capital of Asia; it is as well significance noting with the aim of Japan is the 3rd major forex trading center in the world. The yen is the 3rd mainly traded currency, concerned in about 19 percent of all forex dealings; overall about 21 percent of all forex business takes place throughout the Asian trading session.

Economical, sizzling spot of the Asian trading session includes; Hong Kong, Tokyo, & Sydney, Singapore.

Liquidity is sometimes thin during the Asian session, these are why many FX traders avoid the Asian session and opt to trade the London / New York sessions instead. That supposed price will sometimes make influential moves throughout the Asian session.

Major news releases for Australia, China, Japan, and New Zealand get nearer out for the period of the Asian session, so the AUD, NZD, and JPY currency pairs lean to move further than the others at some stage in the Asian session.

Normally speaking, if the London & New York sessions consequence in big moves, you will perceive consolidation for the duration of the Asian session.

The London trading session:

While Asia comes to a close up, the London trading session gets on the move. There are rather a few major financial centers dotted around Europe, but London has usually been the intermediate of all forex trading. Concerning 30 % of every forex dealings takes rest all through the London trading session.

Owing to the fact with the aspire of the London session go beyond with the Asian & New York sessions, it is logically the most lively trading session & this leads to elevated liquidity/volume & lower pip spreads.

The London session typically sees the nearly all volatile market circumstances because such a large quantity of transactions takes place through this trading period. Keep in mind, instability is good for value exploit traders given that we deal by means of the core price statistics of the market, as an alternative of lesser indicators that insulate price.

Key European news releases mostly come out throughout the London trading session, this means the EUR, GBP, &CHF are all normally the liveliest all through the London session.

The New York trading session:

New York trading session gets on the move at 8:00am EST, this is immediately about the instance traders in London are receiving back from their lunch times, and it also signals the establish of what is an average the nearly all active time stage for forex trading; from 8am EST to 12pm EST.

Between 8am EST & 12pm EST there is more liquidity as the London & New York sessions will be related.

The best part of all economic news are released in the region of the beginning of the New York trading session given that both Europe and New York will be unlocked at this time. All USD and CAD economic news comes up to through or close to the New York trading session.

About 85 percent of all forex trades involve only the US dollar, so some currency pairs involving the USD has the impending to construct big shifts during the New York trading session.

After European markets lock, instability and liquidity tend to pass on down for the duration of the late-afternoon New York trading session.

The New York shut is very significant as it marks the conclusion of the forex trading day, it is key that you utilize New York close charts for the reason that a lot of price action net form as the trading day move towards to a conclusion.

If you enclose no time restraint or you have a job that permits you to acquire on the internet & ensure the charts sporadically, the best occasion to trade is from 8:00am to 12:00pm EST for the period of the New York & London session goes beyond. Together the London & New York trading sessions are outstanding, time to trade largely, so no stuff where you exist in the world you must be able to locate a time that facility with your agenda.