25

Apr

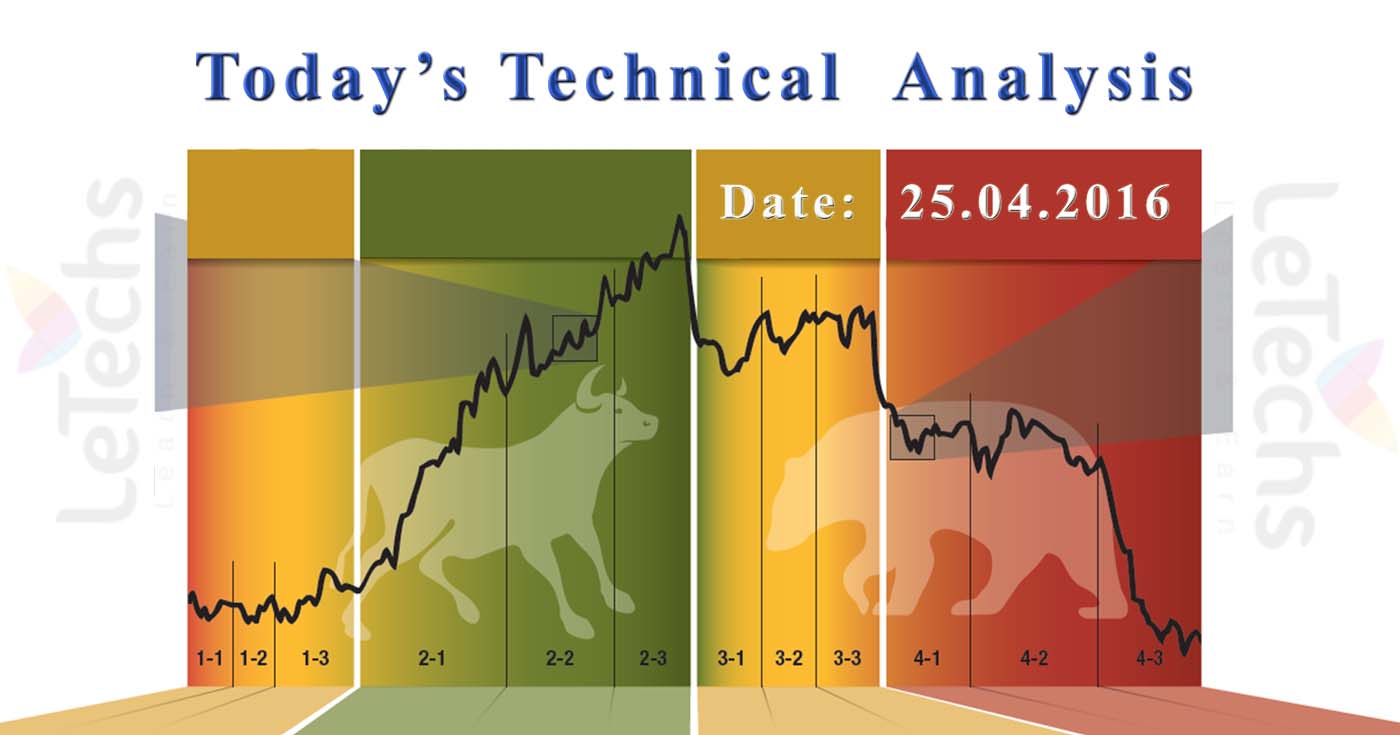

Daily Technical Analysis on 25th April 2016

Today’s Technical Analysis Pairs: EURUSD, GBPUSD, USDJPY, USDCHF & XAUUSD

EURUSD

Manufacturing PMI in Germany increased more than anticipated previous month. The index showed 51.9 compared with 50.7 in the earlier month. Analytics estimated the index to grow to 51.0.

The 1st support lies at the level of 1.115 & after those 1.105. The 1st resistance remains at 1.126 levels, the other one is at 1.135 levels.

It’s a confirmed & a physically powerful sell signal. The MACD indicator is in a negative region. The value is falling. This pairs ruined through the 1st target, the level of 1.126 & reserved going down. We deem the south movement will be sustained. The potential target is 1.115 levels. As an alteration, we might perceive a return to 1.126 levels.

GBPUSD

The British news backdrop was pouring out last Friday. The marketplace paid concentration to the "black gold" dynamics where the price shows a modification. Baker Hughes US Oil Rig count up was released. The statement again shows the decrease of the drilling rigs in the US. The index illustrates 343 Vs the preceding figure of 351 points.

The value is verdict the 1st support at 1.432 levels, the other one is at 1.424 levels. The value is verdict the 1st resistance at 1.44 levels, the other one is at 1.448 levels.

It’s a confirmed & a burly buy signal. The MACD indicator is in a positive region. The value is declining. The value made fresh attempts to rise. If the price strengthens over 1.44 levels the development will be sustained to 1.448 levels. We will sell if the value acquires underneath 1.424 levels.

USDJPY

US & Japanese government bonds yield differential prolonged which enlarged the magnetism of the US possessions. The BOJ (Bank of Japan) procedure to establish negative interest rates on several loans.

The value is verdict the 1st support at 111.4 levels, the other one is at 110.6 levels. The value is verdict the 1st resistance at 112.2 levels, the other one is at 113 levels. This pair is caption towards the resistance of 112.2 levels. Motionless the USD/JPY might turn downward to accurate. The alteration targets are 111.4 levels & 110.6 levels.

USDCHF

The dollar will rise beside the Swiss franc at the last part of the week. The economic calendar was empty and the market paid attention to the news from the USA. In the US, Manufacturing PMI decreased. The index showed 50.8 with the forecast of 52.0.

USD/CHF finds the 1st support at 0.975 levels; the other one is at 0.97 levels. The value is ruling the 1st resistance at 0.98 levels; after those 0.985 levels. It’s a confirmed & a muscular buy signal. This pair is rising to 0.99 levels. We anticipate a rectification to 0.975 levels.

XAUUSD

XAUUSD - Gold markets went rear & forward during the path of the session on Friday, fundamentally changing with reference to the 1250 levels. This is a marketplace that has been strengthening for some time, & we are currently in the central point of the consolidation region, therefore it is going to be tricky to trade. Yet, we would be devoted to seeing pullbacks that provide us a buying chance at lower levels. Eventually, we have to stay calm for that shift & as a consequence, we are on the sidelines at the flash when it gets nearer to the gold markets.