16

Apr

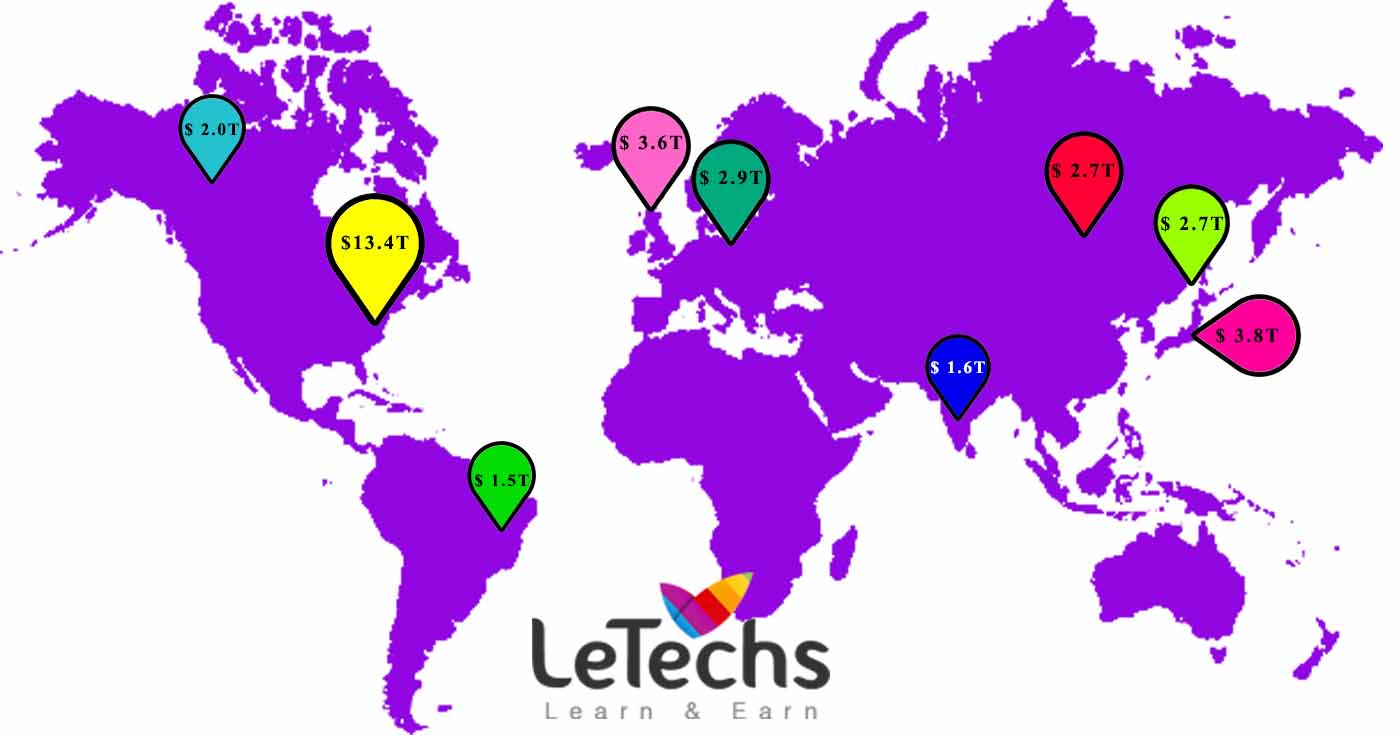

WORLD’S BIGGEST STOCK EXCHANGES

United States - NYSE

Japan - NASDAQ OMX

United Kingdom - London Stock Exchange

Europe - EURONEXT

China - Shanghai Stock Exchange

Hong Kong - Hong Kong Stock Exchange

Canada - Toronto Stock Exchange

India - Bombay Stock Exchange / National Stock Exchange

Brazil - BM&F BOVESPA

United States

New York Stock Exchange: Market Cap 13.4 Trillion.

NYSE Euronext operates global financial markets across commodities, FX, equities, bonds, interest rates.

New York Stock Exchanges represent one-third of traded equities volume worldwide. As one of the world’s leading futures & options trading venues, NYSE Euronext operates four exchanges across the US & Europe offering commodities, fixed income & equity derivatives.

Japan

Tokyo Stock Exchange: Market Cap 3.8 Trillion.

NASDAQ OMX (NASDAQ: NDAQ) is a leading provider of trading, exchange technology, information & public company services crossways 6 continents. During its diverse portfolio of solutions, NASDAQ OMX enables customers to plan, optimize & carry out their business vision with self-assurance, using verified technologies that provide transparency & insight for navigating today’s worldwide money markets. As the maker of the world’s first electronic stock market, its technology powers more than 70 marketplaces in 50 countries, & 1 in 10 of the world’s securities transactions.

United Kingdom

London Stock Exchange: Market Cap 3.6 Trillion.

London Stock Exchange group is a diversified international exchange that sits at the heart of the world’s financial community. The assembly can mark out its history back to the year of 1801.

The Group operates a broad range of international equity, bond & derivatives markets, including London Stock Exchange; Borsa Italiana; MTS, Europe’s leading fixed income market; & the pan-European equities platform, Turquoise. Through its markets, the Group offers international business, & investors, unrivaled access to Europe’s Capital markets.

Europe

Euronext: Market Cap 2.9 Trillion.

Euronext is the first pan-European exchange marketplace, spanning Belgium, France, the Netherlands, Portugal & the UK. Created in 2000, it connects markets which time back to the start of the 17th century. It is the primary exchange in the Euro Zone with more than 1,300 issues value €2.6 trillion in marketplace capitalization & an unmatched blue chip franchise consisting of 20+ issues in the EURO STOXX 50® benchmark & a strong diverse domestic & international client base.

China

Shanghai Stock Exchange: Market Cap 2.7 Trillion.

The Shanghai Stock Exchange was founded on Nov. 26th, 1990 & in operation on Dec. 19th the similar year. It is a relationship institution unswervingly governed by the china Securities Regulatory Commission. The SSE bases its expansion on the code of “legislation, self-regulation, supervision & standardization” to create a transparent, open, safe & efficient marketplace.

The SSE endeavors to realize a variety of functions:

Providing marketplace & amenities for the securities trading; formulate business rules; tolerant and arranging listings;

organizing and regulating members and listed companies; monitoring securities trading; managing & disseminating market information.

Hong Kong

Hong Kong Stock Exchange: Market Cap 2.7 Trillion.

Hong Kong Exchanges & Clearing Limited, or HKEx, operates a securities market & a derivatives market in Hong Kong and the clearing houses for those markets. HKEx was listed in Hong Kong in the year of 2000 & is now one of the world’s largest exchange owners based on the market capitalization of its shares.

Canada

Toronto Stock Exchange: Market Cap 2.2 Trillion.

Toronto Stock Exchange is Canada’s senior equities market, providing domestic & international investors with access to the Toronto Canadian marketplace. Issuers list a variety of securities & equity-related products, including exchange traded funds, income trusts and investment funds.

India

Bombay Stock Exchange: Market Cap 1.6 Trillion.

National Stock Exchange: Market Cap 1.5 Trillion.

Established in 1875, BSE Ltd. (formerly known as Bombay Stock Exchange Ltd.), is Asia’s first Stock Exchange and one of India’s leading exchange groups. Over the past 137 years, BSE has facilitated the growth of the Indian corporate sector by providing it an efficient capital-raising platform. Popularly known as BSE, the bourse was established as “The Native Share & Stock Brokers Association” in 1875. BSE is a corporatised and demutualised entity, with a broad shareholder base which includes two leading global exchanges, Deutsche Bourse, and Singapore Exchange as strategic partners. BSE provides an efficient and transparent market for trading in equity, debt instruments, derivatives, mutual funds. It also has a platform for trading in equities of small-and-medium enterprises (SME).

Brazil

BM&F Bovespa: Market Cap 1.5 Trillion.

BM&FBOVESPA is a company that manages the organized securities and derivatives markets, providing registration, clearing and settlement services. It acts as Central Counter Party, guaranteeing financial liquidity for the trades executed in its environments.