13

Apr

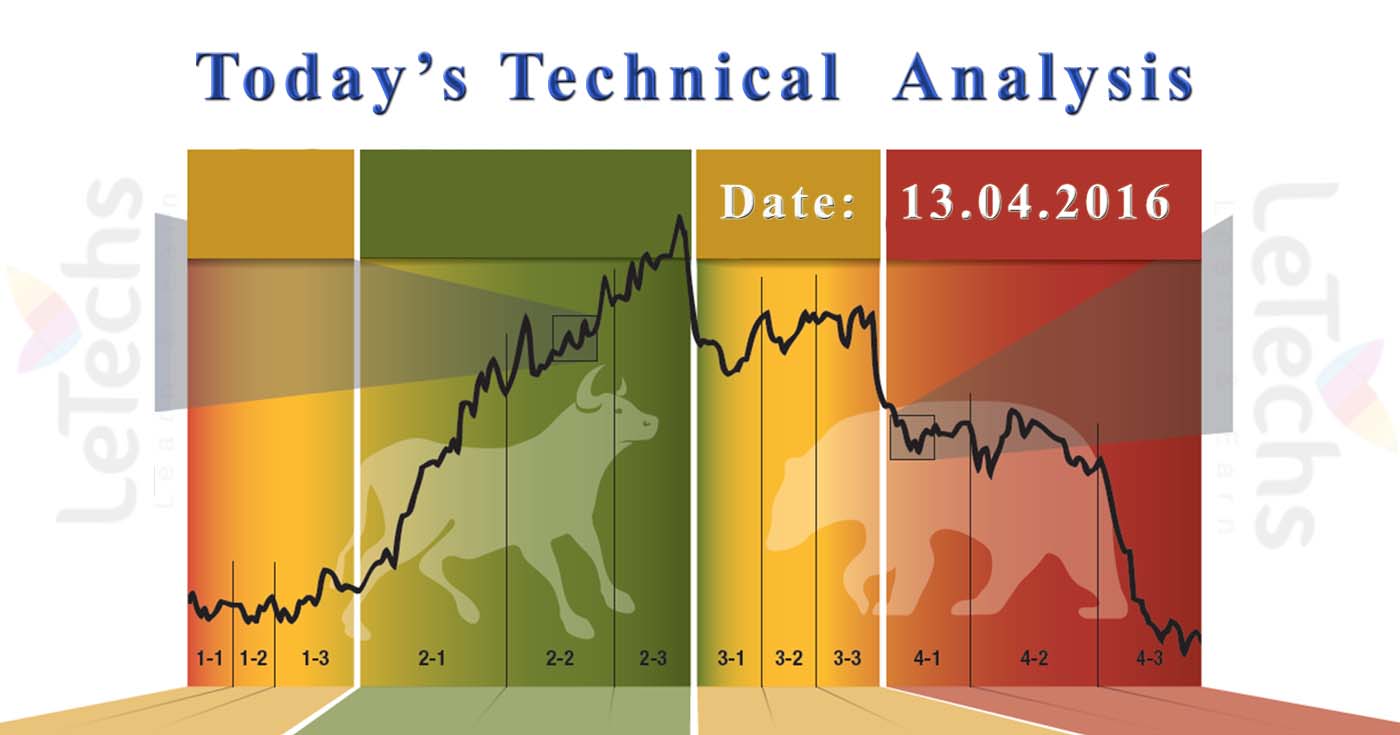

Daily Technical Analysis on 13th April 2016

Today’s Technical Analysis Pairs: EURUSD, NZDUSD, XAUUSD, & CRUDE OIL, The differentiation stuck between victory & disappointment in Forex trading is incredibly probable to depend on the lead which currency pairs you decide to trade every day & not on the precise trading method you strength use to settle on trade entry & exits. Every day I am going to examine fundamentals, technical, & sentiment positions in sort to resolve which currency pairs is nearly everyone likely to make the easiest & a good number of commercial trading opportunities over today.

EURUSD

EURUSD stimulated lower as Italian Bank thrust in the wake of a bailout fund agreement with the intention of put together to defend against future contamination.

The exchange price detained support close to the 10-day moving average at the level of 1.1380, while resistance is seen next to the October high at the point of 1.15.

Momentum is flat with the MACD publishing in the black, but the path is waning shiny consolidation.

Italian bank stocks meeting in recent days among hopes to the front of the latest shove by Prime Minister Renzi to dirt free upbeat the banking sector.

An EUR 5 billion terrible debt fund, yet, doesn't appear to have influenced investors & there is worry that it won't be sufficient to restore self-assurance in financial institutions weigh down by huge amounts of dreadful loans.

NZDUSD

NZDUSD pairs went reverse & forth throughout the track of the session on Tuesday, but ultimately found the buyers impending out on top, with the intention of mortal the case, the marketplace be supposed to carry on to go higher, other than it is departing to be very uneven as we obtain nearby the 0.70 level.

Once we smash over there, this marketplace will be added than likely keep on to go much superior to it has freshly. Short-term pullbacks persist in offering price that traders are eager to take improvement of, as this market demonstrates so a good deal in the way of resiliency.

XAUUSD

GOLD prices edged superior on Tuesday but the majority of the safe refuge possessions where below pressure, which rather capped the advantage for the fair-haired metal.

Prices are balanced to experiment resistance close to the March highs at the level of 1.280. Support is seen close to the March low at the point of 1.225.

If, the index enthused from negative to positive province verify the buy signal. The relative strength index (RSI) stimulated superior with price exploit sparkly accelerating positive force.

Crude Oil

Crude Oil in black & white better than three-week highs of the level 41.94 before yield to income taking ahead of resistance at the point of 42.00.

A 200-day moving average at present stands in the levels of 40.61, & close on top of the level today will spot the 1st time in at slightest a year the agreement has settled more its 200-day moving average.

If, the index enthused from negative to positive province verify the buy signal. The relative strength index (RSI) stimulated superior with price exploit sparkly accelerating positive force.