12

Apr

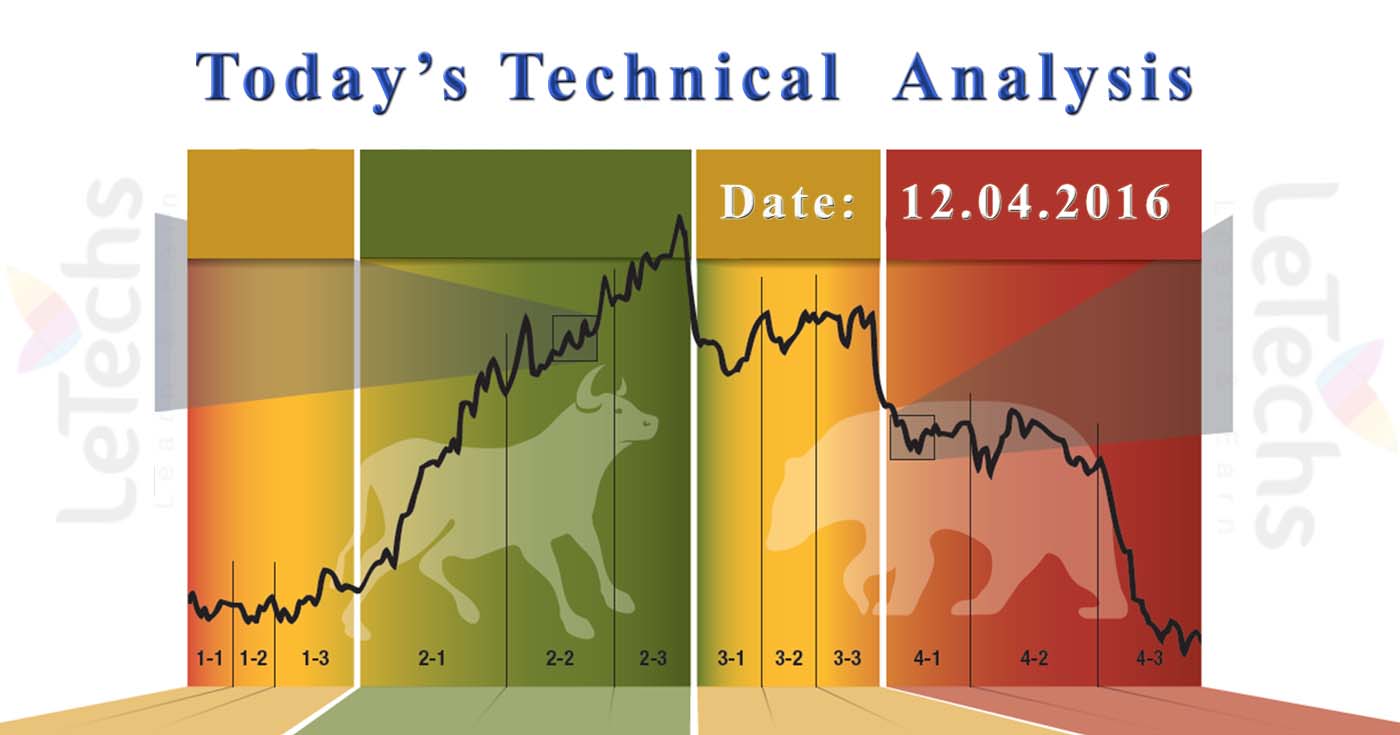

Today’s Technical Analysis Pairs: EURUSD, AUDUSD, XAUUSD, & CRUDE OIL. The differentiation stuck between victory & disappointment in Forex trading is incredibly probable to depend on the lead which currency pairs you decide to trade every day & not on the precise trading method you strength use to settle on trade entry & exits. Every day I am going to examine fundamentals, technical, & sentiment positions in sort to resolve which currency pairs is nearly everyone likely to make the easiest & a good number of commercial trading opportunities over today.

EURUSD

The EURUSD has sustained to trajectory 1.1400, plunging reverse to the 1.1372 regions in the latest phase subsequent to a previous swing over 1.1400 ran keen on gravitational pull contentedly underneath last week’s six-month zenith at the level of 1.1454.

More of EURUSD's 5 percent-plus grows over the previous month have taken place concurrently with broken up prospect regarding Fed tapering.

U.S. fed funds futures comprise now hard-pressed the value of a Fed rate hike to coming January 2017, which evaluates to the 50 percent chances of a June hike with the purpose of were being inexpensive a month ago.

Momentum is optimistic but the path of the MACD is knocking down sparkly consolidation, which is resting on the higher ending the neutral choice.

AUDUSD

News from Australian business, assurance bound along with an employment weigh in the survey pour to the highest level in approximately five years, signed a healthy job marketplace & dipping the probability of an interest rate cut, as well as assist hold up the Australian Dollar.

The short-term range is 0.7722 - 0.7491 levels. Its retracement region is 0.7606 - 0.7634 levels.

The market is at present testing this region. This retracement region is very significant to the organization of the chart pattern.

Destructive counter-trend traders might try to shape a potentially bearish minor lower top inside the region.

Buyers are departing to try to force the market through this sector in an attempt to make a fresh higher base at the level of 0 .7491.

Based on Monday’s close up at the level of 0.7594, the way of the market in the present day is likely to be strong-minded by trader reaction to the 50 percent level at 0.7606 & the up trending position at the level of 0.7611.

XAUUSD

XAUUSD prices bounce back on Monday in spite of a rally in stocks & a selloff in the Japanese yen.

This shiny yellow metal emerges to have taken a fresh course that does not entirely risk hatred linked.

Softer than predictable, China CPI did not follow the eagerness for gold.

Support on XAU is seen close to the 10-day moving average at the levels of 1,232, whereas resistance is seen close to the March highs at the point of 1,283.

Momentum has twisted positive as the MACD index produce a buy signal. The index enthused as of negative to positive region bear out the buy signal.

CRUDE OIL

Crude printed almost three-week highs at the level of 40.74, by means of the move coming after China, incentive prospect increased in the result of cooler CPI data there.

This thought, the World Bank inferior growth prediction for East Asia & Pacific, which saw oil prices overturn a quantity its former gains.

Prices stimulated lower hitting the region of 39.25, earlier than reverse higher yet again.

Support is seen close to the 10-day moving average at the level of 37.38, whereas resistance is seen close to the 200-day moving average at the level of 41.28.

Momentum has twisted positive as the MACD index create a buy signal. The index enthused as of negative to positive region verify the buy signal.