06

Apr

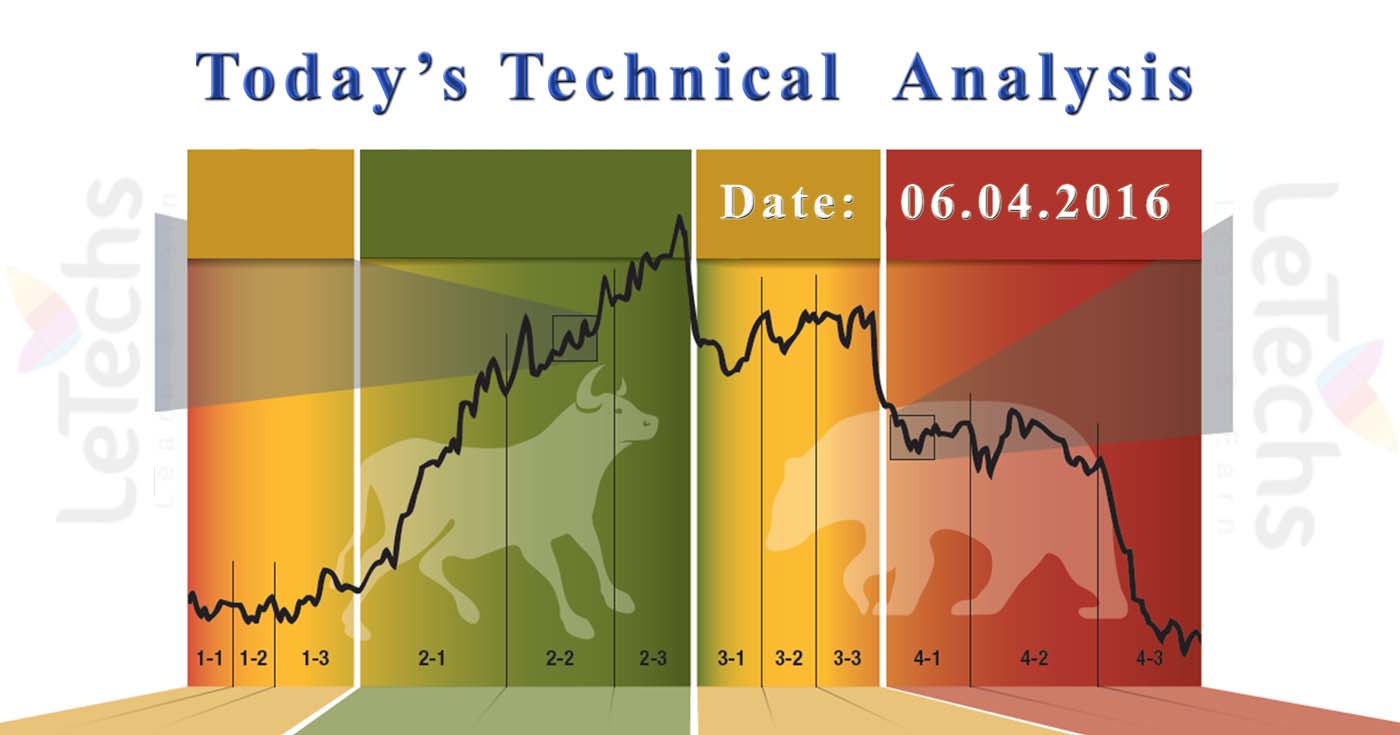

6th April 2016 Technical Analysis Pairs: EURUSD, GBPUSD, USDJPY, & USDCHF. The differentiation stuck between victory & disappointment in Forex trading is incredibly probable to depend on the lead which currency pairs you decide to trade every day & not on the precise trading method you strength use to settle on trade entry & exits. Every day I am going to examine fundamentals, technical, & sentiment positions in sort to resolve which currency pairs is nearly everyone likely to make the easiest & a good number of commercial trading opportunities over today.

EUR/USD

EUR/USD have a further unable to make up your mind faction last day. Prejudice relics impartial in adjacent term.

As long as continue on top of the 1.1335 level is at rest in a bullish stage testing at the levels of 1.15 which stays a superior position to sell with a firm stop loss.

Lying on the downside, an obvious break & daily shut underneath the level of 1.1335 might set off further bearish stress testing at the point of 1.125 or lesser. Our key technical viewpoint remains neutral.

GBP/USD

GBP/USD contains a bearish thrust last day bottomed at the point of 1.4121.

Partiality is bearish in adjoining term testing at the levels of 1.405 spot. Instant resistance is seen in the region of 1.42/25.

An understandable smash over that area can show the way value to neutral zone in adjacent term testing area 1.428. Our key technical viewpoint remains neutral

USD/JPY

USD/JPY has a momentous bearish impetus last day, ruined below 110.96 key hold up as you be capable of observe on my daily chart below.

A prejudice is bearish in shortest term testing at the levels of109.5 spot. Direct resistance is seen in the region of 110.96.

An obvious break & daily close rear above that area might generate fake breakout bullish circumstances.

USD/CHF

USD/CHF has one more irresolute movement last day.

Value slipped under 0.957 however unmoving to stay constantly beneath that area faraway.

If price capable to build an apparent break & steady movement underneath 0.957 level testing 0.9475.

An instant resistance stays just about 0.9625. A comprehensible break over that area might escort price to neutral sector in adjacent term testing 0.9715 regions.