31

Mar

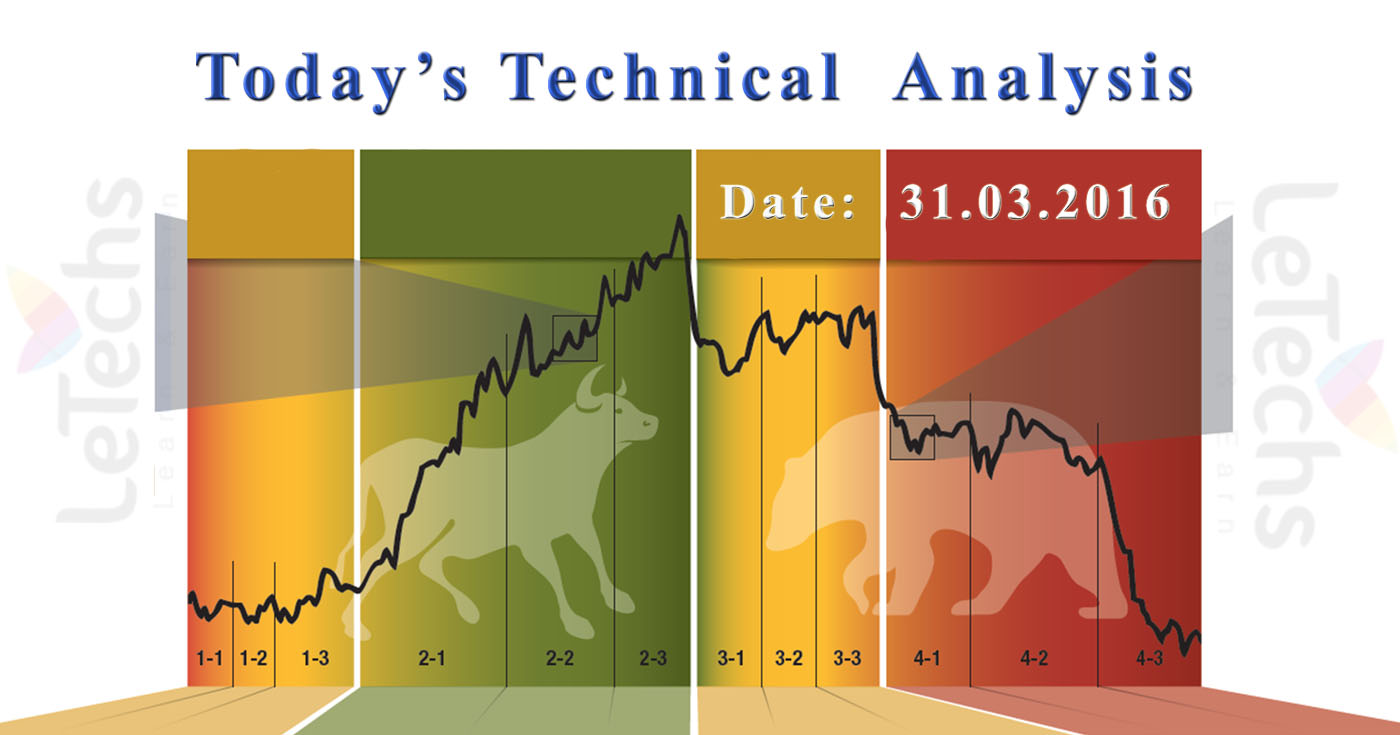

31st March 2016 intraday Technical Analysis Pairs: EURUSD, GBPUSD, USDJPY, XAUUSD, & Crude Oil. The differentiation stuck between victory & disappointment in Forex trading is incredibly probable to depend on the lead which currency pairs you decide to trade every day & not on the precise trading method you strength use to settle on trade entry & exits. Every day I am going to examine fundamentals, technical, & sentiment positions in sort to resolve which currency pairs is nearly everyone likely to make the easiest & a good number of commercial trading opportunities over today.

EUR/USD

Fed Chairman Janet Yellen’s speech through an enormous transform in the quotation dynamics – the price flew to the weekly tall in minutes.

A positive consumer self-confidence data in the US might not hold up the dollar. In the meantime, the March index bound to 96.2 from 92.2 beside the forecast of 94.0.

Germany released the preliminary March data on the value rise at the level of 0.8percent next to the forecasted 0.6percent.

The 1st support lies at the point of 1.126 & after that 1.115. The 1st resistance stands at the point of 1.135, the subsequently is at 1.145.

It’s established a muscular buy signal. This pair can rise to the resistance level of 1.135. After breaking 1.135 the buyers may go to level of 1.145.

GBP/USD

US dollar piercingly retreats in opposition to the pound. This pair flew upwards to the weekly high.

Even if the BoE considers the Brexit solitary of the major threats for the country's financial firmness this time it did not put off the pound as of growing.

The 1st support lies at the point of 1.432 & after that 1.424. The price is verdict the 1st resistance at the point of 1.44 & after that 1.448.

It’s established a strong buy signal. We presume the pair will go to the level of 1.44 first. Having conquered the 1st target & the value might go upwards to 1.448.

USD/JPY

Japanese yen destabilized amid the puny retail sales data in Japan. The index fell by 2.3 percent m/m next to a decrease by 0.4 percent in last January.

Unemployment rates rise to 3.3percent from 3.2percent. Abe’s statements, the Prime Minister, were additional factors that play against the yen. According towards the Prime Minister he does not signify to put off the sales tax raise from 8percent to10percent, which is programmed for next year.

The 1st support lies at the point of 112.2& after that 111.40. The price is verdict the 1st resistance at the point of 113, & after that 113.80.

It is a non-confirmed & a puny buy signal. A potential growth target is 113 levels. We do not keep out the falls to 112.2 levels.

XAU/USD – Gold

XAU/USD has broken down all the way through trend line resistance, subsequent yesterday’s FOMC meeting.

After a short during the night pullback from 1263 resistance, we are considering one sharper rally this morning.

Since such, the bullish sight is rear in play, with 1280 &1284 after those major resistance levels of reminder. Fundamentally we will be surveillance for sustained advanced highs & superior lows on an intraday basis to carry on the bullish attitude.

Crude Oil

US-Crude is contravention higher today; with the fault in the dollar prove an advantage for crude prices.

A short shrink away during the night has identified way to fresh highs & the conciseness, coupled with the truth; it might not even touch the 40 support level, Things to see the power of the recent bullish sentiment. As such, observe for sustained highs & superior lows for this trend to stay in have fun.

It seems we comprise broken out of a time of consolidation & consequently we might see this market trend in a supplementary realistic manner once again.

The next resistance levels of reminder are 42 & 43.58, with support at the level of 40.57, 40, & 39.11.