30

Mar

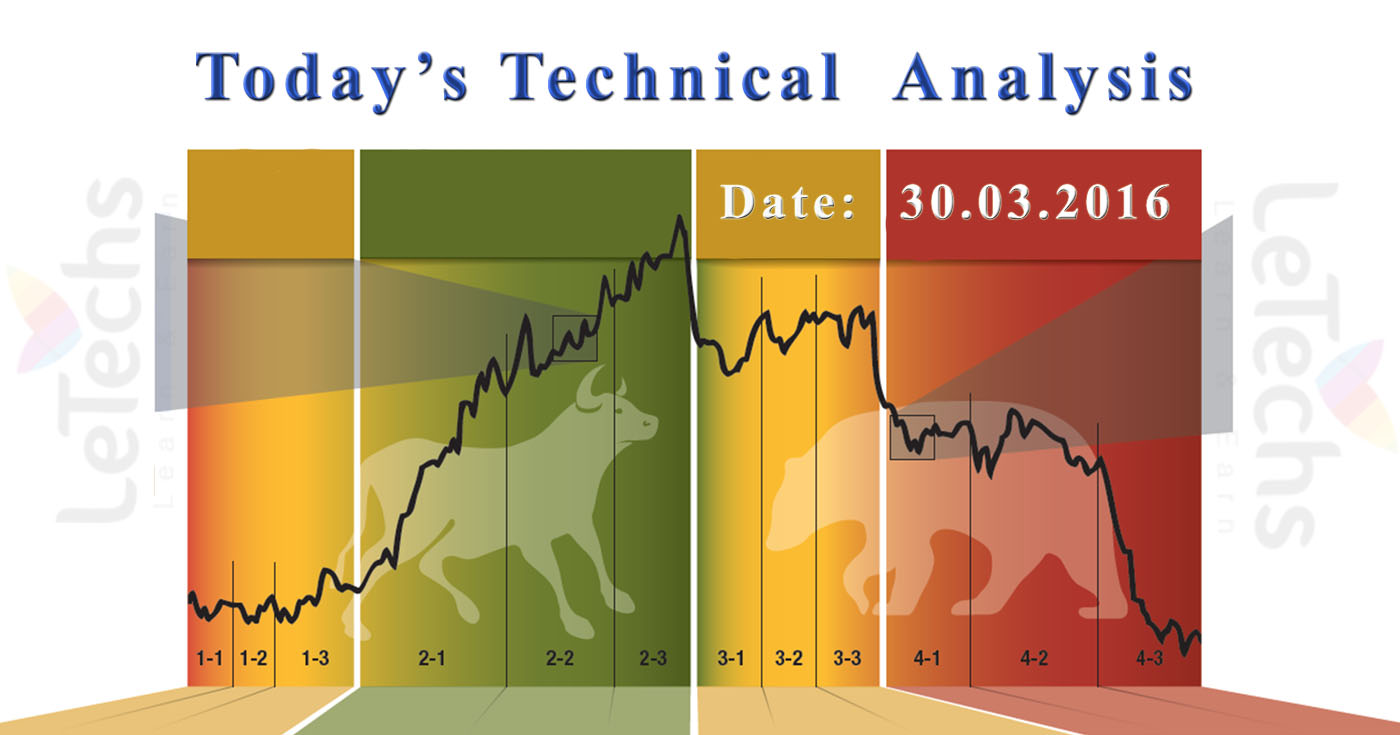

30th March 2016 Technical Analysis Pairs: EURUSD, GBPUSD, USDJPY.The differentiation stuck between victory & disappointment in Forex trading is incredibly probable to depend on the lead which currency pairs you decide to trade every day & not on the precise trading method you strength use to settle on trade entry & exits. Every day I am going to examine fundamentals, technical, & sentiment positions in sort to resolve which currency pairs is nearly everyone likely to make the easiest & a good number of commercial trading opportunities over today.

EUR/USD: This pair EUR/USD amplified on Tuesday. Earlier the USD rose against the Euro currency as investors were prepared for Yellen’s speech. Everyone was guessing whether the Chairman would provide a hint concerning the next rate climb in the US or not.

The Euro zone & the US monetary policies will go on to deviate as long as the investor is positive in the Fed’s future rate raise. In the meantime the Euro will be supported by Mario Draghi’s statement that the rates are at the lowly limit.

The 1st support lies at 1.1260 levels & after that 1.1150 level.

The 1st resistance stands at 1.1350 levels, subsequently solitary at 1.1450 levels.

It’s a non-confirmed & a muscular buy signal. We think the expansion will be sustained now.

The 1st target level is 1.3670, the next level is 1.1450

GBP/USD: For GBP/USD the extensive dollar selling supported. We suggest paying attention to Manufacturing PMI which will be released on Friday. We also remain for Mark Carney’s performance (BOE Chairman) on Thursday.

The price is verdict the 1st support at the level of 1.4320, & after that 1.4240.

The price is verdict the 1st resistance at the level of 1.4400, & after that 1.4480.

It’s a non-confirmed & a muscular buy signal.

We anticipate at the level of 1.44 lines smash with the intention will unlock the path for the buyers to 1.4480 levels.

USD/JPY: For USD/JPY, Yen remains under stress while Japanese Prime Minister Shinzo , thought that he planned to execute the considered rise of sales tax in April if the market did not suffer on or after sudden shocks.

Several analysts anticipated that Shinzo to reschedule the planned increase, with the intention of a threat to the fragile improvement of the Japanese financial system. Simply by the last part of the trades the pair dollar vs. yen cut down in the middle of the dollar’s weak spot.

USD/JPY is verdict the first support at the level of 112.20; after that 111.40.

USD/JPY is verdict the first resistance at the level of 113; after that 113.80.

It’s a confirmed & a muscular buy signal. The potential reduce targets are 2levels of support at the point of: 112.20 &111.40.