29

Mar

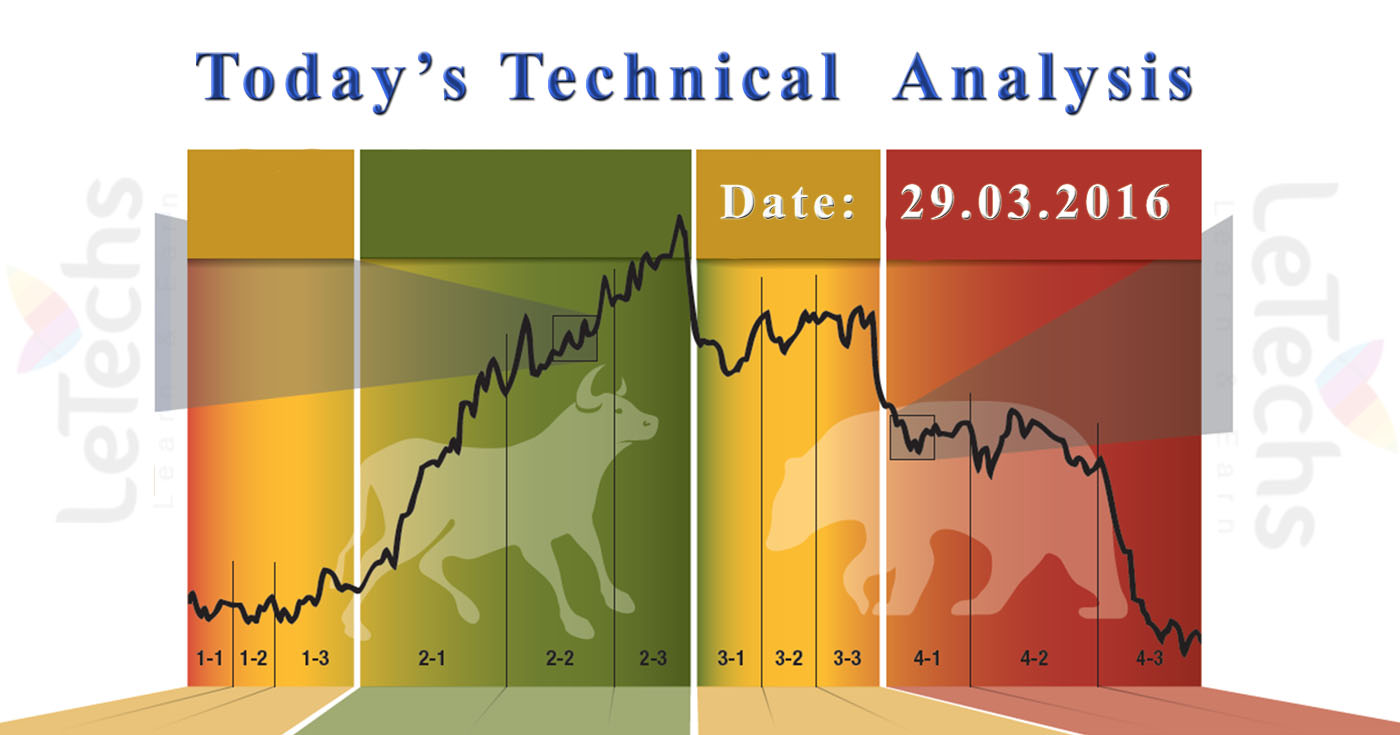

Today’s Technical Analysis Pairs: EURUSD, GBPUSD, USDJPY, USDCHF, & CRUDE OIL.The differentiation stuck between victory & disappointment in Forex trading is incredibly probable to depend on the lead which currency pairs you decide to trade every day & not on the precise trading method you strength use to settle on trade entry & exits. Every day I am going to examine fundamentals, technical, & sentiment positions in sort to resolve which currency pairs is nearly everyone likely to make the easiest & a good number of commercial trading opportunities over today.

EUR/USD: EUR/USD had a bullish thrust yesterday topped at 1.1219 levels. The partiality is bullish in adjacent term particularly if value able to build an apparent break & reliable movement over 1.1220 retesting the trend line resistance & 1.1280 level – 1.1300 level key resistance.

Instant support is seen just about 1.1150 levels. An obvious smash back under that area might lead price to neutral zone in next-door term except would remain the fake breakout bearish scenario stay behind strong testing 1.1065. Our key technical point of view remains neutral.

The uptrend is at rest unbroken in a triangle pattern. It must continue to rally to 1.1208 levels or 1.1225 levels if support in the region of 1.1189 levels holds. Following which a shrink away to 1.1189 level - 1.1174 level zones possible.

GBP/USD: GBP/USD also had a bullish thrust yesterday topped at 1.4282 levels. The prejudice is bullish in adjoining term testing 1.4300 levels – 1.4400 areas as a fraction of the bullish phase from the negative response to moving underneath 1.4050 support areas as you will be able to see on 1Hour chart beneath.

Instant support is seen in the region of 1.42 levels. An obvious break under that area might lead price to neutral zone in next-door term testing 1.4120 areas. Our key technical point of view remains neutral.

USD/JPY: USD/JPY didn’t build noteworthy movement yesterday other than generally unmoving bright to maintain its bullish unfairness & at rest prints superior high & low on daily chart.

The unfairness remains bullish in adjacent term testing 114.50 level, which relics a good position to sell with a stretched stop loss as an apparent break & daily close on top of 114.50 level might trigger additional bullish scenario testing 116.00 level or higher.

Instant support remains approximately 113 levels. An obvious smash under that area might lead price to neutral zone in nearest term testing 112.50/35 area.

USD/CHF: USD/CHF had a reasonable bearish impetus last day bottomed at 0.9722 points. The prejudice is neutral in the adjacent term, almost certainly with a modest bearish unfairness testing 0.9650 point support area which needs to be obviously broken down to the negative aspect to maintain the bearish situation targeting 0.9570 points.

Instant resistance is seen in the region of 0.9785 points followed by 0.9820 levels. An obvious break & daily close on top of 0.9820 levels would be a risk to the bearish scenario.

Crude Oil: WTI Crude Oil marketplace to begin with rallied throughout the path of the day on Monday, excluding found the 40 level be presented far too resistive.

We twist exact back in the region of to form a small piece of a shooting star, & afterward shooting stars, of course, suggest that we are departing to go down from at this point.

If we act, the 38 level underneath will be supportive, other than we must continue to go under their given sufficient time. In reality, we will further likely struggle to get the 36 level, excluding we would stay to observe a daily close below 38 level, for the reason that it would propose that the descending pressure ought to go on.

On the supplementary, if we smash on top of the shooting stars, which are fundamentally the 40 level as glowing, the market must follow the 42 level