25

Mar

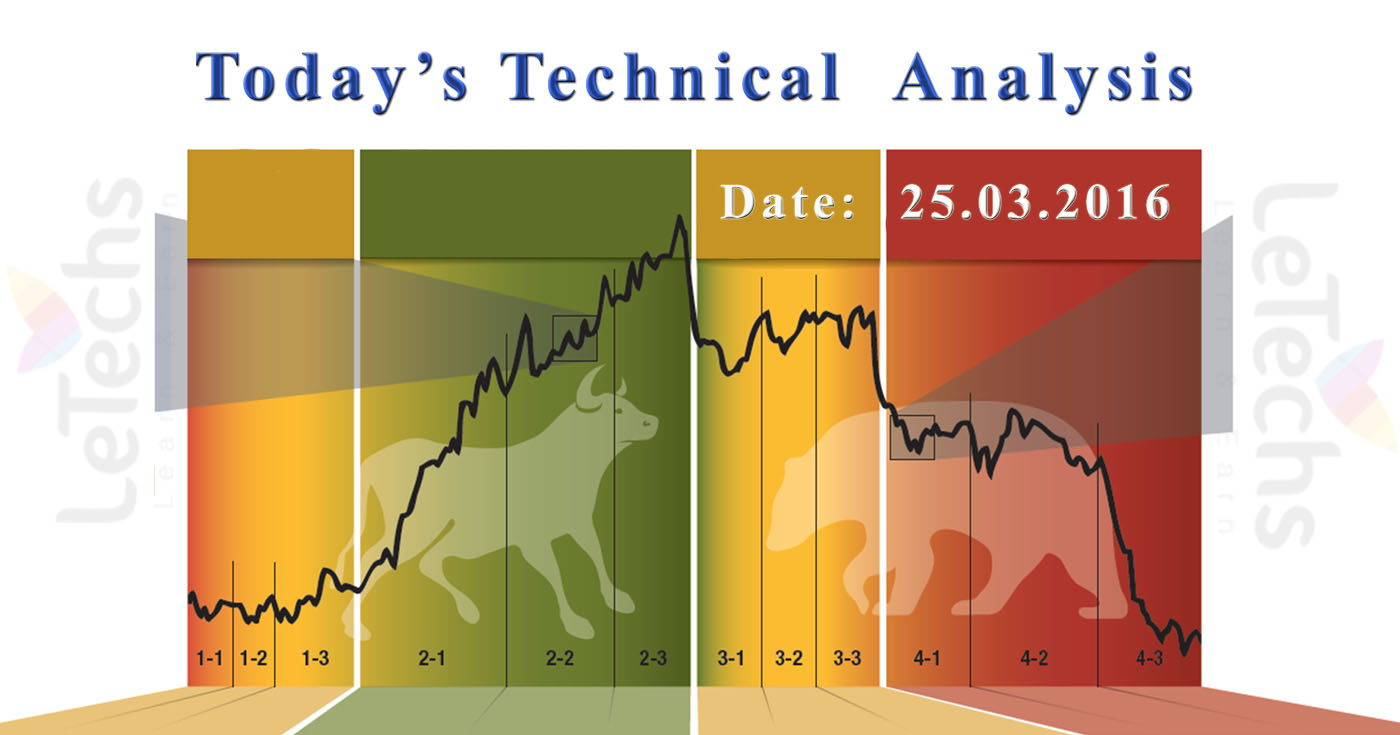

Today’s Technical Analysis of Pairs: - EURUSD, GBPUSD, AUDUSD

EURUSD:

While for US data free this Thursday, weekly unemployment claims cut down to 265K, thrashing potential, whereas the Markit Services PMI return on top of the 50.0 porches in March, up to 51.0, except underneath expectations of 51.3.

Sturdy Goods Orders fell in last month, shiny a broad-based hold up in US capital investment. Official data showed a 2.8percent reject next to a 4.2percent increase in February; at the same time as bookings for non-military capital goods not including aircraft drops 1.8percent, fine under market's potential.

EURUSD pairs trim its daily lose earlier than the closing signal, other than extensive its weekly turn down to 1.1143 level, & detained under the 1.1200, generally retain the bearish, manner.

Through partial liquidity predictable for Today, the pair is able to see a few uneven acts. Technically, the H4 chart shows that the top of the daily successor canal is presently being tested, & moreover, the technical indicators have bounce since oversold reading, other than staying well into the unenthusiastic region, far away from suggestive of a bullish sprint ahead.

At this level, the currency desires to recover the 1.1245 point to turn around its most recent negative manner & be clever to rally up to the 1.1290 level.

Support levels: -1.1120, 1.1085, 1.1040.

Resistance levels: -1.1210, 1.1245, 1.1290.

GBPUSD:

Following 4 straight days of decline for GBPUSD bounced back, helped by the UK retail sales information for last month, somewhat better-than-expected.

However, sales cut down 0.4percent compared to the last month, by means of refuse being guilty to the slow begin to sales of summer clothing stuff. The annual analysis remained at 3.8percent, usually burly according to historical standards.

GBPUSD pairs improved from a low down set at 1.4054 levels in front of the release, & rallied up to the 1.4180 level throughout the US afternoon status close to the last part of the day. The impending EU referendum, yet, relics in focus, & may see genuine approaching back under selling pressure.

Technically, the pair has healthier since in the region of the 23.6percent retracement of this year's reject, at the same time as the technical indicators are presently trailing upward potency within a bullish region.

During the H4chart, the technical indicators carry on moving north from oversold levels, apart from staying under their midlines, while the 20 SMA presents a burly bearish slope.

Support levels: - 1.4160, 1.4120, 1.4070.

Resistance levels: -1.4215, 1.4250, 1.4300.

AUDUSD:

The AUDUSD traded a great deal for the majority of this Thursday, weighed through the sustained turn down in base metals & oil, & the AUDUSD pairs chop down to 0.4767 levels, a last six days low.

The pair, on the other hand, bounced in the US session & trimmed every one of its daily wounded as commodities bounced, & stocks pared their turn down.

The pair well again more than the 0.7500 point & the long term bullish trend relics uninjured, as the value bounce powerfully since a bullish 20 SMA in the daily chart,

Even as the technical indicators have mislaid their bearish slope & are presently getting better within the positive region. In the H4 chart, the value stays under a bearish 20 SMA, at the moment in the region of 0.7560,

Support levels: - 0.7470, 0.7440, 0.7400.

Resistance levels: - 0.7560, 0.7605, 0.7640.