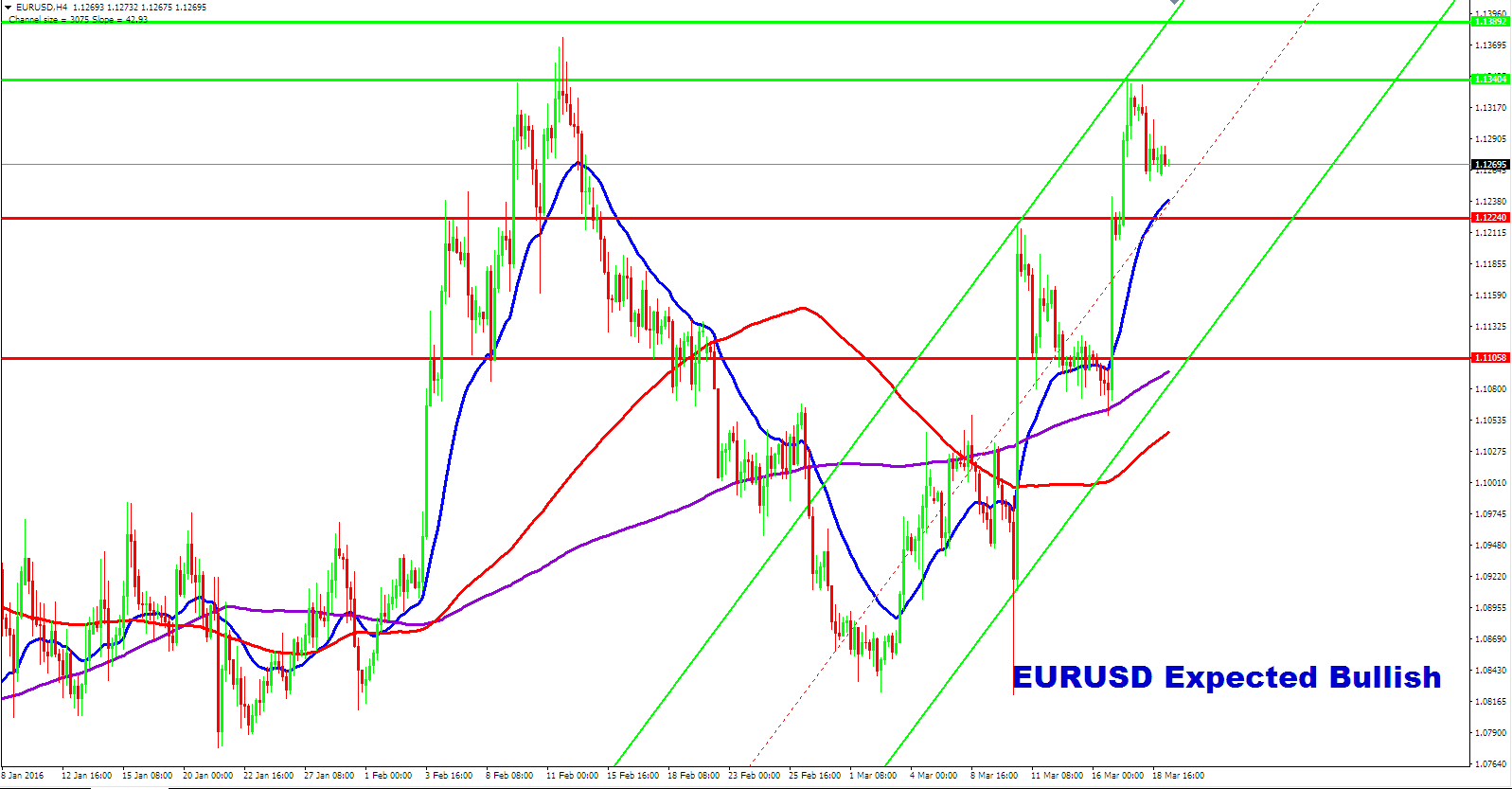

EUR/USD STAYS BULLISH

EUR/USD - Extensive it's bullish unpleasant the earlier week; more gain is expected in the fresh week. Support lies at the 1.1224 level. Additional down, support lies at the 1.115 level somewhere a desecration will aspire at the 1.1105 level.

A break of this point will mean at the 1.105 level. Equally, on the high side, resistance comes in at 1.1340 levels with a hack through here opening the door for additional upside towards the 1.1389 level.

Added up, resistance lies at the 1.14 level somewhere a break will interpretation the 1.145 level. Its weekly RSI is bullish & pointing upper signifying more strength. Overall EUR/USD remains partial to the upside on additional power.

GBP/USD

The grouping of a dollar thrust after Wednesday’s Fed meeting & a reasonable boost for the pound later than Thursday’s Bank of England policy summary led to a razor-sharp gush for GBP/USD.

In the result of together these central bank statements, GBP/USD pair broke out more than its 50-day moving average once more has left on to touch key resistance at the 1.45 level. The climb since late February’s multi-year lows has been considerable, put into query the honesty of the downtrend that has been in place while at least mid-year of very last year.

EUR/USD, the short-term way for GBP/USD should be extremely needy upon the dollar’s constant reaction to a slower rate of Fed rate hikes. If dollar failing continues, the most important upside level to watch is the key 1.4642 resistance level. With any breakout more than 1.4642, a cautious recovery for GBP/USD could potentially be in the creation, with a more upside target at 1.48. To the downside, a few move away back down below the 1.4189 support level should return the prior bearish pressure.

USD/JPY

USD/JPY tumbled this past Thursday to plunge for a moment beneath foremost support around the key 111.00 level, the region of February’s double-bottom lows & recognized a fresh long-term low in the process.

This fall was driven mainly by Wednesday’s pivotal Fed statement on monetary policy, but also by the Bank of Japan a day before, which opted to remain interest rates on hold as a substitute for cutting rates added into negative region.

After USD/JPY plummet to an 111.00-spot low in near the beginning of February, the currency pair begins an extended consolidation close to its lows, which at one point at the end of February retested 111.00 to form the famous double-bottom chart pattern.

Meanwhile, on the higher end of the consolidation, price created a downward trendline that has served as the higher border of the trading range. Overall, this upper border combined with the lower horizontal border at the 111.00 double-bottom lows has created an obvious descending triangle pattern. With both the BOJ and Fed meetings have weighed greatly on USD/JPY; the currency pair is yet again testing the lows of this triangle pattern & has reached an important bearish technical moment. With any advance downside force that prompts a constant breakdown below this triangle, the next most important downside targets are at the key 110.00 & then 108.00 support objectives.

USD/CAD

This earlier week, the dovish Fed statement united with appreciably stronger crude oil prices have lead to a foremost breakdown for USD/CAD underneath both the key 1.32 support level as well as a main uptrend support line extend all the way back to the mid-2014 lows.

Towards the weekend, a currency pair had settled in a tense consolidation somewhat below the key 1.3 psychological support level, which is also an essential 61.8% Fibonacci retracement of the latest bullish trend from the May 2015 lows up to January’s 1.46-area multi-year high.

As such, USD/CAD has reached down to & dipped below yet again critical support stage. With any sustained downside momentum & continued trading below this 1.3 level due to a constant recovery for crude oil & weakness in the US dollar, after that foremost downside target is at the key 1.28 support level. Any additional drop below 1.2800 might open the way for USD/CAD to target extra weakness towards 1.2500.

GOLD – Stabilize by way of Upside Pressure

XAU/USD - GOLD retain its wide uptrend, Extra bullish unpleasant is predictable.

On the downside, support comes at the 1.24 level somewhere a break will turn attention to the 1.23 level. Supplementary down, a cut throughout at this point will open the door for a move lower towards the 1.22 level.

Lower than here if seen may possibly set off more downside pressure target the 1.21 level.

On the other hand, resistance resides at the 1.265 level somewhere a break will aim at the 1.27 level.

A turn above there will expose the 128 level. More out, resistance stand at the 1.29 level. Overall XAU/USD looks to resume its broader average term uptrend but with the warning.