27

Mar

This Week’s Technical Pairs: EURUSD, AUDUSD, USDJPY, EURJPY, USDCAD, GBPJPY, EURAUD, CRUDE OIL, SILVER, GOLD, & AUDNZD.

EURUSD

EURUSD had a blended week. The last week of March features a main event survey and fresh inflation numbers. May be the ECB’s optimism justify. The French elections seem more positive to Emmanuel Macron, the typical candidate, alleviating doubts for a win for Le Pen. Positive Euro-zone PMIs supported the euro as prospects for gaining looks brighter. ECB speakers did not lift gives further fuel, but they did not grip the particular currency down either. In the US, Fed Chair Yellen also skipped the possibility to move the dollar following the dovish hike. The focal point was on the odds of Trump passing his health care program.

Technically, the pair was traded previous week between the earlier strong resistance levels at 1.0817, A solid resistance level was break into the 200-EMAs moving averages. If the pair breaks the previous low, the levels sustain as bearish up to support levels at 1.0712. Otherwise, if the resistance level was crack into the upwards, the pair might me goes into bullish. EURUSD remains BULLISH.

AUDUSD

AUDUSD reversed directions earlier week & lost 100 points. The pair blocked just over the 1.076 line. There are only 3 events on the calendar. In the US, Fed Chair Yellen neglects the chance to shifts the dollar, as she sent out a dovish note after the rate hike. Unemployment Claims were unpredictably weak, soaring to 261K. In Australia, the RBA minutes were positive about the economy, but expressed worry about risks in the housing market.

Technically, the pair was struggled in the 1.076 line. Initially the correction formed in the previous reversal levels at 0.7729. The alteration continues to the downwards channel to the near-term support levels at 0.7605. AUDUSD remains BEARISH.

NZDUSD

The New Zealand dollar had a blended week. Only 2 events are scheduled for the March end. The RBNZ said its statement & tried to talk down the kiwi dollar. But, Wheeler & his team do not seem too concerned about the weak growth rate. In the US, Trump’s healthcare law misery hurt the US dollar. NZDUSD had a unstable week, trading initially between the 0.696 levels & 0.704 levels discussed earlier week.

Technically, the pair was traded in downside directions after breakout the support levels at 0.7053 currently act as a resistance now. The pair was trading near-term support levels at 0.6885. Even with some fault in the US dollar, the kiwi dollar is still thrashing its wounds from the RBNZ decision. NZDUSD remains BEARISH.

USDJPY

The Japanese posted tough gains for a 2nd week in a row. The pair was finished at 111.22 levels, its lowest weekly close since November 2016. This week’s main news on the calendar is Household Spending. In the US, Yellen sent out a dovish note following the rate hike, disappointing the markets. Unemployment Claims were suddenly weak, soaring to 261K. In Japan, the trade surplus was a lot stronger than predictable, helping to increase the Japanese currency.

Technically, the pair opened the week at 112.67 levels & quickly jumps to a high of 112.90 levels. It was all downwards from there, as the pair plunged to a low of 110.61 levels, testing the previous support levels at 110.83. After a breakout from the earlier support levels of 111.62 the pair was trading in a same range. The pair ended the week at 111.22 levels. USDJPY remains NEUTRAL.

EURJPY

EURJPY was in downturned channel. There are only 3 events on the calendar. The previous week of March features a main event survey and fresh inflation numbers. May be the ECB’s optimism justify. The French elections seem more positive to Emmanuel Macron, the typical candidate, alleviating doubts for a win for Le Pen. Positive Euro-zone PMIs supported the euro as prospects for gaining looks brighter. ECB speakers did not lift gives further fuel, but they did not grip the particular currency down either. In Japan, the trade surplus was a lot stronger than predictable, helping to increase the Japanese currency.

Technically the pair was trading in the support levels. A previous resistance act as support at 121.018 levels. Currently the pair was trading in the upturned directions. EURJPY remains BULLISH.

USDCAD

The Canadian dollar showed some movement throughout the week, but ended the week unmoved. The pair was finished the week at 1.3347 levels. This week’s major event was GDP. In the US, Yellen missed the possibility to increase the US dollar, as she sent out a dovish note after the rate hike. Unemployment Claims were suddenly weak, soaring to 261k. Canada’s Core Retail Sales climbed into 1.7 percent, over the expectations. Still, CPI softened to 0.2 percent, same the forecast.

Technically, the pair was trading in the upward channel sustains this week. The pair was struggled at 1.3399 levels which is currently act as a resistance, after a break into the resistance level the pair continue its rally. USDCAD remains BULLISH.

GBPJPY

The pair was traded nearly in a near-range earlier week. This week’s key events are Current Account and Final GDP. Stronger inflation in the UK has the BoE generous more reflection to a rate hike later in the year 2017. In Japan, the trade surplus was a lot stronger than predictable, helping to increase the Japanese currency.

Technically, the pair was trading in the breakout region. An upper side breakout will be sustained for the pair. GBPJPY remains BULLISH.

EURAUD

EURAUD constant its neutral pressures as the pair some cautious assurance. The last week of March features a main event survey and fresh inflation numbers. May be the ECB’s optimism justify. The French elections seem more positive to Emmanuel Macron, the typical candidate, alleviating doubts for a win for Le Pen. Positive Euro-zone PMIs supported the euro as prospects for gaining looks brighter. ECB speakers did not lift gives further fuel, but they did not grip the particular currency down either. In Australia, the RBA minutes were positive about the economy, but expressed worry about risks in the housing market.

Technically, the pair was trading to break the previous resistance levels of 1.4153. A possible breakout the pair drives into the upside direction up to previous high levels. Or else the pair trade in the support levels at 1.3718. EURAUD remains NEUTRAL.

WTI-Crude Oil

The pair was traded in a small range but previous week breaks this out at 50.64 levels mentioned last week. After a breakout the pair was in downward channel. The pair traded almost its support levels at 47.33 reversing the direction sustained. WTI remains BULLISH.

XAGUSD-Silver

The pair was traded an upward channel mentioned previous week. This week the pair was trading in a series of tough resistance levels at 17.22. After breakouts the pair sustain its upside pressure to reach the resistance levels held on 17.75 levels. XAGUSD remains BULLISH.

XAUUSD-GOLD

The yellow metal was in a optimistic week gaining some points. In the US, Fed Chair Yellen neglects the chance to shifts the dollar, as she sent out a dovish note after the rate hike. Unemployment Claims were unpredictably weak, soaring to 261K. An uptrend channel support breaks-out now act as a resistance 1242.56 and also the resistance which is currently act as a support levels at 1229.04. XAUUSD remains BEARISH.

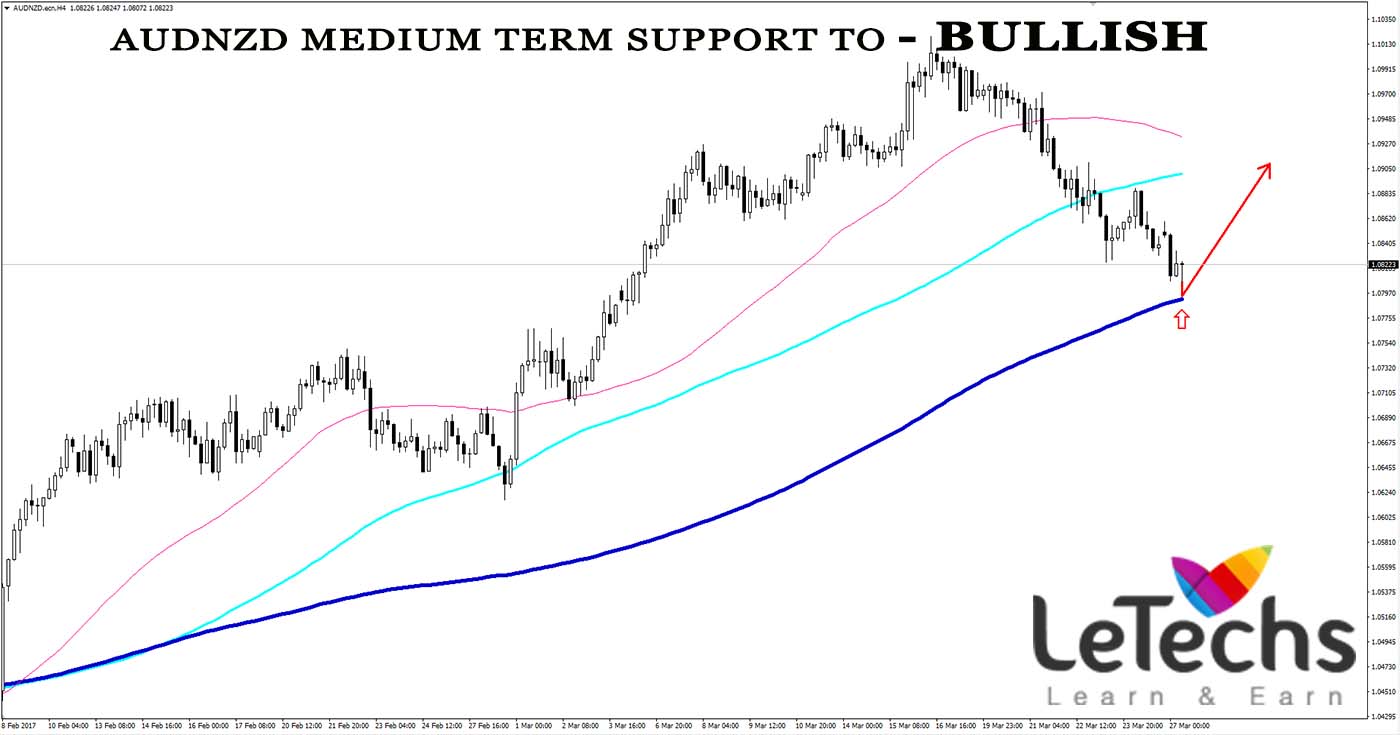

AUDNZD

The pair was gaining some points last week. There are only 3 events on the calendar. In Australia, the RBA minutes were positive about the economy, but expressed worry about risks in the housing market. The RBNZ said its statement & tried to talk down the kiwi dollar. But, Wheeler & his team do not seem too concerned about the weak growth rate.

Technically, the pair was traded in an upward channel which is break-out the previous strong resistance line at 1.0742. Currently act as a support for the pair. AUDNZD remains BULLISH.