17

Mar

Markets seem to G-20 meeting for Indication

Ø CAD- Manufacturing sales @08.30 am

Ø USD- Preliminary UoM Consumer Sentiment @10.00 am

*All Times are in GMT only.

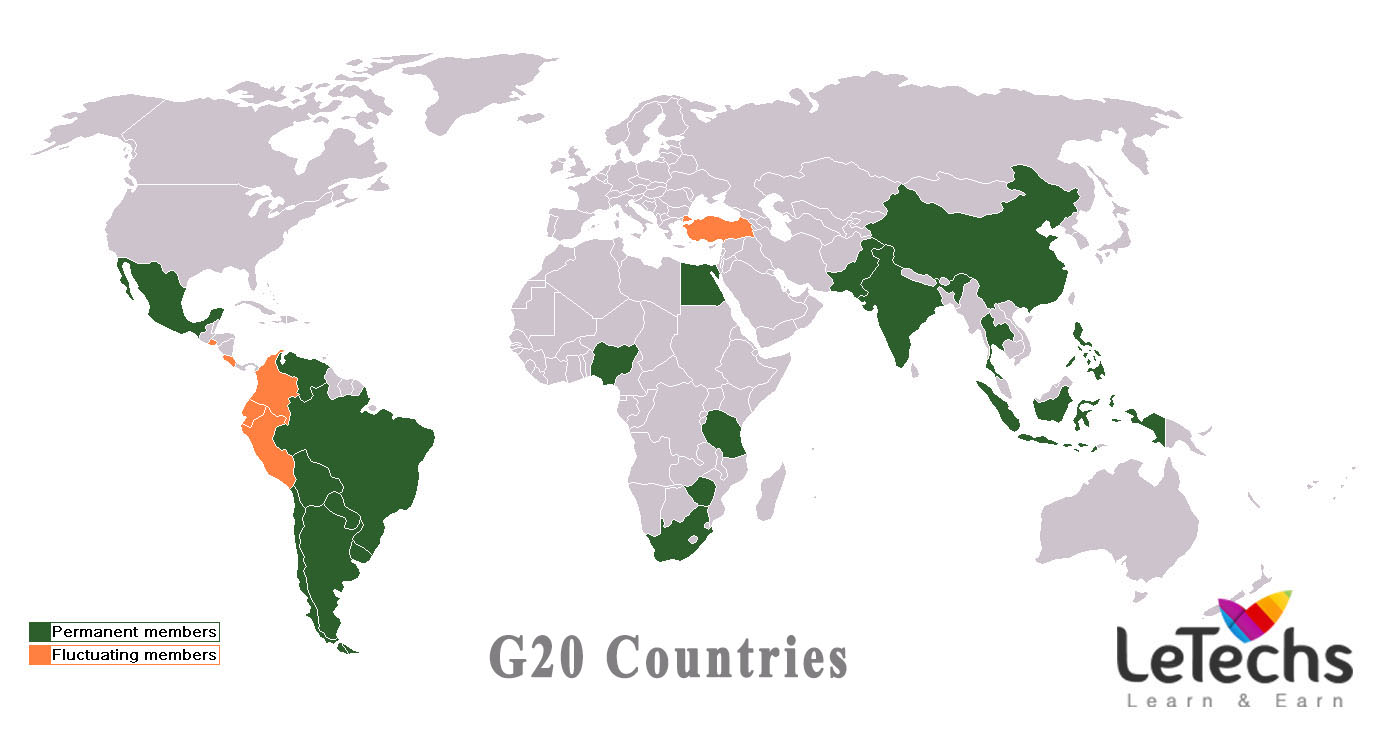

From the Group of 20 Nations Finance Chiefs Meeting

Khoon Goh, research head for Asia at ANZ well-known, Traders are monitoring how China & Japan will respond to force from Mr. Mnuchin to make stronger their currencies against the US dollar. There is a lot of attention if there will be any substance changes out of the G-20 conference.

The WSJ-Wall Street Journal offers a concise imminent of what to wait for from the upcoming G20 meeting, particularly with the spotlight on the US President Trump-Merkel meeting & treasury secretary Mnuchin’s tackle. Mnuchin US Treasury Sec is predictable to urge China, Japan, and Germany & further G-20 members to keep their guarantee to not utilize their exchange rates for spirited gains.

CAD: Manufacturing sales in March forecast to fall 1.8 percent

Regardless of the historically despicable CAD, impetus has sputtered out for the manufacturing as a hold back in the US dampens the requiring for Canadian goods. This was replicates in March's trade data through the 4.8 percent monthly fall in exports & wearing down of the Canada-US trade surplus.

Employment data also forecast a delay in manufacturing with hours worked declining by 2.9 percent m/ m in March even as the industry lost joint 47k jobs in March & April. Motor vehicle sales seem to be a source of failing after a back off in production data. Including February, the forecasted 5.2 percent reduce in manufacturing sales represents the most horrible 2-month period since January & February 2015.

Due to the additional corrosion of industrial prices in March of industrial costs were down 0.6 percent m/m, manufacturing quantity should be somewhat stronger than the nominal produce. Still, due to the scale of the forecasted turn down, the manufacturing sector will maintain to be a pull on the wider economy and intimidate to derail the BoC-Bank of Canada’s account of an export-led recovery.

USDCAD has rallied more than 2weeks after marking a yearly low close to 1.2556 levels. Though oil prices have compressed over this time, we dispute that weaker risk sentiment & a change in relative data blows between the US & CAD have counterbalance the impulse from advanced oil prices. Particularly, we spot to a softer tone in a few of the current CAD data releases.