16

Feb

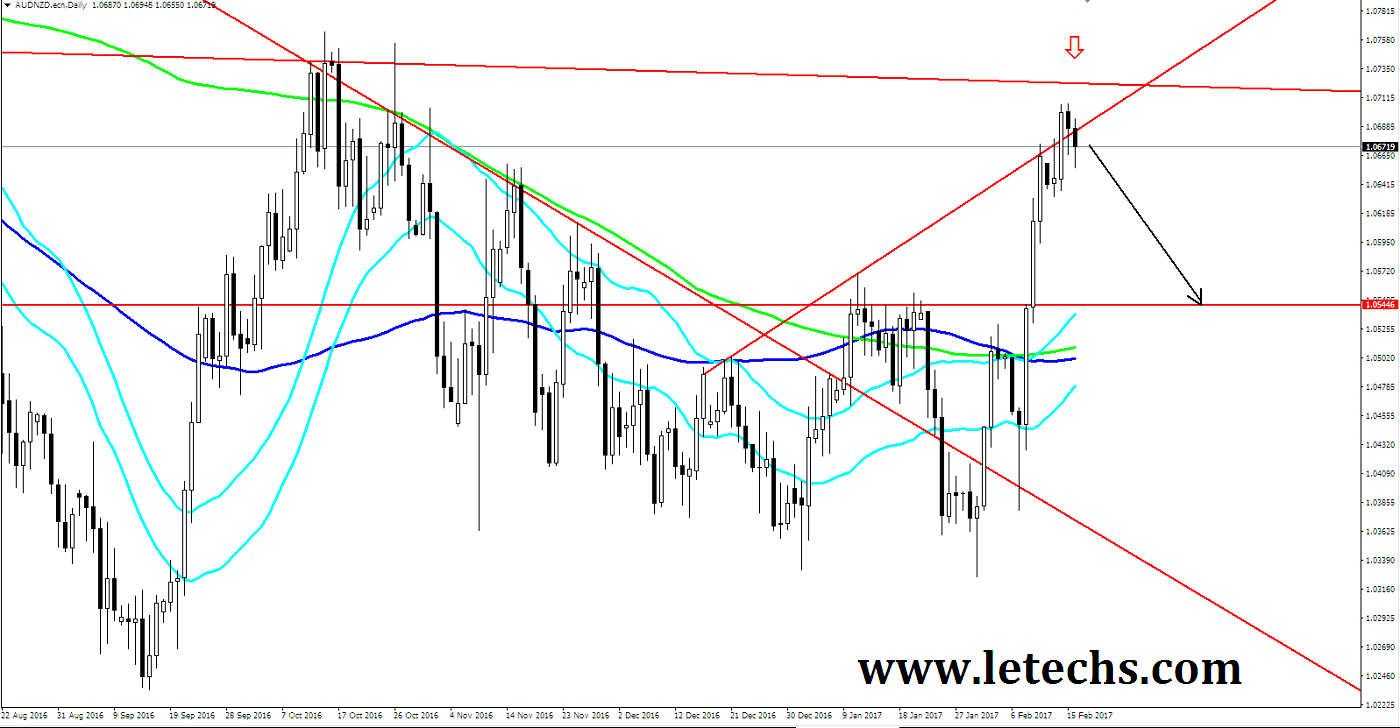

Daily Technical Analysis on 16th February 2017

Today’s Technical Pairs: EURUSD, GBPUSD, USDJPY, & XAUUSD.

EURUSD

The US dollar remained close to its fresh highs against other major pairs. Yellen’s "hawkish" remarks supported the US dollar reviving hopes for the rates hike in next month. The information from Spain further additional pressure on the euro as consumer price index in January cuts down despite the estimate. After reaching the level of 1.0550 the euro bounced off & was adept to reverse a minor part of its losses. The overnight’s upturn attempt stalled just below 1.060 levels barrier. The pair came under transformed selling pressure & slipped into negative zone in the post-Asian session opening. Sellers sustained forcing the value lower & tested 1.0550 levels in the late European hours.

The pair sustained developing well under its moving averages in the 4Hr chart. The 50 & 100-EMAs handled their bearish angle whereas the 200-EMA kept directing superior in the same timeframe. The resistance finds at 1.060 levels, the support comes at 1.055 levels. MACD indicator signs bearish & is still in negative zone. RSI indicator stayed within the oversold region.

GBPUSD

The pound restructured its lows on the rear of mixed employment statistics. The UK's unemployment rate remained unchanged in last December although Claimant Count Change dropped stronger than predictable. Besides, the major got under selling pressure after Yellen's comments on yesterday. A brief segment of night consolidation finished during European morning session. The pound faced an extra downside pressure & accelerated its decrease.

The pair remained under the 50 & 100-EMAs in the 4Hr chart. The 50-EMAs moved south whereas the 100 & 200-EMAs directed superior in the same timeframe. The resistance lies in 1.250 levels, the support comes in 1.240 levels. MACD histogram declined which signs a sell signal. RSI left the neutral zone & remained in the oversold region.

USDJPY

The pair reorganized fresh highs in the light of a stronger dollar following Yellen's hawkish statement. Her speech re-energized market outlooks for the rate hike in upcoming months. We preserve a short-term positive bias for the pair. After last day's rally the pair went from side to side in a 30-pips thin range in the night hours. The key stayed range-bound to higher in the European session. A new buying interest emerged in the post-European session giving the position an upward impetus.

In the 4Hr chart showed that the pair smashed all the moving averages upside. The 50-EMA pointed higher, the 100-EMA remains flat & 200-EMA moved lower in the mentioned chart. The resistance seems at 115 levels, the support comes at 114 levels. MACD remained at the same level which signs the strength of buyers. Oscillator RSI consolidated within the overvalued areas.

XAUUSD

The yellow metal prices slightly distorted on last day. The yellow metal weakened after US Fed Chair Yellen left unlock the possibility of rate hike in next month. In addition, the positive remarks over the US labor market strength & solid inflation forecast fueled the US dollar gain. The pair traded with bearish bias on yesterday. After an unstable Tuesday the yellow metal stabilized among broad based US dollar consolidation. The value slightly weakened in the Asian hours & traded around 1225 levels throughout the European session.

According to the 4Hr timeframe the spot cracks the 50-EMAs downside. The yellow metal was between the 50 & 100-EMAs full day. All the moving averages handled their bullish slope in the mentioned chart. The resistance remains at 1230 levels, the support stands at 1220 levels. MACD indicator stays at the centerline. If the histogram enters the negative zone, that will signs sellers’ growing strength. If MACD comes back into the positive zone the buyers will take the market control. RSI consolidated within the neutral region.