06

Feb

Weekly Technical Forecast on 6-10 February 2017

Technical Pair’s for this week: EURUSD, GBPUSD, AUDUSD & USDJPY.

EURUSD

The pair enjoyed the weakness of the dollar & a few good European data to rise. Know how to this persist. Industrial output data stands out in the 1st full week of February. Top-tier European data was tough of the economy grew by 0.5 percent in 4th Quarter 2016, the unemployment rate shockingly fell & the inflation rate beat expectations. Will this transform Draghi’s uncertainty? In the US, the fresh President’s priorities do not seem to consist of fiscal stimulus & this is not helping the greenback to put it gently. The NFP came out positive on the caption but with a huge miss on wages, set off choppy, but range-bound trade on this pair. Whereas monetary policy deviation weighs on the pair, present growth rates & political issues support the euro. EURUSD remains BULLISH.

GBPUSD

The pair upturned directions previous week, losing more than 120 points. The pair clogged at 1.2469 levels. This week’s major event is Manufacturing Production. It’s been a shaky start for Trump’s Presidency, who has chosen fights with Mexico & Australia but hasn’t outlined monetary or fiscal policies. US job figures were blended, as Nonfarm Payrolls was positive but wage growth was weaker than anticipated. In the UK, PMIs sustained to show extension. The BoE held rates, but UK’s Carney was dovish, saying that future interest rates might move in any direction.

The pair unlocked the week at 1.2594 levels & dropped to a low of 1.2409 levels. The pair after that upturned directions & mounted to a high of 1.2706 levels, testing resistance held at 1.2674 levels. The pair retracted behind in the week & finished at 1.2469 levels. Monetary divergence positive discrimination the dollar, as the Fed will likely raise rates in the 1st half of 2017. The BoE emerged content with low rates, & will be hesitant to make some moves as Britain prepares to begin Brexit discussions with Europe. GBPUSD remains BEARISH.

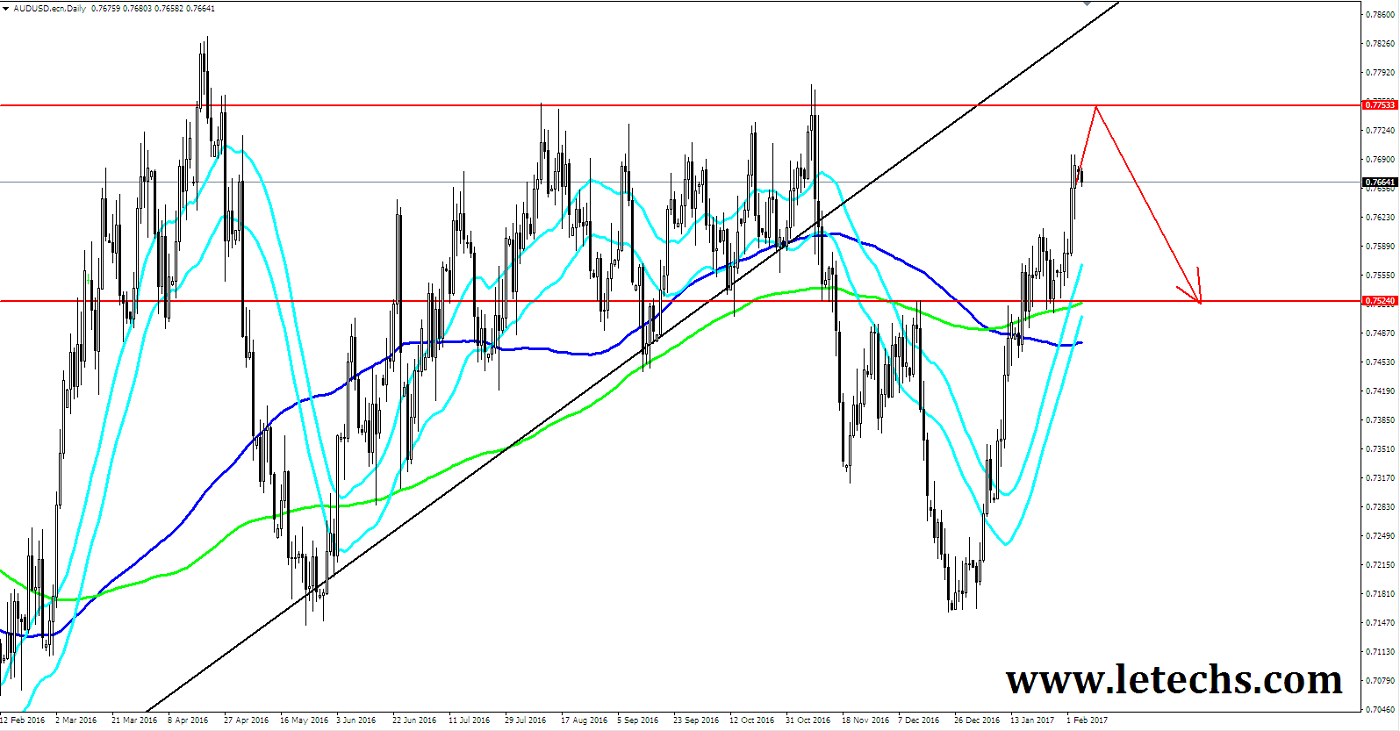

AUDUSD

The pair posted sharp gains earlier week, mounting 130 points. The pair finished the week at 0.7686 levels. This week’s major events are Retail Sales & the cash rate. In the US, controversial progress by Trump, such as the spat with Mexico & a travel ban on Muslim refugees has wound the greenback. US job figures were mixed, as Nonfarm Payrolls was positive but wage growth was weaker than predictable In Australia, Business Confidence enhanced but Building Approvals slender.

The pair unlocked the week at 0.7554 levels & rapidly fell to a low of 0.7528 levels. It was all uphill from there, as the pair mounted to a high of 0.7696 levels, testing resistance at 0.7691 levels. The pair clogged the week at 0.7686 levels. The US economy stays headed in the exact direction, & inflation levels have stimulated higher. This might lead to superior interest rates in the 1st half of 2017. Still, there is restlessness in the markets about Trump, whose economic position remains uncertain. AUDUSD remains BEARISH.

USDJPY

The Japanese yen rebounded with tough gains, as the pair slipped 220 points. The pair finished the week at 112.41 levels, marking the lowest daily close since the last November 2016. There are nine events on the schedule. It’s been a shaky start for Trump’s Presidency, who has chosen fights with Mexico & Australia but hasn’t outlined economic or fiscal policies. US job figures were mixed, as Nonfarm Payrolls was better than predictable but wage growth was weaker than anticipated. In Japan, Household Spending posted one more decline, but manages to beat outlook. As expected, the BoJ held interest rates at -0.10 percent.

The pair unlocked the week at 114.65 levels & rapidly reached a high of 114.94 levels. It was all downwards from there, as the pair fell to a low of 112.05 levels, breaking under the support levels at 112.53. The pair ended the week at 112.41 levels. The US economies continue to smash that of Japan, & Trump’s protectionist stance might sour investors on Japan, which is deeply dependent on exports. UDSJPY remains BULLISH.