31

Jan

Daily Technical Analysis on 31st January 2017

Today’s Technical Pairs: EURUSD, GBPUSD, USDJPY, & XAUUSD.

EURUSD

The euro unobserved positive GDP in Spain & softened on yesterday. Markets watch the forthcoming ECB meeting & Consumer Price Index which is predictable in green. The pair gapped superior at the daily open on last day. The price moved from 1.070 levels to 1.074 levels in the early on Asian hours. The dollar's downbeat tone though, reversed normal Asian session. Bulls unsuccessful to extend their growth & stepped back giving the path to sellers. Bears detained control & forced the spot back to 1.070 levels where the spot traded approximately unaffected in the mid-European trades. A fresh selling interest comes out before US session opening.

The pair made a fine break lower & touched 1.065 levels. The value smashed the 50-EMAs downside & tested the 100-EMAs in the 4Hr chart in the mid-European session. The 50 & the 100-EMAs kept bearing superior whereas the 200-EMAs remained horizontal in the same timeframe. The resistance finds at 1.070 levels, the support comes at 1.065 levels. MACD indicator was at the centerline of the position. RSI was within the neutral zone & moved downwards.

GBPUSD

There was not much to look at the UK calendar on last day. All watch is on the BOE- Bank of England on this Wednesday. The pair gapped higher at the beginning of the fresh week. The spot drives up to 1.260 levels where the price met a tough barrier. The key bounced off the hurdle; fall back towards the opening values closing the bullish gap. The spot pressured the 1.250 levels in the European trades, but lost to retake the handle.

The pound hovered over its moving averages in the 4Hr chart. The 100-EMAs crossed the 200-EMAs upside direction. The 50 & 100-EMAs headed north even as the 200-EMA was neutral-bearish in the 4Hr timeframe. The resistance lies in 1.2600, the support exists in 1.250 levels. MACD declined which signs the buyers’ spot weakening. RSI indicator left the overvalued regions & moved downside.

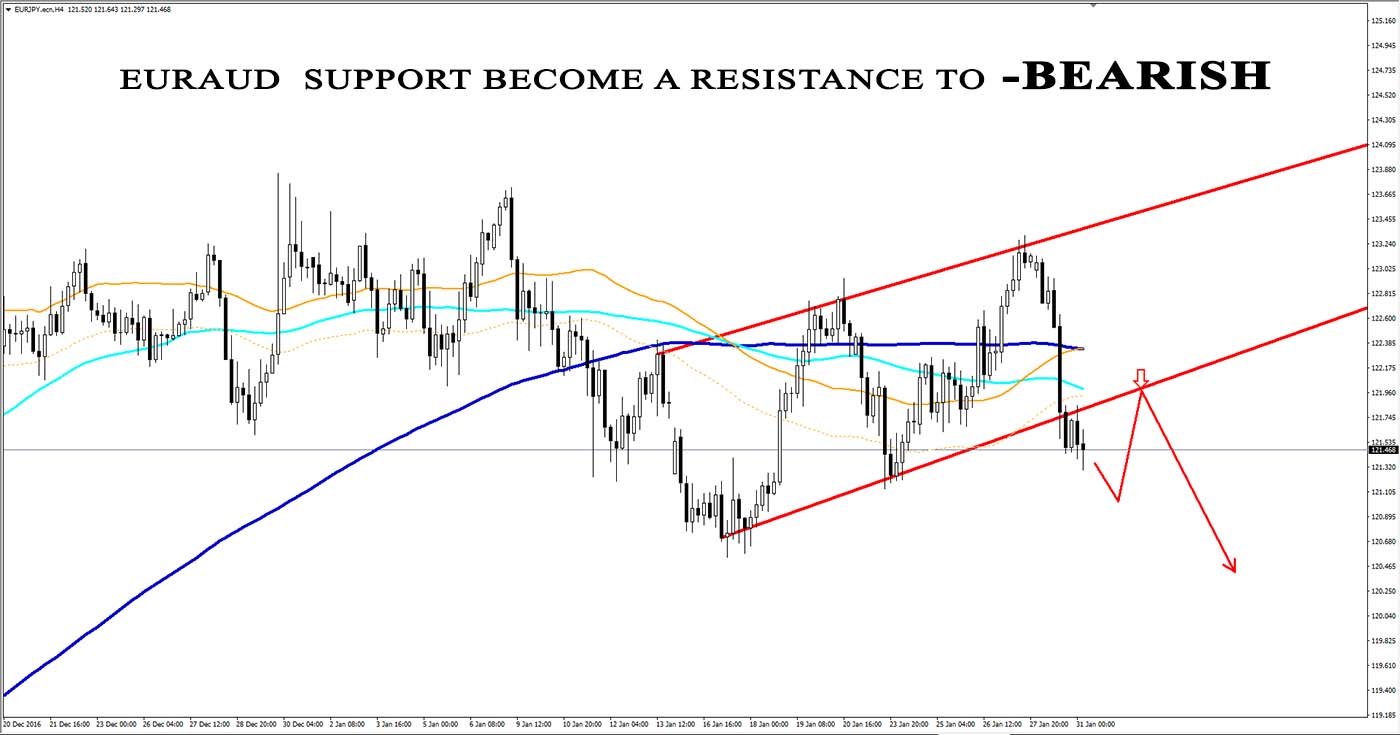

USDJPY

The US treasury bonds expansion helped the US dollar to overturn few losses. Moreover, weak Retail Trades in Japan weakened the general currency. A tough 2 day rally was capped over 115.00. The US dollar gapped inferior against its Japanese peer at unlock on yesterday. The greenback moved from 115 levels to 114.85 levels & extended its losses afterwards. After finding latest bids about 114.23 levels the value twisted around & rallied back to the starting price. The pair remained a few pips under the level before the US session opening.

The value tested the 100-EMAs in the 4Hr chart. The spot stayed around the 100-EMAs after testing the moving averages in the same chart. The 100 & 200-EMAs were horizontal in position whereas the 50-EMAs pointed higher. The resistance seems at 115 levels, the support comes at 114 levels. Indicator MACD traded to the upwards. RSI oscillator was within the overvalued area nearly the neutral zone.

XAUUSD

The yellow metal is in demand in the glow of Trump’s moves. The US President excluded travelers from 7 Muslim countries from incoming the US. Last weekend’s recovery stalled at 1195 levels. After reaching the mark levels the metal upturned its direction and jumped lower. The yellow metal values reached the level of 1190 at the European hours & stayed around the same levels before the US session open.

The value bounced off the 100-EMAs & remained under the 50 & 100-EMAs in the 4Hr chart. The 100-EMAs & 200-EMA remains neutral whereas the 50-EMAs pointed lower in the same timeframe. The resistance stays in 1190 levels, the support stands in 1180 levels. Indicator MACD grew which signs the seller’s positions weakening. Oscillator RSI left the neutral zone & moved downwards.