25

Jan

Daily Technical Analysis on 25th January 2017

Today’s Technical Pairs: EURUSD, GBPUSD, USDJPY, & XAUUSD.

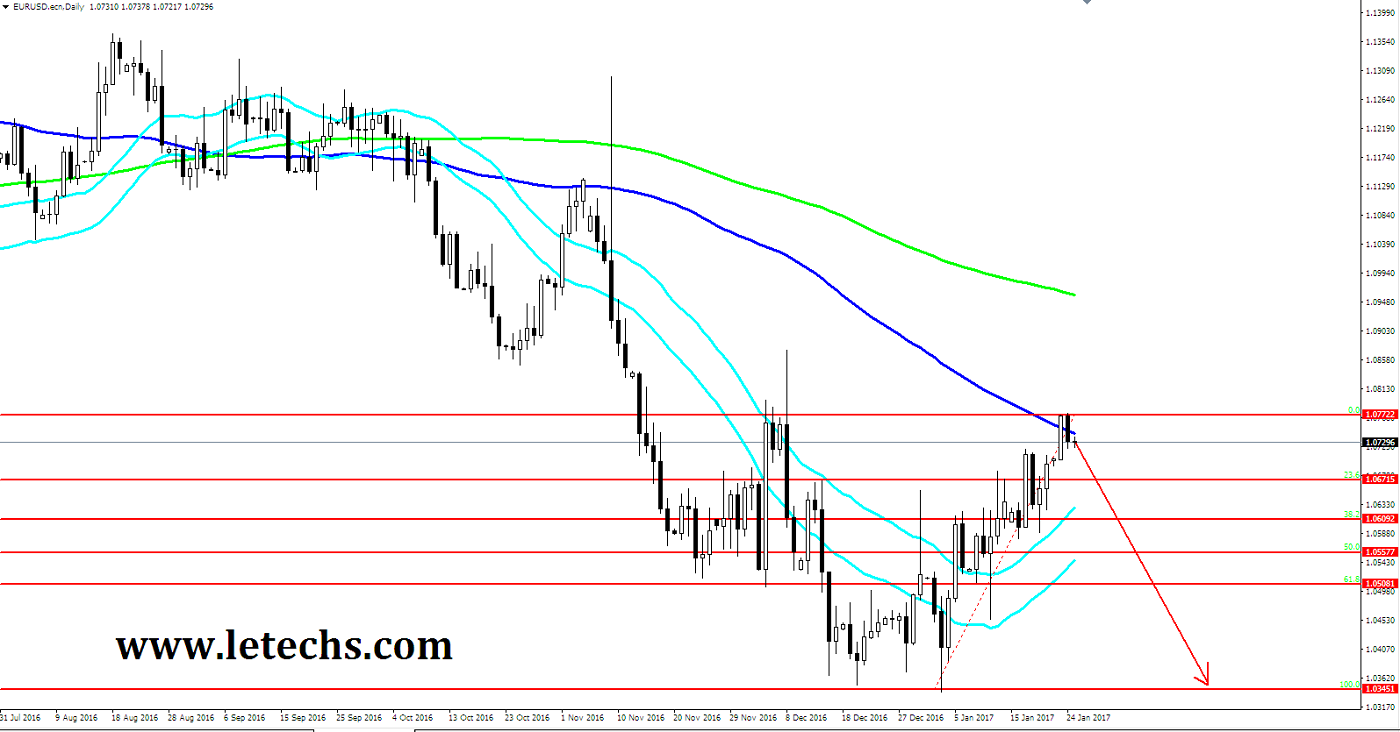

EURUSD

Manufacturing PMI in Germany set positive results. Services PMI showed on the contrary negative numbers. The market will be paying attention on Business Climate in Germany on later the day. Sentiment stayed bullish towards the euro on yesterday. The pair traded in an ascending channel nearly its upper limit. Euro bulls met a fence at 1.075 levels & lost to advance additional. After posting a daily high at 1.077 levels in the Asian hour bulls stepped back & returned the pair to the 1.075 area. The spot stayed over the moving averages in the 4Hr chart. The 50 & 100 EMAs kept heading superior where as the 200 EMA remained neutral in position. The resistance finds at 1.075 levels, the support comes at 1.070 levels.

GBPUSD

Traders reserved some profits before the UK Supreme Court's judgment on Brexit. The Supreme Court had to settle on whether Parliament approval is necessary to launch Article 50. The bullish market structure stayed in place. Buyers lost to retake 1.250 levels & had to move back giving the floor to sellers. A latest buying interest just about the US currency helped the US dollar to get well from the fresh lows. Sellers forced the value lower in the Asian hours but lost to advance under the mark levels of 1.246 before the European session. The pair sustained its slide towards 1.245 ahead of the US session open.

The moving averages were blended in the 4Hr chart. The 200-EMAs remained bearish even as the 50 &100 EMAs were spinning upwards. In addition, the 50-EMAs crossed the 100-EMAs upwards. The resistance lies in 1.250 levels, the support exists in 1.240 levels. MACD histogram decreased which signs the seller’s growing strength. RSI oscillator remained within the overbought region.

USDJPY

The yen established a light support from the positive Manufacturing PMI. Besides, the volatility around Trump’s economic schedule kept on weighing on the US dollar. Sellers sustained to dominate on last day. Though, bears seem to have taken a breath subsequent to meeting the hard support around multi-week lows at 112.5 levels. The value bounced from the 112.5 levels support zone in the Asian hours & developed a goodish upturn building on to its impetus back over 113 levels handle afterwards.

According the 4Hr chart the pair stayed under its moving averages. The 50 & 100 EMAs advanced downwards whereas the 200-EMA stayed neutral in position. The resistance seems at 114 levels, the support appears at 113 levels. All the indicators bounced from oversold zone staying within the negative regions. MACD histogram grew which hints buyers’ strength. RSI bounced off the oversold areas.

XAUUSD

On Tuesday, volatility around Trump's Presidency sustained weighing on gold prices limiting a downslide. In spite of the ongoing easing the yellow metal stayed in green on last day. The resistance levels of 1220 appeared to be a hard pip to break. After testing the levels the yellow metal bounced back in the Asian hours & comes back into 1210 levels in the European session. Sellers lost their steam around the switch waiting for fresh market movers. The 50 & 100 EMAs kept their advance upwards even as the 200-EMAs just twisted upside direction. The resistance remains in 1220 levels, the support stands in 1210 levels. MACD reduced which signs the buyers’ spot weakening. RSI jumped to a downside levels.