02

Jan

Weekly Technical Forecast on 2-6 January 2017

Technical Pair’s for this week: EURUSD, GBPUSD, AUDUSD & USDJPY.

EURUSD

The pair made a recent movement to the upside in thin end-of-year trading ended the 2016 over 1.05 levels. The 1st week of 2017 is already filled with the key events, with inflation & PMIs standing out. The euro gets pleasure from a “flash surge” throughout the holiday week. Thin trading conditions & perhaps little algo activity sent it elevated before it came back down to the ground. Spanish CPI for December flies more than predictable, giving us an early sign of rising inflation this year. In the US, consumer confidence climbed even as other measures weren’t that inspiring. The holidays are ended & the 2017 is now. The monetary & fiscal divergence seen in 2016 is likely to drop over into near the beginning of 2017. The ECB persist printing money while the FED is place to hike also in the New Year. As well as on the fiscal side, high potential for fiscal stimulus from Trump among a sluggish growth rate in Europe also make a variation. EURUSD turns last week NEUTRAL to this week BEARISH.

GBPUSD

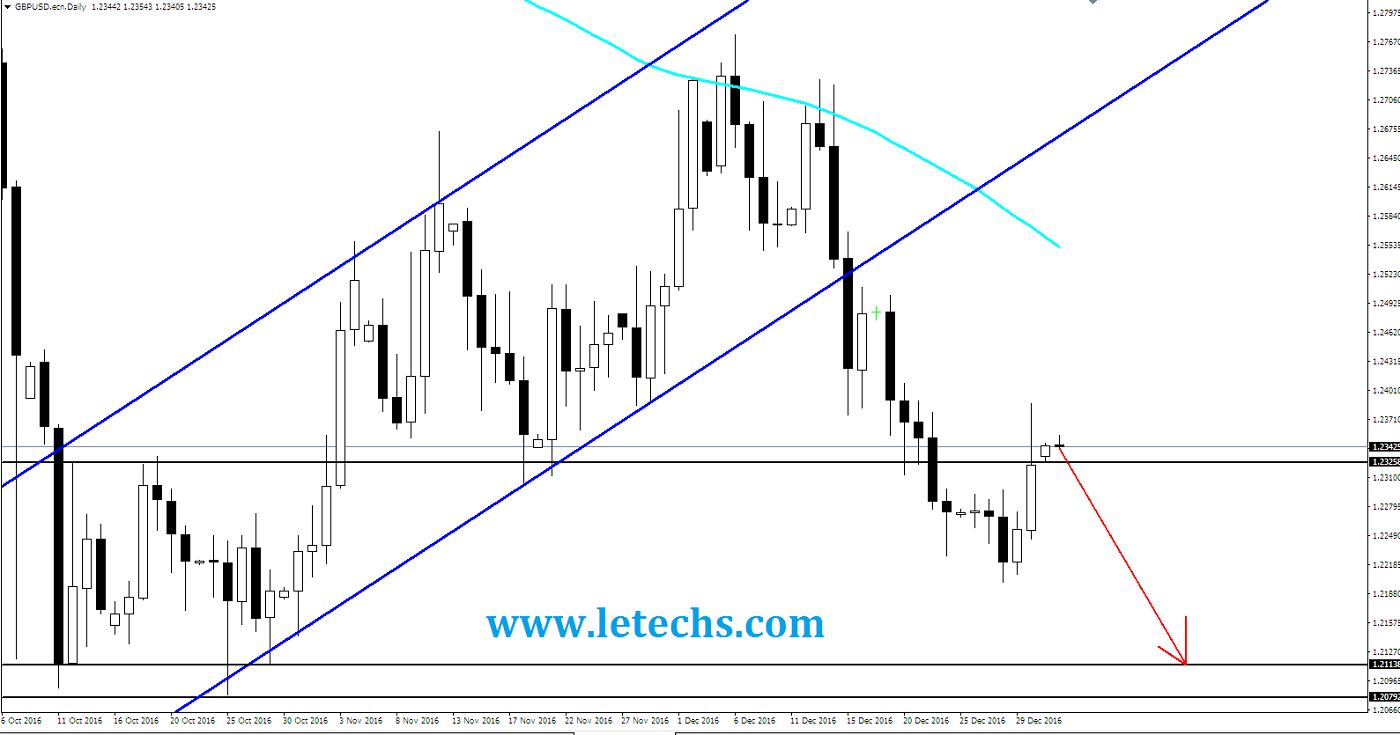

The pair posted slight growth previous week, with the pair ended the week at 1.2337 levels. This week’s major events are the 3 PMI releases. In the US, consumer confidence bound as consumers maintain to feel optimistic regarding the economy as we go into 2017. On the labor front, unemployment claims go down, beating anticipations. There were no key British releases in the year-end.

The pair unlocked the week at 1.2287 & cut down to a low of 1.2195 levels, testing resistance at 1.220 levels The pair then twisted directions & jumped to a high of 1.2388 levels. The pair finished the week at 1.2337 levels. By means of the Trump presidency just not many weeks away, the markets are expect US growth to sustain, which might mean more rate hikes from the Fed. So, the US dollar might begin 2017 with broad gains. GBPUSD remains BEARISH.

AUDUSD

The pair ended the year gently, as the pair was unchanged last week, closing at 0.7178. There are 6 events this week’s on the calendar. The week among Christmas & New Year’s was marked by less volume & the pair finished the week unmoved. In the US, consumer confidence moved & unemployment claims cut down, beating expectations. There were no key Australian events previous week.

The pair unlocked the week at 0.7175 levels & reached a low of 0.7160 levels. The pair after that changed directions & mounted to a high of 0.7247 levels, testing the resistance at 0.7223 levels. The pair was incapable to consolidate at this level & ended the week at 0.7178 levels. AUDUSD remains BEARISH.

USDJPY

The pair fell down as low as the 116 line, but ended the week at 116.76 levels. This week’s has 4 events on the schedule. Japanese consumer inflation & spending indicators sustained to point descending channel earlier week. The yen was buoyed by the BoJ Summary, which was moderately optimistic about the Japanese economy. In the US, consumer confidence shine, as US consumers still optimistic concerning economic conditions. On the labor front, unemployment claims cut down, beating anticipations.

The pair unlocked the week at 117.30 levels & mounted to a high of 117.81 levels, testing resistance at 117.52 levels. The pair suddenly changed its path & fell to a low of 116.02 levels. The pair finished the week at 116.76 levels. Welcome to a brand new year 2017! Through the Trump presidency just about the corner, the markets are eager US growth to sustains, which might mean more rate hikes from the Fed. So, the US dollar might begin 2017 with large growth. USDJPY remains BULLISH.