30

Dec

Daily Technical Analysis on 30 December 2016

Today’s Technical Pairs: EURUSD, GBPUSD, USDJPY, & XAUUSD.

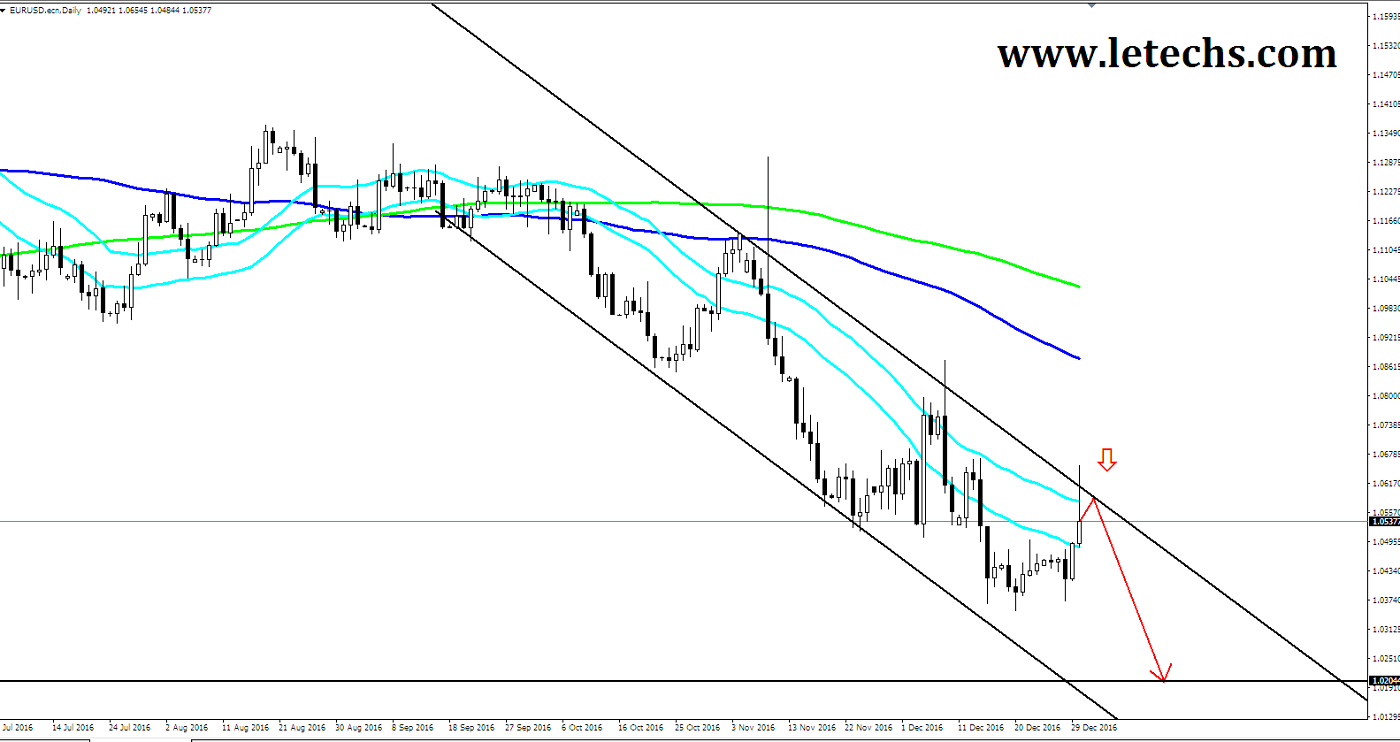

EURUSD

The dollar move away from Fourteen year peak across the euro among some profit taking ahead of New Year holidays. The pair returned to upbeat short-term mode on last day. The value found few support around 1.0400 levels & retreated reversing all last day’s losses. The euro rally washed out after reaching the weekly high at 1.0479 levels. The pair twisted around & erases its few fresh gains before the US session opening.

The value smashed the 50-EMA upsides & beginning towards the 100-EMAs in the 4Hr chart. The pair remained under the 100 & 50 EMAs throughout the European hours. The 100 & 200 EMAs pointed lower although the 50-EMA turned neutral. The resistance finds in 1.0450 levels, the support comes in 1.0400 levels. MACD indicator was at neutral in position. If the histogram returns the negative region, that will hints seller’s growing strength. If MACD moves into the positive zone the buyers will take the market control. RSI left the neutral region & remained close to the overbought levels.

GBPUSD

The pound was adept to reverse its few losses on the rear of the positive data of Nationwide Housing Prices in the nation. Even if technical indicators keep giving bearish signals marketplace emotion was bullish on earlier day. The pound bounces off the latest low at 1.22 levels & headed north turn around best part of its losses recorded in the last sessions. The revival delayed at 1.2272 levels where the pair faced few sellers’ resistance levels. Sellers detained control & forced values lower before the US session.

The value smashed the 50-EMA upsides but lost to retake the 100-EMA in the 1Hr chart. The pair bounced off the 100-EMAs & jumped downside. The moving averages kept heading lower in the 1Hr chart. The resistance lies at 1.23 levels; the support seems at 1.2200 levels. Indicator MACD traded to the downwards. RSI oscillator enters the neutral zone.

USDJPY

The yen strengthened against the US dollar among the greenback weakening crosswise the board. The Japanese currency unnoticed BOJ Summary of Opinions release. We might see a sharp US dollar selloff from its latest highs. The pair drops down from 118 levels – 116 levels among a new selling interest. Sellers met a fence at 116 levels which unwanted pair upwards. The greenback upturned few its losses before the US session opening.

The value cracks the 50 EMA downsides & tested the 100-EMAs in the 4Hr chart. The 100 & 200-EMAs kept heading superior although the 50-EMA becomes neutral. The resistance is appears at 117 levels, the support stays at 116 levels. MACD moves into the negative zone. If MACD stands in the negative region, sellers’ spot will support. RSI oscillator bounced off the oversold regions.

XAUUSD

The yellow metal prices grew on last day as risk-off sentiment finished them additional attractive in the current slight market. The metal was adept to lengthen its recovery previous day among broad based US dollar retracement. The values moved on previous day morning & touched the 1150 barrier at the start of the European session. The metal lost to smash through the resistance which appears to be a hard nut to split. The levels discarded pair which somewhat rolled rear before the US session.

The value cracks the 50-EMA upwards & tested the 100-EMAs in the 4Hr chart. The yellow metal lost to recover the 100-EMA & bounced off the moving before the US session. The value was in-between the 50 & 100 EMAs in the 1st part of the day. The 50-EMAs were neutral although the 100 & 200-EMAs directed lower in the 4Hr chart. The resistance exists at 1150 levels, the support stands at 1140 levels. MACD traded to the upwards momentum. The RSI left the overvalued areas.