29

Dec

Daily Technical Analysis on 29 December 2016

Today’s Technical Pairs: EURUSD, GBPUSD, USDJPY, & XAUUSD.

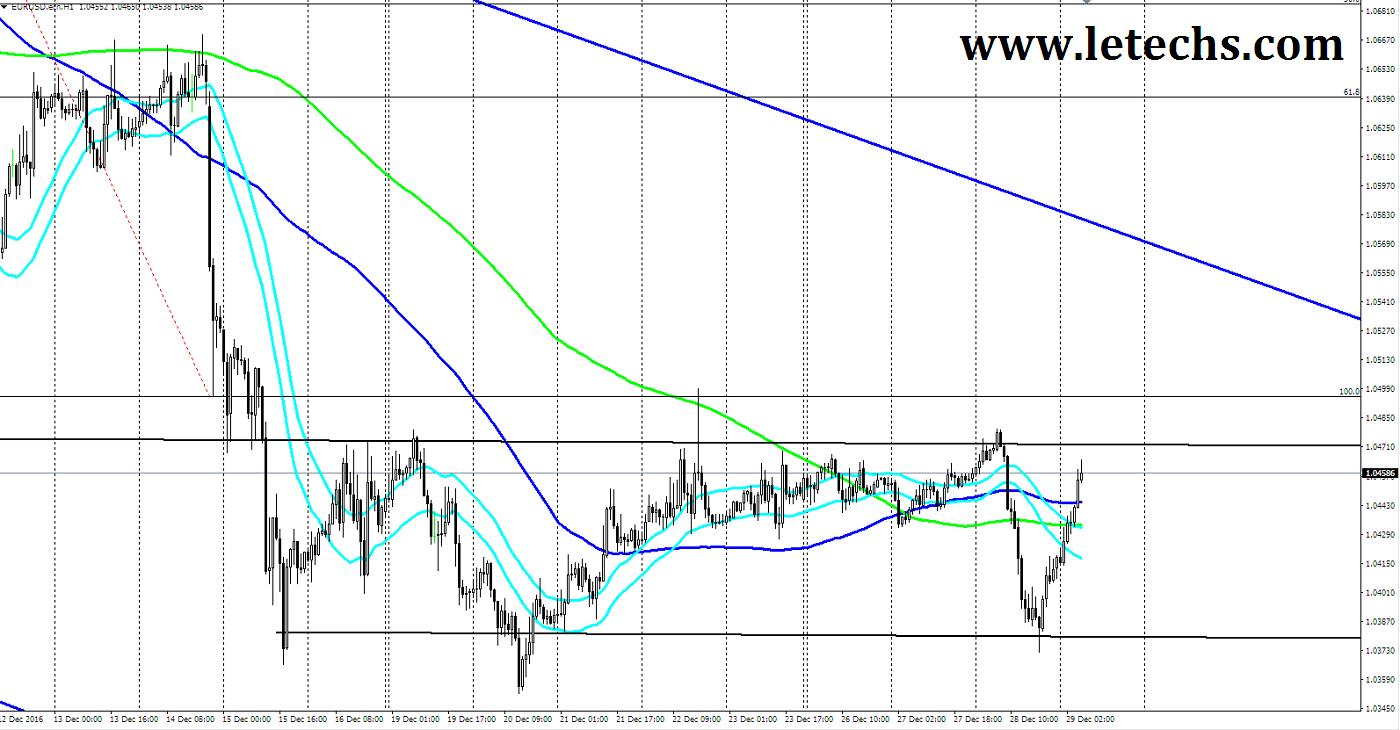

EURUSD

The dollar builds up across the board on yesterday. The dollar is tough on the back of the latest US positive data, Fed's plans to hike the rate next year & Trump’s assurance to rise fiscal spending to renew the US economic growth. The pair wiped out its fresh gains on last day. A recent bout of selling drives the euro to the mark levels at 1.045 in the previous European trades. After breaking the level sellers take a breath gathering vapor to force the value lower. Bears complete their gains in the US session when the pair smashed under 1.040 levels.

The value broke all the moving averages downside in the 1Hr chart. The 50 & 100-EMAs are turning downwards although the 200-EMA is unmoving direction north in the same time frame. The resistance finds in 1.0400 levels, the support comes in 1.0350 levels. MACD stayed at the centerline. RSI left the neutral zone & advanced south which signs the current downside position.

GBPUSD

Improved fears of a tough Brexit joined with the latest UK's data of Mortgage Approvals came in negative weighed on the pound. An attempt to regain at 1.23 levels lost. The price bounces from the level & moved south. Weakness risk remains high currently as the dollar is a focus for fresh buying interest across the board. In the meantime, the pair approached the quick support at 1.22 levels before the US session opening.

The price bounced from the 100-EMAs & moved south breaking the 50-EMAs on its path downwards in the 1Hr chart. The moving averages handled their bearish slope in the same time frame. The resistance lies at 1.2300 levels; the support seems at 1.2200 levels. MACD stayed at the same level which signs the strength of bears. The RSI indicator stands within the oversold areas.

USDJPY

The dollar strengthened against the yen on the rear of the blended data from Japan. Industrial Production grew less than it was anticipated. On the further side Retail Trade numbers beat all investor’s forecasts. The dollar bounces back from its latest low at 117.00 levels & slowly trended upwards on last day. A new buying interest around the greenback promotes the pair sending it to latest multi-month highs.

In the 1Hr chart the value cracks the 50-EMA upside directions. The 50, 100 & 200 EMAs kept directing higher. The resistance appears in 118.00 levels, the support stays in 117.00 levels. MACD was at the neutral in position. RSI left the neutral region & headed north which signs the upward momentum now.

XAUUSD

The yellow metal remained below the pressure against the US dollar on yesterday. Still, trades were less volatile among the New-year holidays. The metal traded over the 1140 levels on last day. Buyers, yet, lost to keep control over the market which twisted negative in the European session. Sellers sent the pair downside through 1140 levels & blocked at the mark levels of 1136. The value tested the 50-EMAs in the 1Hr time frame. The 50 & 100-EMAs intersect the 200-EMA upwards in the 1Hr chart. The resistance exists at 1140 levels, the support stands at 1130 levels. Indicator MACD traded to the upwards. RSI Oscillator left the overvalued areas.