22

Dec

Daily Technical Analysis on 22 December 2016

Today’s Technical Pairs: EURUSD, GBPUSD, USDJPY, & XAUUSD.

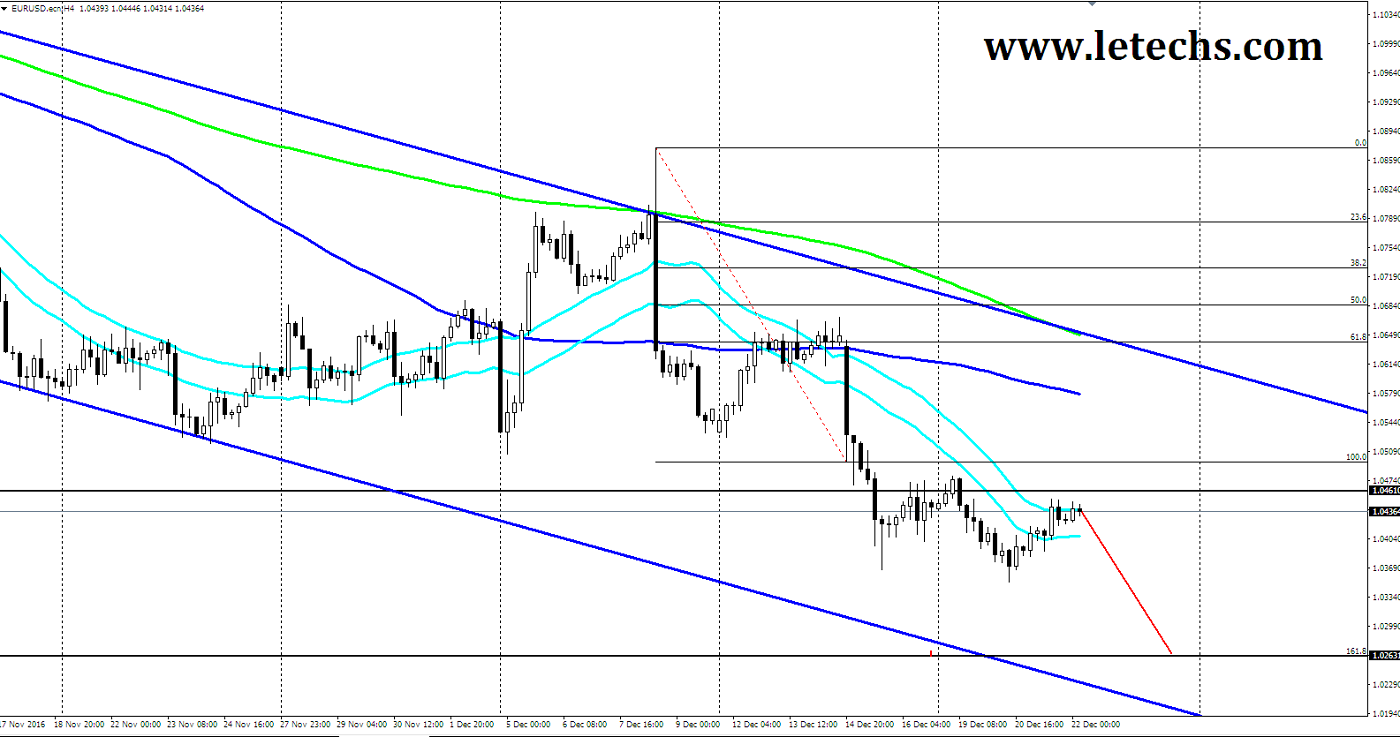

EURUSD

There were no significant events on the calendar in the Euro-zone on yesterday. Markets are preparing for the next holidays. The only reports that were worth our notice came in the US–Existing Home Sales. The risk-on sentiment stared to the side & the dollar retreated from its latest highs. The dollar retracement allows the euro buyers a chance to wipe out few losses. Still, the euro was adept to turn around its slight losses on last day. Following a short struggle around 1.04 levels buyers won a little position & forced the value to 1.045 levels.

The price tested the 50 & the 100 EMAs in the 1Hr chart. The 50 & 100 EMAs shows to be a solid barrier to crack at once. The price slowed down just about the moving averages and remained there till the US hours opening. The resistance finds in 1.045 levels, the support comes in 1.04 levels. MACD grew which hints the seller’s spot fading. RSI indicator stands within the oversold region.

GBPUSD

The pound bordered lower on previous day among negative Public sector net borrowing. As well, the current decline should be credited to broad dollar's strength. The sterling sustained hovering around the 1.23 levels, with a clearly bearish sentiment. The pair experienced a few downside instability post-European session open. Still, a bearish sentiment did not have legs, after posting a daily low at 1.2317 levels the currency pair twisted around & upturned all its daily losses.

The 4Hr chart showed that the value sustained rising well under the moving averages. The 50-EMA intersected the 100-EMA downside & surrounded the 200-EMAs in the same time frame. The 100 and the 200 EMAs stand neutral in position. The resistance lies at 1.24 levels, the support stays at 1.23 levels. MACD is at the same level which signs sell signal. The RSI indicator stayed within the oversold region.

USDJPY

Kuroda's remark confident the yen selling in addition to the discrepancy between US & Japan interest rate. The current correction can be credited to the broad dollar weakening attached with some profit taking earlier than Christmas holidays. The overall viewpoint stayed bullish on yesterday. The US dollar retreated from its latest high at 118 levels & reached the 117 levels at the last day’s trades.

The value smashed the 100 EMA & 50 EMAs in the 1Hr chart. The 200 EMA directed higher although the 50 & 100 EMAs were horizontal in the 1Hr time frame. The resistance seems at 118 levels, the support appears at 117 levels. MACD declined which supports the buyer’s positions reducing. Indicator RSI left the overvalued zone.

XAUUSD

The yellow metal traded around 11 month low lasting under pressure among a solid dollar & new expectations around latest Fed rate hikes next year. The medium term downtrend still perseveres in the market. We do not observe signals of a solid recovery for currently. Still, the metal handled to re-growth Tuesday's losses earlier day. Buyers stirred prices from 1125 - 1135 where they clogged & comprehensive its consolidation on top of new low at 1122 levels.

The value tested the 50 & 100 EMAs in the 1Hr chart. The 50 EMA intersects 100 EMAs downside in the same time frame. The 50 & 100 EMA remains neutral while 200 EMA directs much lower. The resistance exists in 1140 levels; the support stays in 1130 levels. Indicator MACD grew which supports the sellers’ spot weakening. RSI indicator held within the oversold areas & headed southwards currently.