16

Dec

Daily Technical Analysis on 16th December 2016

Today’s Technical Pairs: EURUSD, GBPUSD, USDJPY, & XAUUSD.

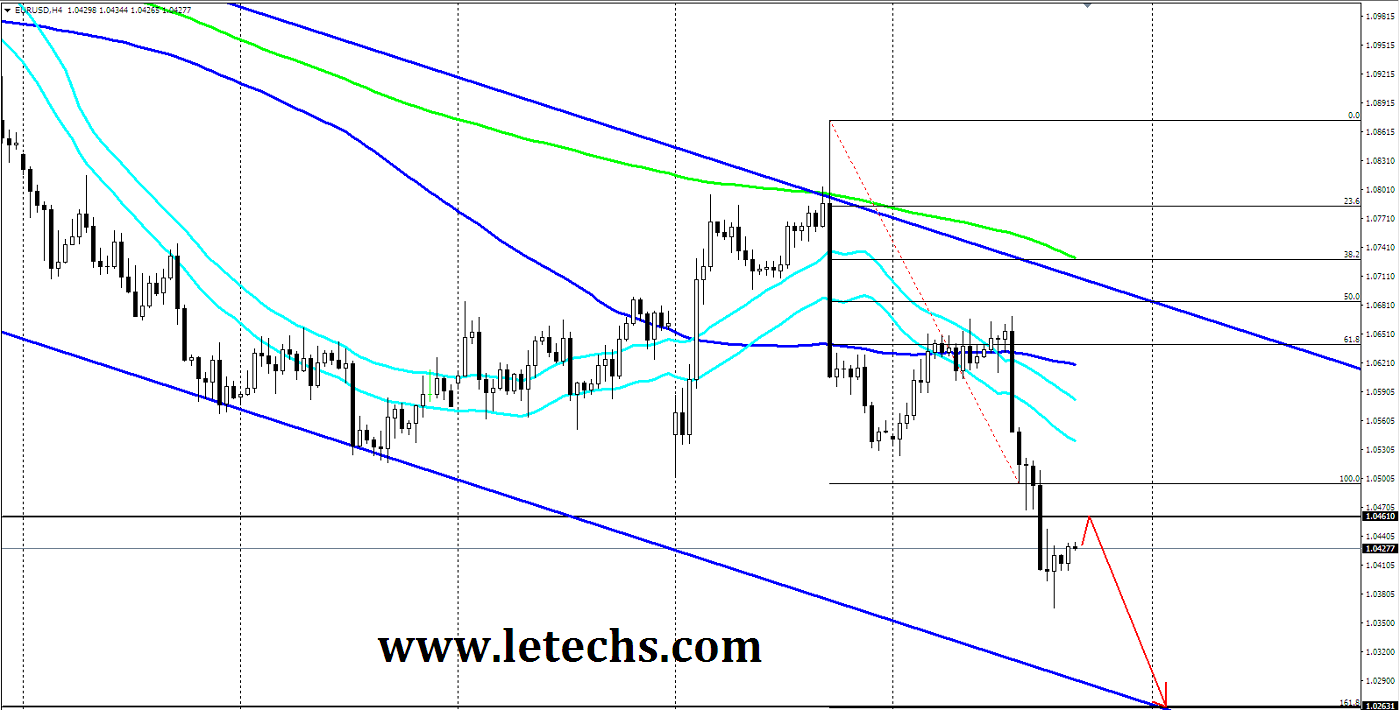

EURUSD

The euro little bit growth in early trades among positive Euro-zone Manufacturing PMI publishes. Still, a solid dollar did not give the primary currency a chance to region. A latest selling interest sent buyers hit. The euro disregarded oversold conditions on daily revises and sustained moving much lower across the conditions of a US dollar increase. The value remained a while just about 1.05 levels during the Asian session. The pair features further downwards pressure & stirred lower post-European session open. Sellers smashed 1.05 levels & tested 1.044 levels in the mid-European hours.

The price rebound 50 EMAs downside in the 4Hr chart. The value handled its bearish tone in the same chart. The euro drive away from the moving averages which all directed lower. The resistance finds in 1.0452 levels, the support comes in 1.04 levels. The MACD histogram reduced which hints the seller’s strength. RSI indicator was holding close to the oversold area, favoring a latest movement lower.

GBPUSD

The pound unnoticed UK's Retail Sales & made lower in the yearly trades. BoE's members commonly voted to run off interest-rates & QE program unaffected. The bearish outlooks prevailed on yesterday. Sellers extended their growth after a near pause around 1.2500 levels. A converted selling pressure helps them to crack the level & the upward trend line in the mid-European hours. The pair gone the upward channel & made lower bearing towards 1.2400 levels before the US session opening.

The value smashed the 50 & the 100 EMAs downwards & tested the 200 EMA in the 4Hr chart. The 100 & the 200 EMAs handled their bullish slope although the 50 EMAs turned lower. The resistance lies at 1.25 levels, the support appears at 1.24 levels. MACD moves into the negative zone. The RSI indicator stayed within the oversold region.

USDJPY

The Dollar effectively outperformed the yen following the Fed hiked its rates on 14th December. The pair maintained its buy tone on last day. Buyers handled to mount over the 117 levels reconfirming the 4-week up-trend. Following a short volatility in the yearly trade bulls forced the value higher & smashed at 118 levels in the mid-European session. Buyers resist consolidating above the level the second session of the day.

In the 4Hr chart the price sustained developing well over the moving averages. The resistance remains in 118 levels, the support stays in 117 levels. Indicator MACD histogram grew which hints buyer’s power. RSI indicator stands within the overvalued area.

XAUUSD

The yellow metal go down to its lowest in more than Ten-months on predictable reaction following US rate hike & Fed’s plans to hike rates 3 times in upcoming year. The bearish market structure stayed in place on last day. Following a brief pause around 114 levels a latest bout of selling force drives the metal to new lows.

The price sustained developing well under the moving averages in the 4Hr charts. The moving averages directed much down in the same time frame. The resistance levels will be at 1141, the support levels will be at 1131. MACD reduced which confirms the potency of sellers. RSI oscillator held within the oversold region.