04

Nov

Daily Technical Analysis on 4th November 2016

Today’s Technical Pairs: EURUSD, GBPUSD, USDJPY & XAUUSD.

EURUSD

The dollar was adept to reverse its few losses on yesterday. The dollar strengthened due to profit taking, the pair sharp drop and decrease of election concerns. The trend is objectively bullish as buyers have the market control now. The pair remained in an ascending channel on last day, hovering around 1.1100 levels in the European session. The EURUSD became little bit bearish in post-European open when the value retreated from the fresh highs. Sellers forced the euro under 1.1100 levels trying to recover control. The pair edged lower and surrounded the level of 1.1050 at the start of the US session.

The moving averages are twisting upside in the 4HR chart. The resistance comes in 1.1100 levels, the support lies in 1.1050 levels. MACD is in the positive zone decreased which hints the buyer’s spot weakening. Indicator RSI is within the overbought region.

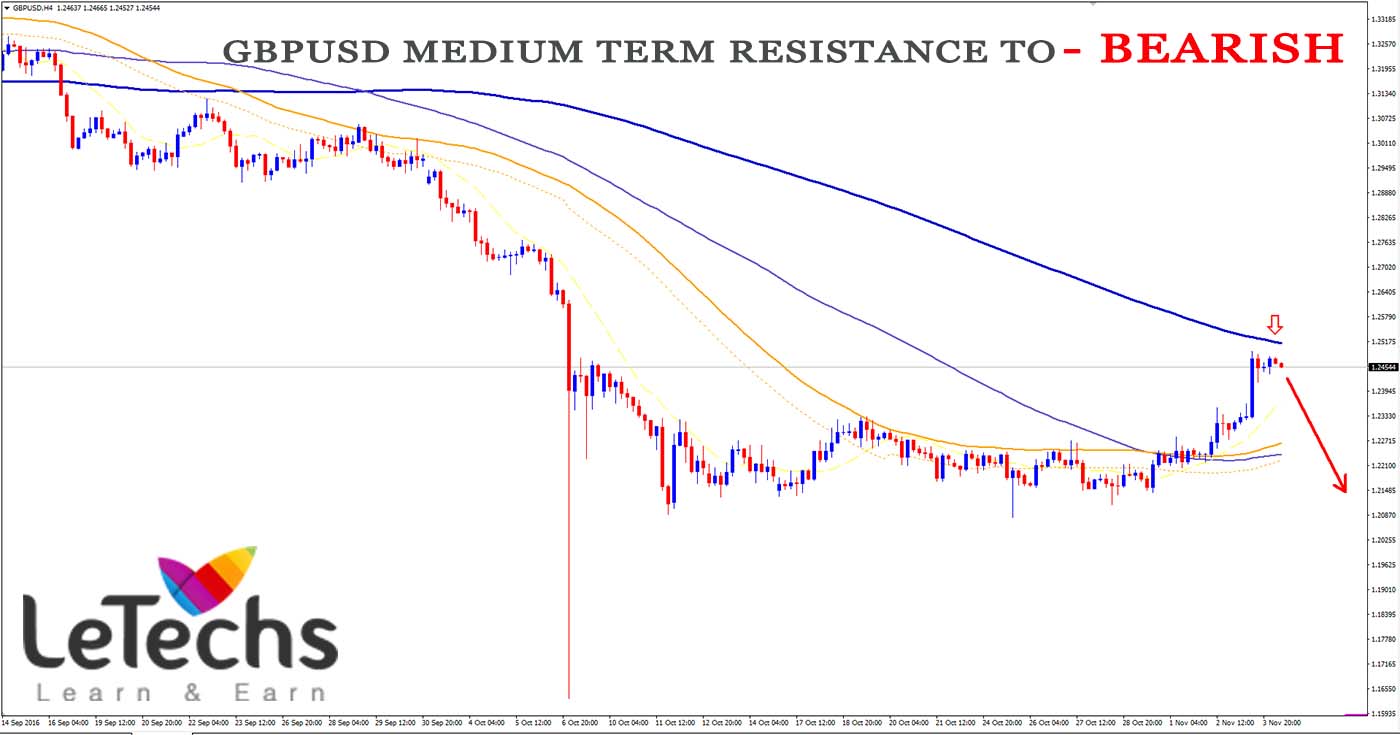

GBPUSD

A good forecast of UK’s Services PMI promoted the pound on yesterday. End of the day sterling extended its rally when the BoE kept its rates on hold. The pair unlocked on a positive note and stayed in bulls' hands throughout the day. The pound was in the mid of another bullish development throughout the European session. Traders pushed the pound higher; the pair currently seems to be heading towards its quick resistance close to the level of 1.2500. After breaking the 100-EMAs the price sustained leads north towards the 200-EMAs and touched the moving before the US session opening. The resistance seen at 1.2500, the support finds at 1.2400 levels. MACD is in the positive zone histogram grew which indicates the buyer’s growth. RSI is within the overbought region. If the bullish prospect remains intact the pair may extend its recovery towards 1.2500 levels.

USDJPY

The yen was has been in an insistence this week as safe-haven assets. A weaker dollar promoted the demand for the Japanese currency. The pair remained close to an oversold critical line. The pair is yet in a near-term descending channel. The price little bit recovered in the Asian session and widen its growth throughout the European session on yesterday. The ongoing recovery might be attributed to few profits taking from sellers following the recent sharp decline. Buyers forced the price towards its quick resistance level of 103.50, reversing minor part of its fresh losses.

The USDJPY pair surrounded the 200-EMAs before the US opening. The 200-EMA is slowly turning downside, although the 50 and 100 EMAs are already driving lower. The resistance finds in 103.50 levels, the support stays in 103.00 levels. MACD is in the negative zone decreased which hints the seller’s strength. RSI oscillator is within the oversold region.

XAUUSD

The yellow metal prices remained mostly positive following the Fed’s decision to keep rates unmodified. The volatile on uncertainty over the US election outcome keeps weighing on the dollar. Gold values surged on last day morning and were adept to smash the resistance level of 1300 when the price suddenly twisted around and sharply fell. The metal moved towards 1290 levels and cracks the level in the mid of the European session. After breaking the level values moved lower and tested the mark level of 1285.

The XAUUSD approached the neutral 200-EMAs in the 4HR chart. The 50 EMA is crossing the 100 EMAs upwards, both lines are moving north. The resistance remains at 1300 levels, the support stands at 1290 levels. MACD is in the positive level decreased which indicates the buyer’s spot weakening. RSI left the overbought region and drive downwards. If the bearish trend prevails the pair will go towards 1280 levels.