12

Sep

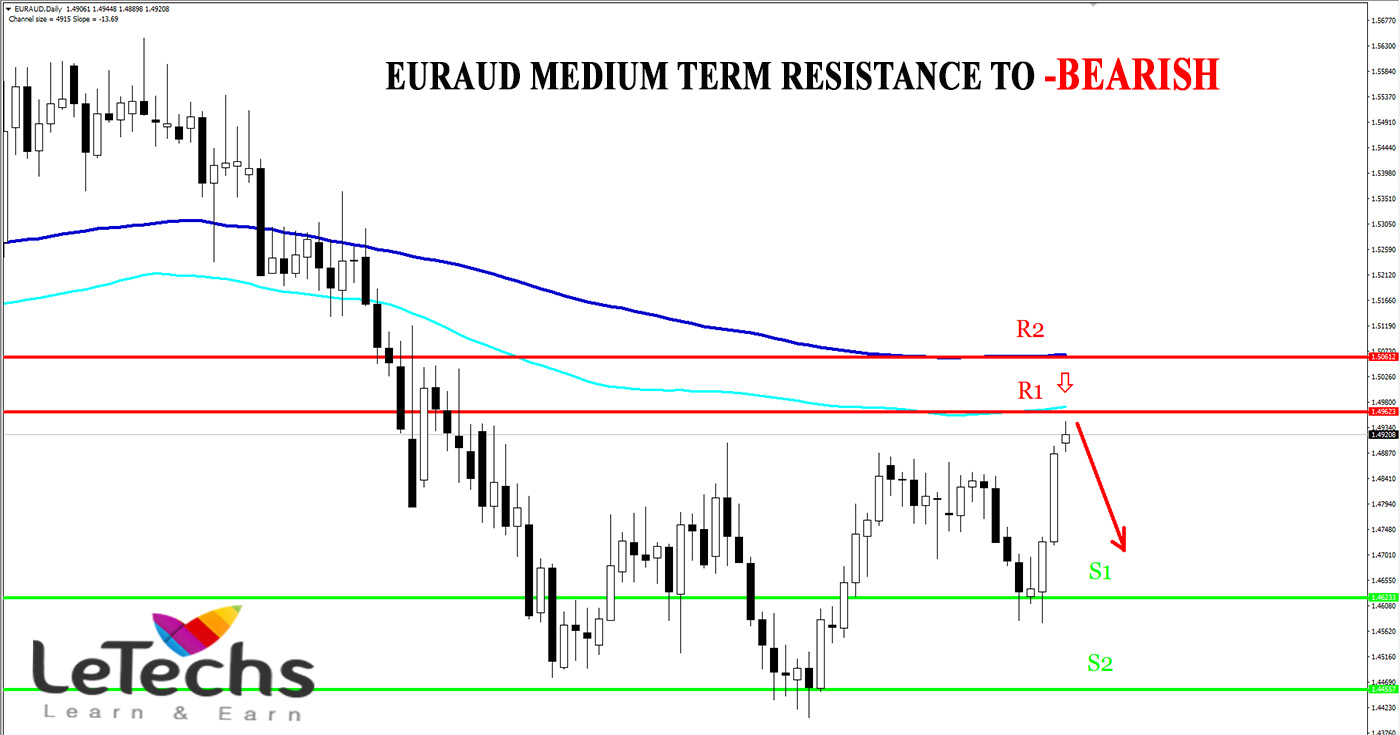

Forex Weekly Technical Forecasts on 12-16 September 2016

This Week’s Technical Pairs: EURUSD, GBPUSD, AUDUSD, & USDJPY

EURUSD

EURUSD made an act to the upside but might not go too long as the dovish tone still overcome. It has once more public appearance this week. A significant German survey & final inflation figures remains out this week. The ECB left all policy measures unmodified and did not give any details about modification to the span or the logistics of the QE program. Against the absence of details, Draghi’s statement was dovish, and the euro was unable to move higher. It became in a week that looks the greenback on the rear foot, with yet another depressed figure.

Euro vs. dollar started the week below the 1.1190 levels. After that it leads and even topped 1.13 levels ahead grinding back down. The European Central Bank is too long from achieving its goals and keeping the force on the euro is crucial to getting nearly to higher inflation. Acting now might be premature, but giving a chance of an upcoming move might serve to tilt to the euro down. Even if the Fed is shaky regarding the timing of the upcoming move, the direction is very sure of a rate hike. EURUSD remains Bearish.

GBPUSD

GBPUSD mounted to nine-week highs but was helpless to consolidate and place tiny losses previous week. The pair finished the week at 1.3262 levels. There are nine key events for GBPUSD this week’ schedule. The ISM Non-Manufacturing PMI falls off to 51.4 points, its worst results since 2010. In the UK, Services PMI amazed by pointing to expansion, while Manufacturing Production was depressed, with reduce of 0.9 percent.

The pair unlocked the week at 1.3293 levels and reached a high of 1.3444 levels. After that reversed directions and fell to a low of 1.3238 levels, as support held firm at 1.3219 levels. The pair finished at 1.3262 levels. British figures have been usually solid in the Q3, despite concern of an economic backlash from the Brexit results. If the good news will be constant, In the US, there is a reasonable possibility that the Fed will press the rate trigger in upcoming months, but a final conclusion will depend on key US figures. GBPUSD stands Neutral.

AUDUSD

AUDUSD moved over the 0.77 line earlier week, but was helpless to consolidate at these levels. The pair closed the week with tiny losses, finishing at 0.7539 levels. This week’s major event is Employment Change. The ISM Non-Manufacturing PMI falls off to 51.4 points, its worst looks since 2010. The Australian dollar briefly improved ground following the RBA handled the benchmark interest rate. Australian GDP widened 0.5 percent, nearly the forecast of 0.6 percent.

The pair unlocked the week at 0.7564 levels. Suddenly dropped to a low of 0.7532 levels previously in the week and then placed solid gains, mounting to 0.7732 levels, testing the support levels at 0.7692. AUDUSD closed the week with sharp losses at 0.7539 levels. Despite few soft Q3 data wipeout the US, there is a possibility chance that the Fed will raise rates in this yearend, so sentiment towards the greenback stays bullish. AUDUSD remains Bearish.

USDJPY

The Japanese yen bounce back previous week, as the pair dropped 140 points, ended at 102.51 levels. There are only 3 main events this week. In the US, a key services report depressed, as ISM Non-Manufacturing PMI falls off to 51.4 points, its worst looks since 2010. There was some positive news from the Japanese economy, as Final GDP improved 0.2 percent in 2nd Quarter over the forecast of 0.0 percent.

The pair unlocked the week at 103.92 levels & rapidly reached a high of 104.05 levels, as resistance held firm at 104.25 levels. After that reversed directions & fell to a low of 101.13 levels, testing the support levels at 101.51 ahead bouncing back higher. The pair finished the week at 102.51 levels. The BoJ has stands on the sidelines, for months, but might adopt additional easing measures at upcoming week’s policy meeting. The US is headed in the reversed direction, with the Fed hinting that it might take action and raise rates ahead this December. USDJPY stays Bullish.