25

Aug

Daily Technical Analysis on 25 August 2016

Today’s Technical Pairs: EURUSD, AUDUSD, USDJPY.

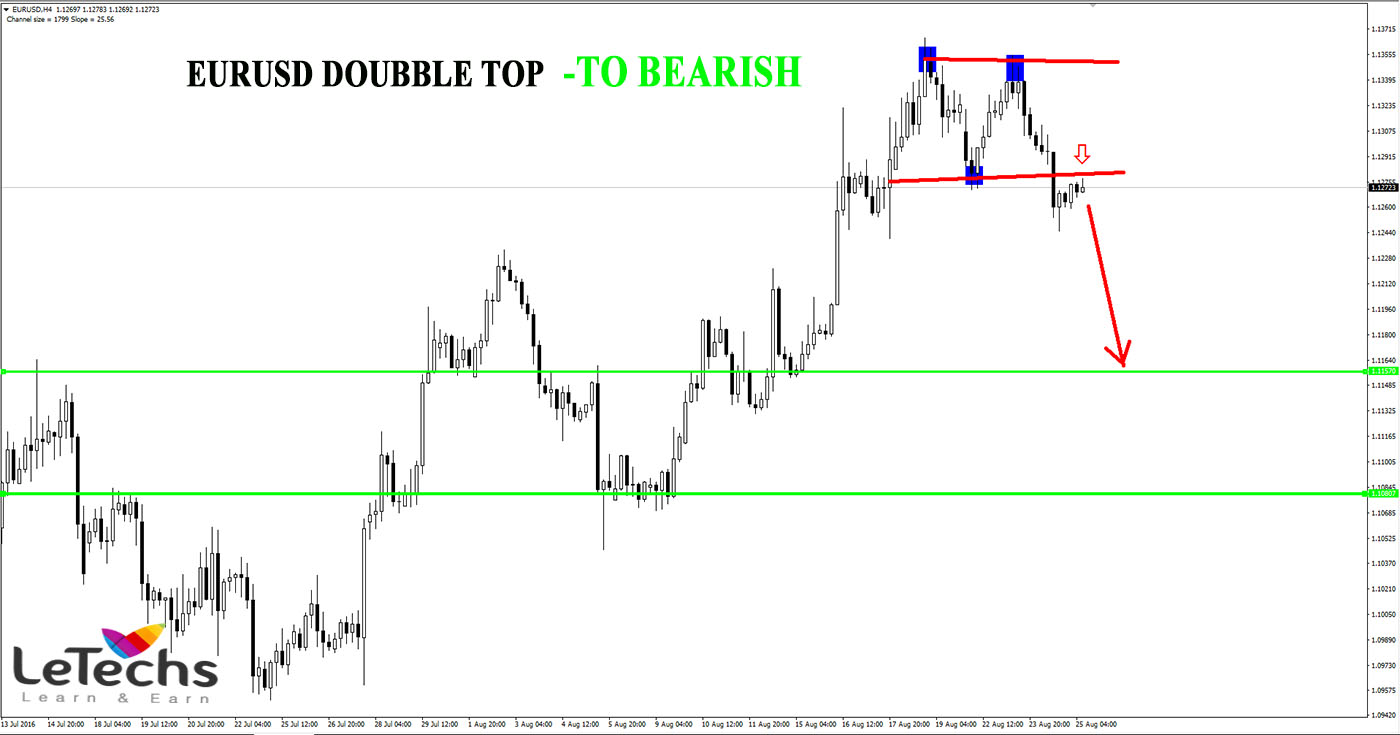

EURUSD

The result of Wednesday’s major economic data publishes such as US Crude Oil & Existing Home Sales did not cut off the strength of US dollar. This is for the reason of a solid prospect of rate hike by this September. As a conclusion bulk of traders anticipates a hawkish statement will be published tomorrow. The pair was unable to develop over the significant level of 1.1320.

Today, the significant economic data scheduled are US Core Durable Goods Orders & US weekly Unemployment Claims. The US Core Durable Goods Orders measures the modification in the net value of fresh purchase orders posted with manufacturers for durable goods, ignoring transportation items. Further, the US Unemployment Claims measures the figure of individuals who entered for unemployment insurance for the 1st time throughout the last week.

In the Asian session, EURUSD started to fall, thus breaking through and consolidating under the significant level of 1.1320. The pair is driving towards the 1.1245 levels. We predict the pair dropping to slow down close to the support level of 1.1245. However, in the rites of the European currency the depressing the market place might fall to the key support level at the level of 1.1195-1.1210 region.

AUDUSD

On a Daily chart, the pair still shows an intact growing wedge pattern but the downside force is tried to smash the lower range trend lines. The market value was comparatively unmodified as last day’s daily chart created a Doji candle where the starting & ending differs by only 2pips. On the 1HR chart Moving Averages of 20 & 100 are plotted over the candle which hits divergence.

Today, the significant economic data scheduled are US Core Durable Goods Orders & weekly Unemployment Claims, a key deviation from anticipation might results in volatile market movements. If the actual numbers are better than expects, we might see the value jump down to 0.7585 levels. But if the result is lesser than forecast, we might see the value go towards 0.7630 levels.

USDJPY

USDJPY pair initially drop down throughout the all session on yesterday, but we twist right back over as the 100 level constantly to offer support. The market is extending attention to the case that there is a chunk of a psychological levels in this pair at that very huge figures, & that the BoJ might get involved. We consider that whenever this market place pulls back, buyers will come back but I don’t fairly think that there’s can be suitable momentum to drive this market any high distances in the short-term. So we believe that buying short-term rebound are regarding the only chances will present themselves in the upcoming months.

Technically, the bullish trend is yet the predominant momentum. MACD is fixed over the line & Moving Averages of 20 and 100 are under the candles. It advises the bull is in control until currently. It is always a well practice to train for two opposing outlooks before trading.