25

Jul

Weekly Forex Technical Analysis on 25 to 29 July 2016

Technical Pairs: EURUSD, GBPUSD, AUDUSD & USDJPY

EURUSD

EURUSD pairs had finite movement, but fairly near on lower ground. Will it constant lower? A very busy schedule has GDP & inflation remaining out further the Bank Stress Tests.

The ECB left policy unmodified & left unlock the door for some alterations in its policy. Still, there was no clear pre-disclosure of any action in September. Brexit doesn’t looks to be high catastrophe in the view of Draghi, but risks yet stands to the downside. Over all, EURUSD stays steady. The German ZEW economic sentiment moved negative & affects elevated volatile due to Brexit. In the US, housing numbers become fine & sustained the positive trend. Draghi putting pressure on the euro constantly. EURUSD remains in Bearish scenario.

GBPUSD

GBPUSD pair posted razor-sharp losses previous week, falling 120 pips as Brexit existence bit. The pair clogged just over the 1.31 level. This week’s major event is Preliminary GDP. The biggest blast to the pound came with the key release of PMIs: they revealed the Brexit impact at its worst, with services PMI shocking buried into contraction zone. Unemployment Claims stands stable and easily taken out the forecast. In the UK, CPI grows to 0.5 percent, taken out the estimation. British employment figures were solid, as Claimant Count Change placed a negligible gain & Average Earnings Index grew to 2.3 percent, a seven-month high. In the US, construction figures were steady, as Building Permits & Housing Starts meet anticipations.

GBPUSD pair unlocked the week at the level of 1.3229 & rapidly reached a high of 1.3315. The pair fell to a low of 1.3062 levels, testing the support levels at 1.3064 mentioned previous week. Now GBPUSD blocked the week at 1.3104 levels. We begin with resistance levels at 1.3514. This level has held tough since late June. The next levels will be1.3426. 1.3276 has boost in resistance after strong losses by the pair. A weak resistance line is in 1.3142. An immediate support level is at 1.3064. 1.2902 might be the next levels. Since 1985 this is the lowest level 1.2790 & it is the final line at present. GBPUSD remains Bearish Scenario.

AUDUSD

AUDUSD place some sharp losses earlier week, cut down 150 points. This week’s key event is CPI. In the US, housing figures were stable & sustained the positive trend. Unemployment Claims stands stable & easily taken out the forecast. In Australia, the RBA minutes hinted that the bank was ready to lower interest rates if required, which set pressure on the Aussie.

AUDUSD unlocked the week at 0.7589 & suddenly reached a high of 0.7606. The pair then twisted directions & cut down to a low of 0.7440 late in the week, as support held hard at 0.7438 mentioned last week. The RBA might lower rates if next week’s CPI release is uncertain. With a Fed rate raise in the second half a modest possibility, monetary discrepancy supports the US dollar. AUDUSD remains Bearish scenario.

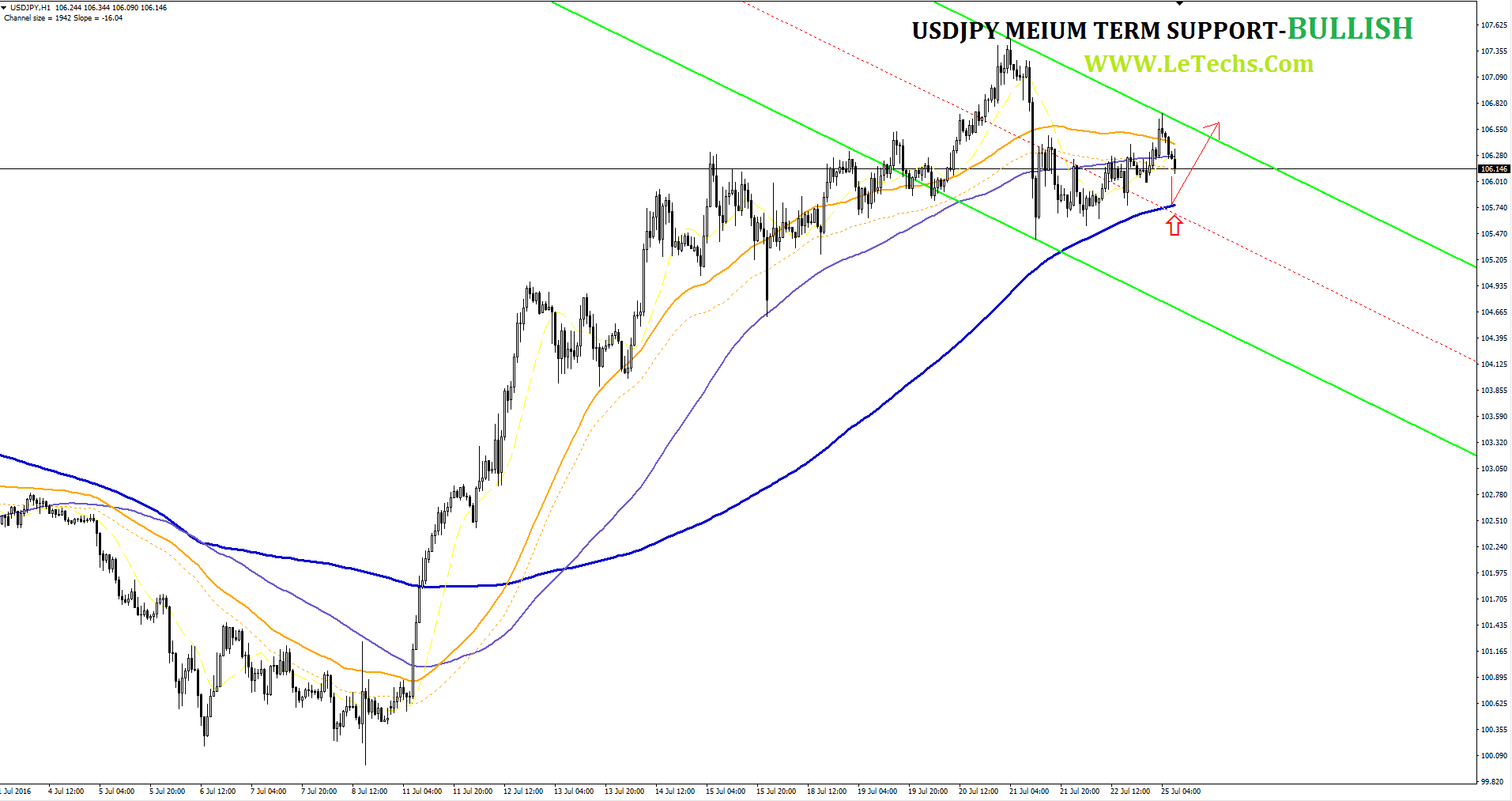

USDJPY

USDJPY placed modest gains previous week & closed just under the 106 level. This week’s JPY highlights are Tokyo Core CPI, Retail Sales & the BoJ Monetary Policy Statement. There were no significant Japanese releases previous week, but the pair still showed some uncertainity as Prime Minister Abe is anticipated to set together an important spending package. The yen set gains following BoJ Governor Haruhiko Kuroda ignored the idea of using helicopter money to conflict collapse. In the US, construction figures were stable, as Building Permits &Housing Starts meet anticipations.

USDJPY pair unlocked the week at 105.39 & rapidly reached a low of 105.25 levels. The pair mounted to a high of 107.49, testing the resistance levels at 107.39 mentioned previous week. The pair was helpless to consolidate at these levels & clogged the week at 105.95 levels. USDJPY remains Bullish scenario.