11

Jul

Weekly Forex Technical Analysis on 11 to 15 July 2016

Technical Pairs: EURUSD, GBPUSD, AUDUSD & USDJPY

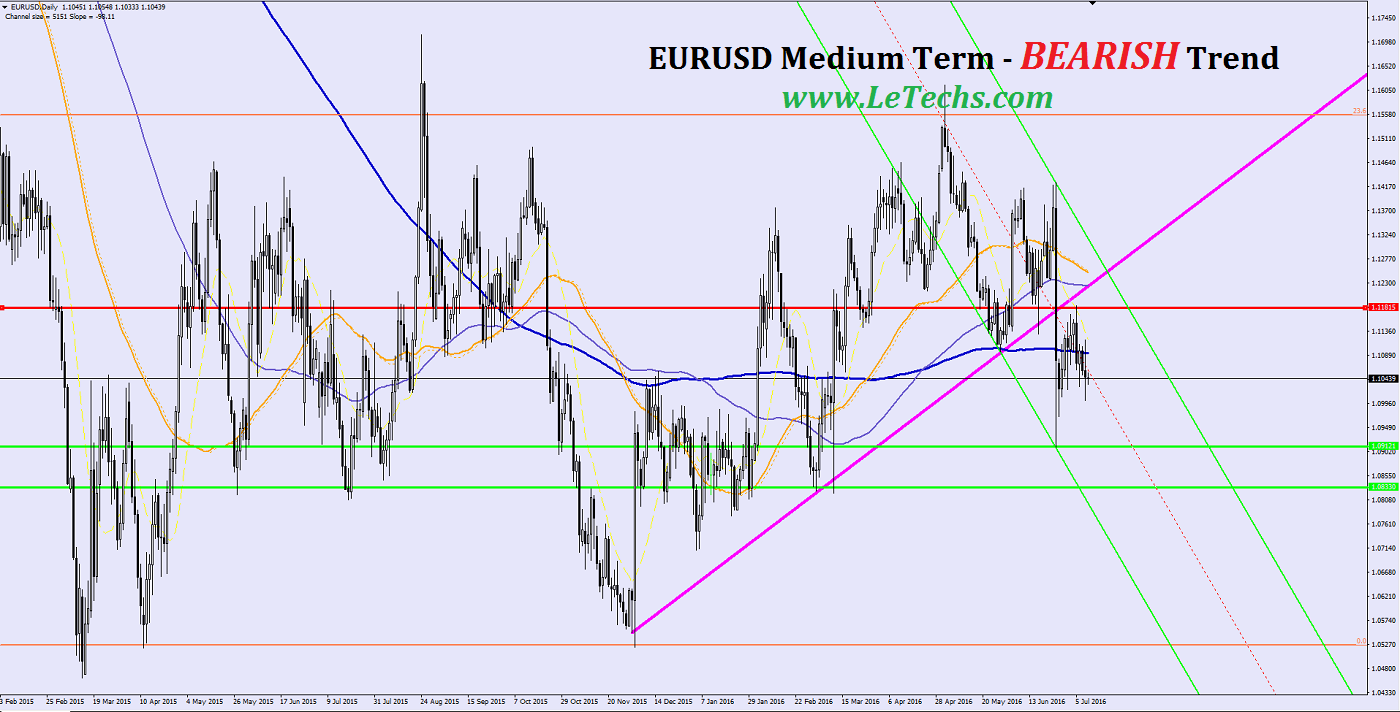

EURUSD

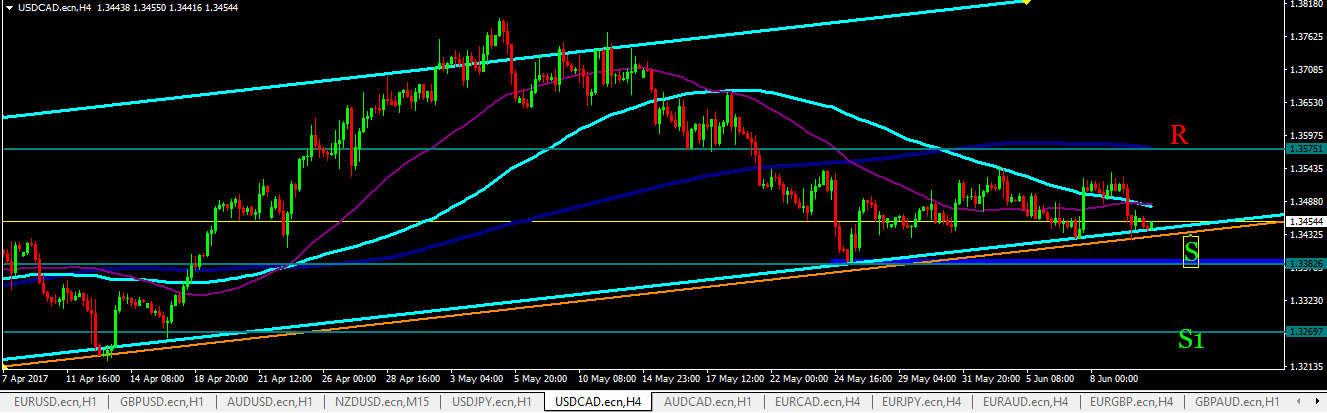

EURUSD hurt in a fresh round of Brexit-related selling but the shows seem limited. Will the fall further now? Inflation rates emerged. After quite calm in markets, reality starts biting in on Brexit. Apart from the departure freeze in few UK property funds, the shock on the euro has been by virtue of bond yields which are tumbling depressed. By the intention of more and more capitals providing unfavorable yield, the ECB has fewer capitals to buy in its 80 billion euro QE schedule. This plans stress for Draghi. Services PMIs in the euro-zone yet look fine but they do not imply to reflect the post-Brexit globe. In Germany, factory orders do paint a gloomier image. In the US, the NFP appears out better than anticipated & briefly helped the greenback. EURUSD might not smash to a higher floor but fairly slipped below the 1.1070 levels.

The post-Brexit impacts are likely to sustain weighing on the euro. In further, the less bond yields in the euro-zone might pressure the ECB to scramble to additional measures as the pool of qualified capitals to buy. EURUSD still Bearish.

GBPUSD

It was one poorer outing for the pound, as GBPUSD drift almost 350 points earlier week. The pair was blocked at 1.2940 levels. The pound drives after Mark Carney BoE Governor hinted solidly that the BoE would lesser interest rates in the upcoming summer. The Past in the US, Federal Reserve minutes were warned & a rate rise remains unlikely. US employment figures were solid in the final of the week.

GBPUSD unlocked the week at 1.3282 & rapidly climbed a high of 1.3341 levels, as resistance remains at 1.3426. The pair then fell down razor sharp, reaching a low of 1.2778. GBPUSD then recurred and mounted to 1.2938 levels. 1.3426 held hard as the pound begins the week with gains. By the intention of Brexit aftershocks sustaining to rattle the UK and the markets predicting a rate cut from the BOE, the rigid pound might have another worse week. GBPUSD stays Bearish.

NZDUSD

NZDUSD pair firstly cut down throughout the course of the week, but twisted back to create a massive green candle, the market place looks ready to crack out & sustain to go much deeper.NZDUSD remains Bearish.

AUDUSD

AUDUSD had a great week, mounting close to 100 points. This week’s key event is Employment Change. The RBA didn’t cause a change, leaving the benchmark rate at 1.75 percent. In the US, the Fed minutes were warned and a rate rise stays unlikely. US employment figures were solid in the final of the week, but the US dollar didn’t earn a drive.

AUDUSD unlocked the week at 0.7462 & reached a low of 0.7407 levels, support levels testing at 0.7334 for once again a straight week. The pair then modified their directions and mounted to a high of 0.7572 levels and blocked the week at 0.7556 levels.

In the US, monetary policy is not anticipated to be hawkish and a rate raise shows doubtful. The market place will have to deal with the fresh Brexit reality, & sustaining volatility in the markets might weigh on the Aussie. Overall AUD USD remains Neutral.

USDJPY

USDJPY chops down over 200 points previous week, shortly breaking under the symbolic 100 level. The pair clogged the week at 100.36 levels. For USDJPY there are 7 significant events this week.

The Brexit impact has bolstered the yen as jittery investors constant to flock to the safe-haven money. In the US, the Fed minutes were warned and a rate rise remains unlikely. US employment figures were solid in the final of the week, but the hard yen held its own across the greenback. USDJPY unlocked the week at 102.48 & suddenly reached a high of 102.80 levels. The pair then twisted his directions and fell down all the way to 99.98 levels, as support held tough at 99.71. The pair locked the week at 100.36 levels. The BoJ has no demand to adopt additional easing steps which would ledge the yen’s strength. As well, Brexit anxiety will likely sustain to bolster the refuge yen.