30

Jun

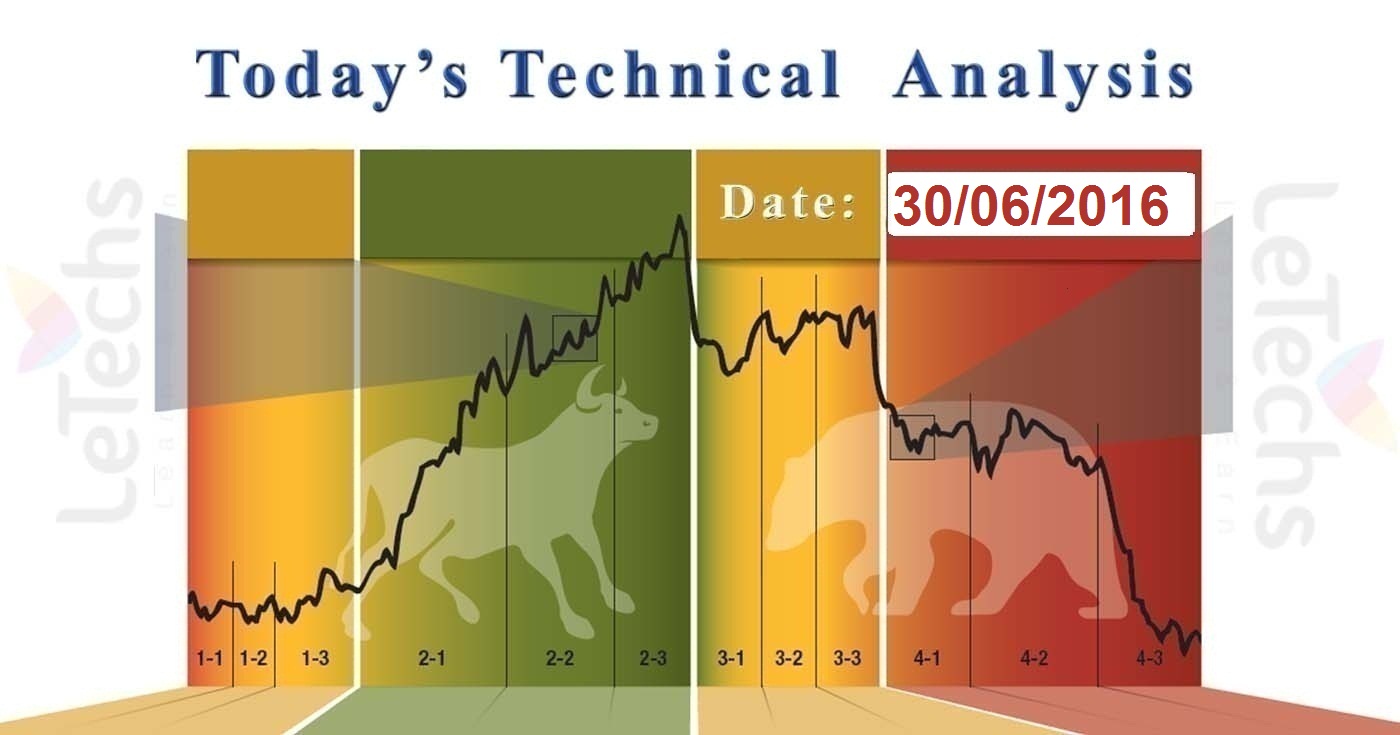

Daily Technical Analysis on 30June 2016

Technical Pairs: EURUSD, GBPUSD, USDJPY, Brent-Crude Oil, & XAUUSD.

EURUSD

The euro did not move its positions following Consumer Confidence news in the Euro-zone. At the mean time the ECB will not force with the addition monetary policy easing. The controller wants to see any confirmation that the Euro-zone economy slows down ahead it takes any process.

The euro sustained mounting upwards bit by bit. The instruments are stayed in a downside channel on the 4HR chart; the euro grew to its upper border. The pair was adept to rebound by 0.47 percent & put a fresh local high at 1.1130 levels. The resistance remains in 1.1130 levels, the support stands in 1.1000 levels.

MACD is in negative zone, the indicators will signs a Bullish signal although its histogram grows. RSI remain in neutral region; its growth from the oversold zones will be a buy signal. The price is under the Moving Averages of 50, 100 & 200 which are moving downsides, that is a sell signal. The 200-days moving average is a solid resistance for the euro which it reached on Wednesday. The pair might constant its growth if the euro smashes the level of 1.1130 where the 200-SMA reaches. Once we crack over the 1.1130 mark level, we think the next level will be 1.1200.

GBPUSD

On Yesterday, the pound rebound as the market sentiment sustained to stabilize following a shocking results of UK to depart the European Union. In the meantime, the leader of the Conservative Party & a candidate for Prime Minister Stephen Crabb ignored the possibility of next referendum about the Brexit.

The pound strongly recovered last day & was adept to gain about 1.12 percent throughout the day. The pair is tricky to near the gap it unlocked this week along. The resistance stands in 1.3500 levels, the support remains in 1.3300 levels.

MACD is in negative zone, the indicators will signs a Bullish signal although its histogram grows. RSI remain in neutral region; its growth from the oversold zones will be a buy signal. The price is under the Moving Averages of 50, 100 & 200 which are moving downsides, that is a sell signal. If the pound grows it will forward to 1.3700 levels to near the gap. Only a change under the strong support at the level of 1.3300 can build up sellers’ positions.

USDJPY

The rapid recovery of the yen disappears when the demand for the safe capitals dimmed. Previously, the Standard Chartered Bank clearly lowered its outlook for the pair at the final of the third quarter. The Bank acclaimed that the BoJ & the Ministry of Finance can widen their impetus measures to support the country economy following the Brexit.

The dollar tried to crack through 102.50 levels throughout the day following rolling back previous at the Asian session. The pair touched the same level where it blocked the day before – 102.80 levels. The resistance remains in 103.50 levels, the support stands in 102.50 levels.

MACD & RSI indicators are preserved. Even though MACD stayed in the negative region its histogram will grow, signing us a buy signal. If the indicator keeps forwarding north the growth of the pair will be constant. RSI is in the neutral zone. The indicator bounces back the oversold region that is a buy signal. USDJPY pair is under the Moving Averages of 50, 100 and 200 which are moving downside directions. The 50-days moving average is nearest resistance for the instrument. The pair is already oversold on the daily time frames & its recovering. If the USDJPY pair sustains growing it’s another stop might well be at 103.00 – 103.50 levels. A crack under 102.00 levels would unlock the path to 101.40.

Brent – Crude Oil

The crude oil futures sustained to rebound due to the rebate of oil stock in the US. At the mean time the dollar chop down when the market place decreased its expectations that the Fed would raise the rate in 2016. The raise of the dollar also commit to the demand for the Brent.

The oil quotations sustained its recovery & gained regarding 3.29 percent throughout the day. The value is trying to return to the upward directions. The Brent surrounds the 50.50 – 51.00 regions where it cut down a week ago. The resistance stands in 50.50 levels, the support stands in 49.50 levels.

MACD is in a positive zone that signs a buy signal. RSI kept grew following bounce from the oversold region. The Moving Averages of 50, 100 and 200 created a cross-over on the 4HR chart. The price smashes all of them; the 100-days moving average is a support for the futures at present. The price bounces back from the 50-days moving on the daily time frames. We advise to examine long positions with the first targets are 50.50. After fixing over the first target, the next level will become 51.50.

XAUUSD

On Yesterday, the gold eventually showed a growth when investors ignored any further rate raise of the Fed this year when UK decided to departs the European Union.

The yellow metal was in the green zone Wednesday. The value recovered & gained regarding 0.78 percent. The pair surrounds the resistance level of 1330. The resistance stands in 1330 levels, the support remains in 1300.

MACD is in the positive zone, if the MACD returns to reduce; the drop of the pair will be constant. RSI stayed close to the overbought region. If the signal line brings into the zone the growth will be sustained. In the outlook where the oscillator fell we will get a sell signal. The value is near to the 2 year high on the daily time frames. The value is over the Moving Averages & it directs upwards. The value is nearly in solid resistance level of 1330. If the price cracks it we anticipate the growth to 1360 levels.