23

Jun

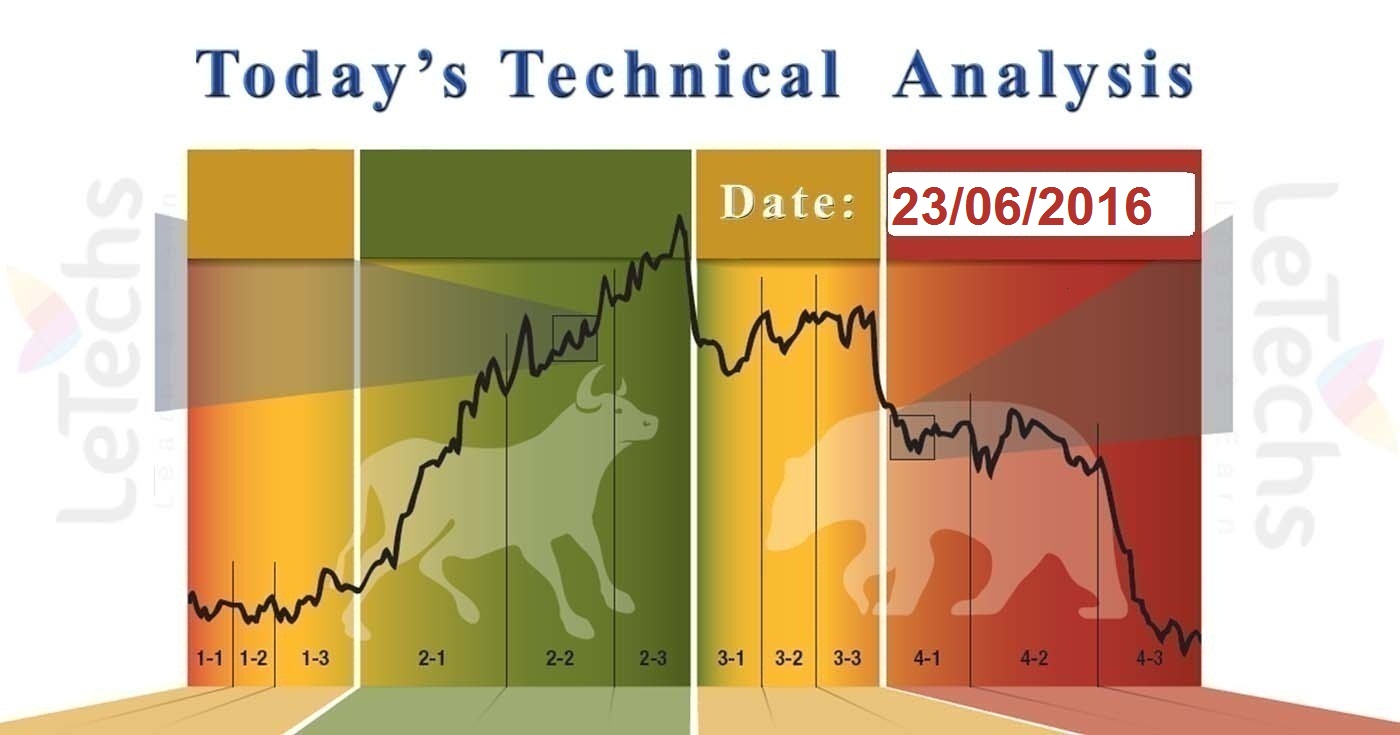

Daily Technical Analysis on 23 June 2016

GBPUSD - Polls have opened in a historic referendum on whether the UK should remain a member of the European Union or leave. An estimated 46,499,537 people are entitled to take part in the vote - a record number for a UK poll.

The UK will hold a referendum to decide whether it remains part of or exits the European Union. We have already seen an increase in market volatility ahead of the vote and expect this to continue in the weeks ahead. Whilst these market conditions will present many trading opportunities, you should be aware that they may also result in wider spreads and periods of reduced liquidity with increased probability of gap risk. Please make sure you are comfortable with the risk on the positions you are holding in light of the expected further market volatility.

The European Union Referendum in the UK Today is a very tight race with implications for not only the pound, but also the euro, the dollar, the yen & basically all markets. A decision to stay could trigger a big relief rally, a Fed hike & some comfort for the euro. A Brexit decision could devastate the pound, deal a blow to the euro and certainly support the safe haven yen and dollar.

On Yesterday, the dollar fell across all major currencies when the polls showed almost consistency between the supporters & opponents of the Brexit. The pound stayed at the same levels last day. All trades were among the mark levels of 1.4670 & 1.4760. GBPUSD pair spent the whole day bouncing from the channel boundary. The resistance remains in 1.4760 levels, the support remains in 1.4670 levels.

The value is over the Moving Averages of 50, 100 and 200 on the 4Hr time frames. The Moving Averages indicates upwards. All indicators are overbought levels. MACD decreased is in the positive area. If MACD reduces additional the pair will fall. RSI remained under the overbought level of 70. The oscillator will signs a sell signal until it remains under the overbought region. The pair is moving upwards. The bulls’ targets are 1.5000 levels. If the value falls it will go to 1.4400 levels.

Technical Pairs: GBPUSD, EURUSD, AUDUSD, Brent-Crude Oil, & XAUUSD.

EURUSD

Mario Draghi’s statement supported the euro. According to the European Central Bank Governor Mario Draghi, the ECB is ready to all emergency caused by the referendum in the UK. The pair showed a mix dynamics last day. The quotes will grow throughout the Asian & the European sessions & fell at the American one. EURUSD pair stayed in the descending channel. The resistance stands in 1.1300 levels, the support stands in 1.1250 levels.

MACD does not show a signal. If MACD brings into the negative zone there will be a sell signal. If the indicator turns in to the positive zone the signal will be bullish. RSI is in the neutral region. The Moving Averages of 50, 100 and 200 are parallel to one another. Its direction is horizontal. The value is over the Moving Averages. The potential reduce targets are two levels of support: 1.1250 & 1.1130 levels. The potential improve target level is the resistance of 1.1450 levels.

USDJPY

USDJPY the forecast of the International Monetary Fund, the Fed should obtain the balanced & temporary excess of the target level of inflation. That will cover the Fed from the additional economic weakness. The pair stayed in a downside channel. It spent the full day at the starting level. The resistance stands in 105.30, the support remains in 104.50 levels.

MACD is in closed the zero line. RSI remains in neutral zone showed no signal. USDJPY pair is under the Moving Averages of 50, 100 & 200 on the 4Hr time frames which are moving downsides. It might sustain the downward trend in the short term periods. The potential targets are 103.50 levels.

Brent – Crude Oil

The Brent oil futures will rise following an uncertain Weekly Crude Oil Stock report. However, the less Brent quotations reduced by the final of the day. The UK referendum is yet the focal point of the market attention. The oil quotations depleted last day. The quotes cut down from 51.23 to the level of 49.50. The resistance stands at 50.50 levels, the support stands at 49.50 levels.

RSI reduced from the overbought level of 70. If RSI stays falling that will be a sell signal. The Brent smashes the 100-SMA and clogged at the 50-SMA. The buyers need to crack over the level of 50.50 for a solid growth. The path to the mark level was 51.50 * 52.50 will be unlocked following this breakthrough. If the value falls it will go to 49.50 & 48.50 levels.

XAUUSD

The referendum in the UK is the key event in the markets. The consistency between the supporters & opponents of the Brexit had an unfavorable impact on the yellow metals. The pair stayed at currently reached level. The precious metal futures consolidated Wednesday. XAUUSD pair spent the whole day between 1260 & 1270. The resistance remains at 1280 levels, the support stands at 1260 levels.

MACD is in negative area decline will be sustained. RSI access the oversold region. If the value brings into the area reduce will be constant. The value broke the levels of 50-SMA & blocked at 100-SMA. The resistance level of 1280 value can grow. We do not refuse the falls to 1260 levels.