22

Jun

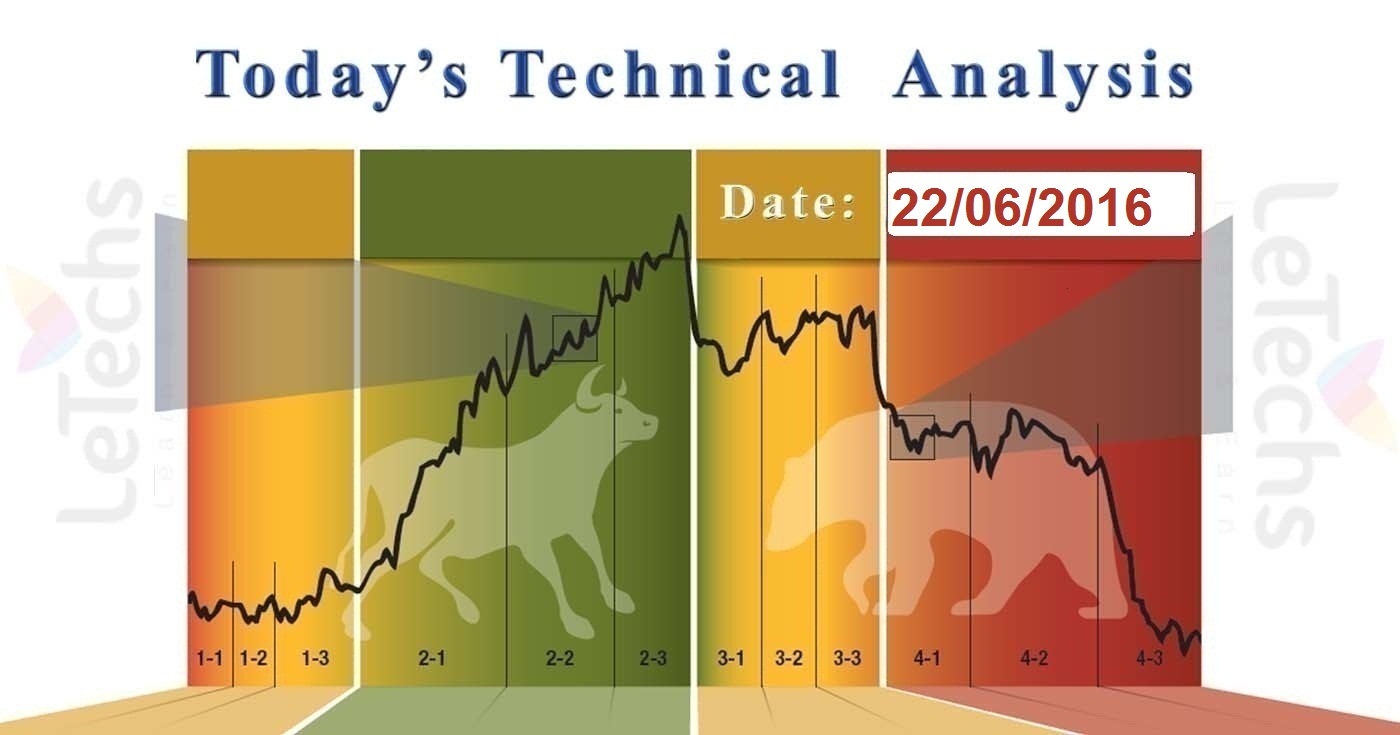

Daily Technical Analysis on 22nd June 2016

Technical Pairs: EURUSD, GBPUSD, AUDUSD, Brent-Crude Oil, & XAUUSD.

EURUSD

Economic sentiment publish supported the euro on Yesterday. On Tuesday Draghi & Yellen gave their statements. According to Draghi the inflation is balanced in the Euro-zone. Yellen told that the rates would stay at the current low levels a long period of time. According to Yellen the US economy showed a solid growing of the GDP. The pair was declining the whole day. The euro smashed the level of 1.1300 & testing the level of 1.1250. EURUSD pair stayed in the descending channel. The resistance stays at 1.1300 levels, the support stands at 1.125 levels.

MACD indicates decreased positive region. If MACD turns into the negative zone there will be a sell signal. RSI reduced & try to reach the oversold region. Reduce of the signal line signs a sell signal. The Moving Averages of 50, 100 & 200 are parallel to one another. Its directions are horizontal. Bearish trends returned to the market place. As we anticipated the value was not able to grow over the level of 1.1370. We consider reduce to be constant now. We can sell if the pair consolidates underneath the level of 1.1250.

GBPUSD

The pound gained some support from the latest poll which had seemed the growth of Britain’s who wanted to remain in the EU. The pair set a new 7-week high across the dollar. Public Sector’s Net Borrowing can also support the national currency. The pound reversed Tuesday since the 7-week high when investors starting to close long positions. The pair chops down from the level of 1.4760 to the next support levels at 1.4670. The value finished the trades in the area of 1.4620 levels. The resistance stands at 1.467 levels, the support stands at 1.456 levels.

The value is over the Moving Averages of 50, 100 & 200 on the 4Hr time frames. All indicators are overbought the position. MACD is in decreased positive zone. If MACD decreases additionally the pair will fall more downhill. RSI left the overbought point of 70. The oscillator also shows a sell signal until it remains under the overbought region. As we expected the resistance 1.4670 did not let the pair to further grow. This is a solid level which the pair might not crack from February, 2016. The first target level is 1.4560. We consider that the smash under the level of 1.4560 should drive this market place looking for the level of 1.4400.

USDJPY

The yen fell across the US dollar following a significant strengthening the last day. The Yellen’s statement supported the dollar Tuesday. Besides, reduce of the risk appetite bottomed the demand for the "safe haven" capitals when fears that the UK might depart the EU stepped away.

USDJPY pair remained in a downside channel. We saw a technical alteration at present. The dollar was improving yesterday & returned few of its previous lost. The resistance remains at 105.30 levels, the support stands at 104.50 levels. MACD will grow, there is a buy signal signs the indicator. RSI giving no signal is in neutral zone. USDJPY pair is underneath the Moving Averages of 50, 100 & 200 on the 4Hr chart. It moving downhill that signs a sell signal. We consider the pair will return to the region of 105.70 – 106.00 levels. Conversely it will reduce to the level of 103.50.

Brent – Crude Oil

Brent - Weekly Crude Oil Stock in the US showed -1900M. According to Secretary General of OPEC the quantity of the oil production is improving in Nigeria. The oil quotations recurred to a growth. The value has been improving 3days in a line. The Brent left the downward channel far trailing. The resistance remains at 51.50 levels, the support remains at 50.50 levels.

MACD is in a positive zone. RSI try to reach the overbought level of 70. If RSI brings into the overbought region we will get a buy signal. The Brent smashes all over Moving Averages of 50, 100 & 200. If the oil consolidates over them the buyers will become more solid. We accept the growth will be constant.

XAUUSD

XAUUSD- gold futures sustained to lose their price preparing for the UK’s long-awaited referendum. XAUUSD pair started an alteration. The instrument drives from 1293 & touched 1263 later the day. The resistance remains at 1280 levels, the support stands at 1260 levels. MACD is in negative zone. If the histogram stays in the negative region the decline will be constant. RSI try to reach the oversold. If the value gets into the zone, reduce will be sustained. The value cracks the 50-SMA & blocked at 100-SMA. The Moving Averages are twisting. The indicators advised the sell positions. The smash under the level of 1270 would unlock the path to the level of 1260 & 1250. The gold might pull back to the level of 1280 to sustain falling from it.